|

Getting your Trinity Audio player ready...

|

- CoinGeek returns for Day 2 of the London Blockchain Conference

- Visionaries Stage: How to win the trust wars

- Building brands through community: Elfried Samba’s vision

- Visionaries Stage: Why EQ beats IQ in modern branding

- Visionaries Stage: Execs must boost brand trust

- Visionaries Stage: Marketing the magic, not the math

- Visionaries Stage: Earning trust through action

- Visionaries Stage: CBDCs and the power shift ahead

- Visionaries Stage: Cross-border risk management

- Visionaries Stage: Programmable trust for regulators

- Visionaries Stage: Cross-border money: Who leads?

- Visionaries Stage: CBDCs and stablecoins can coexist

- Visionaries Stage: Digital currencies, shared future

- Visionaries Stage: Stablecoins for real-world use

- Visionaries Stage: The rise of stablecoin era

- Visionaries Stage: Stablecoins are mega highway

- Innovation Stage: The culture ownership reset

- Innovation Stage: Music rights fractionalization opens doors

- Visionaries Stage: Stablecoins reshape money like Airbnb

- Visionaries Stage: Stablecoin opportunities for banks rise

- Visionaries Stage: Tokenization takes off

- Visionaries Stage: Checks on tokenization hype

- Visionaries Stage: Bridging finance and crypto

- Visionaries Stage: Tracking assets in real time

- Visionaries Stage: Educating policymakers on digital assets

- Visionaries Stage: Policy works ramps up in UK

- Visionaries Stage: Regulators are partners, not foes

- Insights Stage: Regulators play catch-up

- Insights Stage: Africa’s payment innovation

- Insights Stage: Regulation strive for progress

- Insights Stage: Capital or support for startup growth?

- Insights Stage: Blockchain powers business growth

- Insights Stage: Blockchain as a modernization tool

- Visionaries Stage: TradFi using client trust in integrating new tech

- Visionaries Stage: Bridging TradFi and Web3

- Insights Stage: Exploring blockchain’s role in sustainability

- Insights Stage: Sustainability

- Visionaries Stage: Consumer trust drives tech adoption

- Insights Stage: Blockchain fuels accurate reporting

- Insights Stage: No government? Embrace blockchain

- Insights Stage: Getting decision makers on board with blockchain

- Insights Stage: Plan ahead or lose value

- Visionaries Stage: Blockchain’s role in democracy

- Visionaries Stage: Blockchain in public innovation

- Visionaries Stage: Fail, scale, convince, and win

- Visionaries Stage: Digital ID drives government progress

- Visionaries Stage: Driving productivity in digital governance

- Visionaries Stage: Human-led, tech-driven

- Visionaries Stage: Open source tool boosts data sharing

- Visionaries Stage: Leaders matter

- Visionaries Stage: Keep experimenting, embrace failure

- Visionaries Stage: Estonia’s digital edge pays

- That’s a wrap for the London Blockchain Conference!

CoinGeek returns for Day 2 of the London Blockchain Conference

CoinGeek is back in Battersea for Day 2 of the London Blockchain Conference! We’ve got sessions on personal branding in the DeFi era, stablecoins, how to fix Britain’s public sector, and much more—don’t miss a session by joining us for our Live Blog all day today.

Visionaries Stage: How to win the trust wars

Day 2 opens with another heavy-hitter taking the stage for a keynote—social media and branding wunderkind Elfried Samba. Samba is going to talk to us about how to win trust and attention in the hype-heavy age of decentralization. Samba is CEO and founder of marketing agency Butterfly Effect, and previously served as the Global Head of Social Content for Gym Shark, a brand he helped grow into a social media behemoth and one of the most recognizable, new fitness brands.

Building brands through community: Elfried Samba’s vision

Visionaries Stage: Butterfly Effect’s Co-Founder and CEO, Elfried Samba, believes in building brands through community. While working at Gymshark as their Head of Global Social Content, Samba put this philosophy into practice—and developed it. In his tenure, Gymshark went from:

- 24 employees to 1000

- 1m followers to 20m

- £8m – £1.4bn

- Shouted out by Mark Zuckerberg

All by leveraging the community.

Visionaries Stage: Why EQ beats IQ in modern branding

Samba started his agency, Butterfly Effect; effectively, he was exporting the model he refined at GymShark to other, new brands.

His philosophy comes down to trust.

“Whatever you’re doing, you’re scaling for trust. People have been bombarded with so many messages, there’s so much AI, people don’t know what to trust.”

One of the big reasons: IQ is becoming democratized, so the only answer now is EQ. The brands that can still make people feel something are those that scale. If you’re still relying on facts, figures, product references to win, it’ll be very difficult to do that. You need to get people to feel something.

Visionaries Stage: Execs must boost brand trust

82% of people are more likely to trust a company if its execs are active on socials

Elfried Samba, co-founder and CEO of Butterfly Effect, offers some stats:

88% of people trust Word of Mouth: the most influential of these are friends and family; next, online reviews; then (and sliding further down the list all the time) creators.

One of the lower-ranked sources in terms of trust? The brand itself. Only 30% of consumers trust brand messaging directly—proof that traditional marketing alone can’t drive belief.

82% are more likely to trust a company when its senior executives are active on social media. 77% are more likely to buy when the CEO uses social media. 50% of millennials expect CEOs to speak out on societal issues.

Visionaries Stage: Marketing the magic, not the math

Elfried Samba flashes a standard definition of blockchain on screen: “A digital database or ledger that is distributed among the nodes of a peer-to-peer network.”

“We can do better than that,” he smiles to the crowd.

Samba says that blockchain innovators and advocates need to take a leaf rom Steve Jobs’ book, communicating the benefits of the technology as opposed to reciting technical capabilities.

When Jobs and Apple marketed the iPod, they didn’t brag about how many gigabytes of storage it had—they merely told their customers that it could let them keep 1,000 songs in their pocket.

Visionaries Stage: Earning trust through action

Talk less, do more.

In closing, Butterfly Effect’s CEO, Elfried Samba, repeats his core thesis: make people feel something. Being known is not enough. You have to be liked. You have to be respected. These things allow you to earn trust. Most importantly, trust is earned through actions, not words.

For blockchain, what’s needed is humanization: tell better stories. Simplify the approach. Talk less, do more.

Visionaries Stage: CBDCs and the power shift ahead

In the first panel of Day 2 on the “Visionaries Stage” of the London Blockchain Conference, a diverse panel of experts explores the global evolution of state-issued digital currencies, CBDCs, and the relative virtues of private vs. public digital money.

The distinguished panel was made up of Angus Brown, founder and CEO of Minit Money; Tamara Schmidt, of the Digital Euro Association; George Samakovitis, professor of fintech with the University of Greenwich; Diego Ballon Ossio, Partner at Clifford Chance law firm; and Myles Wright, CEO Fnality Services Limited.

Discussion kicked off with Brown, who is from South Africa, explaining the outlook in Africa. He talked about how mass migration in Africa is a huge driver of payment system development—people move and need to move their money as well.

“Blockchain and CBDC and stablecoins have the opportunity to make a huge different,” says Brown, who particularly highlights stablecoins as having made significant progress recently in Africa as “return of money, not return on money.”

Visionaries Stage: Cross-border risk management

Ballon Ossio: Cross-border risk management is needed.

Diego Ballon Ossio, a partner at Clifford Chance, outlines one of the key challenges in the area of stablecoins and CBDCs, namely the differing categorization of these various assets in different countries. You need to operate with a risk.

Visionaries Stage: Programmable trust for regulators

George Samakovitis: “We can ’embed compliance’ in private digital assets.”

Samakovitis “on the compliance side… I think we can establish, what I call “embedded compliance.” This, he explains, is programmable, encoded compliance, already built into the token, allowing regulators to focus on other priorities, such as policy.

Myles Wright follows this up by talking about what excites him the most, which is the ability of smart contract, also built into the assets, to streamline processes such as escrow and repo agreements.

Visionaries Stage: Cross-border money: Who leads?

Angus Brown: Banks must get busy with CBDCs or stablecoins will jump in.

On the much-debated issue of stablecoins vs. CBDCs, Angus Brown describes the role of the central bank in issuance of money as an “existential problem.”

He says that if central banks “don’t do something and get active in this space, someone else will.”

If banks don’t get busy, Brown argues that stablecoins will jump into this space, adding that stablecoins have the advantage of getting round regional trade boundaries. For this reason, when designing a CBDC, central banks must take into account the need or ability to exceed national boundaries.

Visionaries Stage: CBDCs and stablecoins can coexist

Samakovitis: CBDCs and stablecoins can exist alongside each other.

Myles Wright, CEO of Fnality Services Limited, states that, based on his experience and that of Fnality, central banks are primarily focusing on retail CBDCs, which leaves a gap in the market for a wholesale alternative. He believes this will come from the private sector, and says this is where Fnality is active.

Meanwhile, George Samakovitis of the University of Greenwich steers the conversation towards what features a successful CBDC might need. One of the main ones he points to is offline capability.

He also notes that, in his opinion, most of the beneficial features and use cases of CBDCs can also be achieved by private-sector stablecoins. However, he argues that it could, and should, be a situation of “as well as” not “instead of”—both CBDCs and stablecoins can live side by side to benefit users and consumers.

Visionaries Stage: Digital currencies, shared future

A hybrid solution could be answer to the CBDC-stablecoin debate.

Wrapping up, Tamara Schmidt, the host of the panel, asks a final question to all the speakers: “What is one thing we must not forget if CBDCs and digital money are to serve the public good?”

Samakovitis: “Privacy, security resilience and frictionless cross-border transactions.”

Wright: “I believe that there will be a hybrid solution that emerges…and these different solutions will co-exist and are often complementary.”

Brown: “We must place trust in the instrument.”

Ballon Ossio: “You need to also look at the legacy systems and make sure they integrate well.”

Visionaries Stage: Stablecoins for real-world use

Making a stablecoin is relatively easy. Creating one that can work at scale is difficult—and as stablecoins promise to become the next standard medium of transacting, it’s a challenge that any issuer must keep in mind.

The Visionary Stage’s next keynote addresses precisely this subject: “Stablecoins that scale: five tests for real world money” will kick off momentarily.

Visionaries Stage: The rise of stablecoin era

Stablecoins will be the world’s new money.

The designated hitter for this keynote: Dr. Bernhard Kronfellner, Head of Web3 EMESA at BCG.

Dr. Kronfellner looks at the crowd and asks: Do we even need five tests?

“The crowd here has changed—from people wearing hoodies to people that are wearing suits. So, this is actually—without the five tests—the first indicator that stablecoins and digital assets have already become in the interest of the big banks the big brands, and it will be the world’s new money.”

Visionaries Stage: Stablecoins are mega highway

Stablecoins can be the superhighway for money.

Dr. Bernhard Kronfellner, head of Web3 EMESA, BCG, sets out the five tests for stablecoin:

- Additional value

- Use cases

- Revenues

- Regulations

- CBDC-Co-existence

To start with ‘additional value’, Dr. Kronfellner shows two images side by side: one warped, pot-hole-stricken road, and another smooth, 20-lane mega highway. Stablecoins, in essence, are the mega highway.

Innovation Stage: The culture ownership reset

Origin Exchange: “A complete reset of the ownership of culture.”

Brendan Lee, CEO and founder of digital consultancy Elas, took to the “Innovation Stage” of the London Blockchain Conference to speak about the “Origin Exchange,” a global marketplace for fractional ownership of music publishing rights.

“Imagine what it would be like to own a piece of Michael Jackson’s Thriller,” posits Lee. He argues that music right has been largely kept in the hands of a few large companies.

“What is needed is a whole new infrastructure layer,” says Lee.

Origin Exchange fractionalizes music ownership and puts it on the blockchain, specifically BSV, opening the door for millions of music fans to own a slice of publishing right to their favorite songs, says Lee. This would be a legally recognized share in the IP, and could open up a huge untapped well of investment opportunity.

Taking that media and adding the value of top is a “gamechanger,” says Lee. “Songs can be broken down into subset units and sold with limited overhead… in instantaneous transfers.”

Origin exchange is “a complete reset of the ownership of culture.”

Innovation Stage: Music rights fractionalization opens doors

Fractionalizing music is just the beginning.

Elas CEO Brendan Lee says that Origin Exchange’s fractionalization of music rights is just the beginning. It can be used across media, including film, television, and art.

“The sky is the limit, and we have the only plane on the runway,” says Lee. He concludes by saying that the only blockchain capable of facilitating this is BSV.

Visionaries Stage: Stablecoins reshape money like Airbnb

Stablecoins can do for money what Airbnb did for accommodation.

In a world of innovation, booking overseas accommodations has been disrupted by Airbnb and has never been easier. But when you want to transfer money to the other side of the world, you’re still looking at five banking days.

Stablecoins can do for money what Airbnb did for accommodation, in other words.

BCG’s Head of Web3 EMESA, Dr. Kronfellner, sets out five benefits stablecoins help unlock:

- Lightning-fast transactions

- Reduced transaction costs

- Enhanced transparency

- Programmability and automation

- Global accessibility and financial inclusion

Visionaries Stage: Stablecoin opportunities for banks rise

Stablecoin upside for banks increasing; downsides decreasing

BCG’s Head of Web3 EMESA, Dr. Kronfellner, says banks are exploring various avenues to capitalize on the stablecoin boom. These include:

- Offering wallets or custody;

- Issue their own stablecoins

- Create a consortium with others to issue a stablecoin

- Issue tokenized deposits (like JP Morgan is already doing)

They could also simply wait-and-see, which might be appropriate for some banks: “They will see that the revenue will be reduced and a decrease in cross-border transactions or other typical stablecoin use cases, and some clients will go away. But not being a first-mover, for a tier 3 bank, might be good.”

Either way, he says the upsides in stablecoins for banks are growing, while the downsides are reducing.

Visionaries Stage: Tokenization takes off

On the “Visionaries Stage,” a panel of industry experts goes inside two tokenization case studies: A digital bond issuance and a tokenized real estate project.

The panel is made up of Armin Peter, executive in residence at Global Digital Finance; Sonia Chawla, head of legal investment transactions at Schroders; Emma Lovett, executive director at J.P. Morgan; Ben Elvidge, product lead at Trilitech; and Sabih Behzad, head of digital assets and currencies transformation at Deutsche Bank.

Behzad began by laying out what tokenization is, and why it is important. For him, tokenization offers three big things: accessibility, programmability, and cost benefit.

On the second of these, he particularly highlights the possibilities of programming compliance, a popular point today, as it was also raised in the first panel of the day on CBDCs and stablecoins.

Visionaries Stage: Checks on tokenization hype

Tokenization holds great promise, but cation may be needed.

Ben Elvidge of Trilitech explains how tokenization is being applied in the uranium field.

“Its about improving the wider market infrastructure for all participants in the nuclear supply chain,” says Elvidge.

Sonia Chawla followed this optimism by introducing an element of caution. She believes the technology is not quite there yet. This is backed up by Emma Lovett, who says that a lot of the work that has been done so far is on private permissioned blockchains, which are much safer but “act like individual island.”

Visionaries Stage: Bridging finance and crypto

TradFi and crypto-native firms converging.

Sabih Behzad says there is movement from both ends of the market. Crypto native firms are looking to see how they can get involved in traditional financial products, just as TradFi and banks are looking to see how they can adopt and use blockchain technology.

While this convergence continues, Sonia Chawla says there remains a problem to overcome—education. According to Chawla there is “still a long way to go” when it comes to educating regulators, TradFi, and consumers, which can slow down adoption of new technologies and processes, such as tokenization.

Visionaries Stage: Tracking assets in real time

Emma Lovett: “Real-time” transaction tracking of blockchain can be a game changer.

Blockchain “can give you real-time on who owns what when,” says Emma Lovett, who added that she would like to see more participation.

Summing up the discussion, Armin Peter points to the use case of tokenization in the repo market as a crucial area of promise, while also underscoring that there are issues that still need to be overcome, one notable one being different regulatory environments across jurisdictions.

Visionaries Stage: Educating policymakers on digital assets

Educating policymakers and changing minds on digital assets.

Next up on the “Visionaries Stage,” a panel of current and former policymakers and academic discuss global regulatory mindsets in the context of digital assets.

The highly credentialled panel consists of Dr. Francesco Pierangeli, Deputy Director and Assistant Professor at UK Centre for Blockchain Technologies of University of Birmingham; Alun Cairns, Former MP and Secretary of State; Ikhlaq Sidhu, Dean of the IE School of Science & Technology; Nicholas Webb, Managing Director of Digital Finance at Cosegic; and Baroness Manzila Pola Uddin, Member of the House of Lords of the U.K.

Baroness Uddin began by outlining the U.K. situation, and her personal passion for “digital tech for the common good.” She tells a story about being a mother with a child who could benefit from the help of new technology, but being met with a lack of understanding and dismissals.

She also discusses her own work, which involves attempting to inform her parliamentary colleagues about the Web3 space.

Visionaries Stage: Policy works ramps up in UK

Baroness Uddin: Work underway in U.K. parliament on how to make the most of blockchain

Baroness Uddin says she would like to see a “council of advisers” set up in government to explore how digital assets can be implemented and fostered. She also wants to see the U.K. as a competitor to the U.S. in the space.

On this, Baroness Uddin says there is a “huge amount of work underway in parliament.”

Visionaries Stage: Regulators are partners, not foes

Regulators are not the enemy.

Cosegic’s Nicholas Webb begins with a shout-out to his former colleagues among the regulators, highlighting the tough job they have in adapting to and monitoring the digital asset sector.

He also notes that regulators tend to be “naturally cynical” when it comes to the space, due to the less-than-compliant corner of the market they deal with most often.

Former MP and Secretary of State, Copia, Alun Cairns, chimes in, adding some sympathy for the difficult job regulators do. He advocates for companies in the blockchain space to “work with” regulators in good faith.

He says he believes the U.K. is in a good position, having learned from regulation in other countries such as EU and U.S., to come up with a better system.

Rounding off his comments, Cairns also hits at a common theme of the conference, more education.

Insights Stage: Regulators play catch-up

Panel on digital asset regulation says “more work to do” on cross-border collaboration.

The first panel of the afternoon on the “Insights Stage” of the London Blockchain Conference, hosts a selection of entrepreneurs and experienced industry players, discussing how collaborative regulation can shape the future of virtual assets and drive economic growth.

Offering up their expertise is Jonathan Middleton, director for digital innovation at NayaOne; Reginald Tumusiime, CEO of the Blockchain Association of Uganda; Nick Wellington, Board Advisor, and Transformation Director for Innovate Finance, RegTechUK; and Sarah Sinclair, founder and CEO of Co-Labs Global.

Kicking off the discussion, Jonathan Middleton outlines the challenge of regulators predominantly—and understandably—tending to only think about their own jurisdiction. He did note that there are some efforts underway to collaborate across boarders, citing a proposed regulatory sandbox between the U.K. and the U.S., but he says there is more work to do in this area.

Insights Stage: Africa’s payment innovation

Reginald Tumusiime: Africa the place for payment innovation.

CEO of Blockchain Association of Uganda, Reginald Tumusiime, speaks of the situation in Africa. “It’s one of those interesting markets for anyone thinking differently, innovating in the payment space,” says Tumusiime.

He says this is a result of regulations becoming clearer in several African countries. The driver for this change, says Tumusiime, was a call for greater financial inclusion from the population.

Insights Stage: Regulation strive for progress

Regulatory collaboration is needed, but we shouldn’t wait for it to be “perfect.”

Sarah Sinclair, founder and CEO of Co-Labs Global, begins by describing the times we’re living in as the “most frightening time, but also the most exciting.” On blockchain regulation, she highlights the importance of oversight and supervision, whilst calling for deeper “coordinated” collaboration.

In this collaboration, NayaOne’s Jonathan Middleton argues that “don’t let perfect be the enemy of the good,” he suggests that we shouldn’t wait for everything to be aligned, or “we’ll be here in ten years.”

Reginald Tumusiime of the Blockchain Association of Uganda notes that regulation should focus on “enabling firms to innovate and build,” but it can be refined over time.

Insights Stage: Capital or support for startup growth?

How can startups grow? Regulatory support or more capital.

Nick Wellington of Innovate Finance tells the Insight Stage audience that more regulatory support is needed to help businesses scale up. “In 2008, it was about startups; we now have a mature fintech market,” says Wellington. “It has different needs now.”

Offering a different priority, Reginald Tumusiime, CEO of the Blockchain Association of Uganda, says that the biggest issue from his perspective is not a lack of support from regulators, but a lack of capital. “More capital is needed for startups to grow,” says Tumusiime.

Insights Stage: Blockchain powers business growth

We’re now at the open-air Insights Stage, where we, along with dozens of other headset-wearing watchers, hear from the finance professionals that are succeeding in integrating blockchain with their businesses.

Moderated by Bilal Jafar, Hedge Fund & Crypto Correspondent for Dow Jones, this session is not to be missed if you like your conference sessions with a practical bent.

Insights Stage: Blockchain as a modernization tool

Modernization, not reinvention.

Dow Jones’ Bilal Jafar is joined by three finance professionals: Riccardo Donega, Head of DLT and Digital Assets products at Italy’s Banca Sella; and Richard Baker, founder and CEO of fintech Tokenovate.

Jafar starts big: How is blockchain different from previous modernization revolutions?

Tokenovate’s Richard Baker says he likes the word “modernization”: blockchain isn’t about replacing anything; it’s about enhancing it.

“This technology is bringing in a remarkable moment. It’s the next generation of platform the world is going to be building on as we think about rights, land titles.”

Visionaries Stage: TradFi using client trust in integrating new tech

Panel: TradFi can integrate new technologies, thanks to longstanding customer trust.

The final panel of the day on the Visionaries Stage of the London Blockchain Conference explores the intersection of DeFi and TradFi.

The panel was made up of Dr. Francesco Pierangeli, Deputy Director of the U.K. Centre for Blockchain Technologies and Assistant Professor at University of Birmingham; Marcus Van Abbé, Head of Digital Market Infrastructures at R3; and Nathaniel Zollinger, Chief Technology Officer of Crypto Finance AG.

The panel kicked off with the industry experts discussing how TradFi manages to build trust with their clients through regulation and visibility. This trust then allows them to introduce new technologies without scaring clients or damaging their relationships.

Visionaries Stage: Bridging TradFi and Web3

Hybrid finance products and systems are the best of both worlds, for now.

Marcus Van Abbé, Head of Digital Market Infrastructures at R3, tells the Visionaries Stage of the London Blockchain Conference that hybrid finance products—combining TradFi with Web3 technologies—are becoming more common. He notes that this is being led by traditional finance sector player.

Fellow panelist Nathaniel Zollinger, Chief Technology Officer of Crypto Finance AG, discusses the importance of scalability in hybrid products. He suggests that there are currently no blockchains capable of handling the number of transactions that TradFi deals with. This is why the solution, for now, must be a hybrid integrating new technologies into legacy systems and processes.

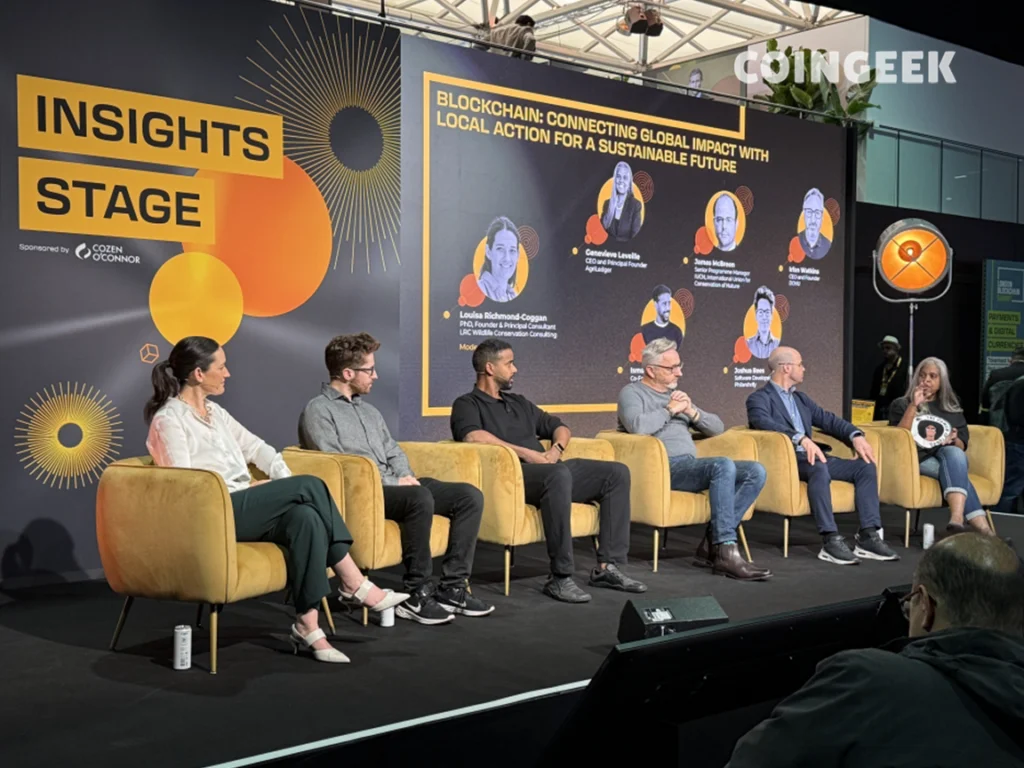

Insights Stage: Exploring blockchain’s role in sustainability

Blockchain: Connecting global impact with local action for a sustainable future.

Moderator Louisa Richmond-Coggan, Co-founder of LRC Wildlife Conservation Consulting, is taking over the Insights Stage to host a panel discussion on sustainability, specifically how blockchain can connect global impact with local action for a sustainable future.

“Global solutions only succeed when they strengthen and scale what is already working on the ground.”

Insights Stage: Sustainability

Moderator Louisa Richmond-Coggan is joined by five panellists:

- Genevieve Leveille, CEO and founder of AgriLedger

- James McBreen, senior programme manager of the International Union for the Conservation of Nature

- Ifron Watkins, CEO and Founder of DOVU

- Ismael Dainehine, co-founder and CEO at EverGive

- Joshua Rees, software developer at Philanthrify

Visionaries Stage: Consumer trust drives tech adoption

Consumer trust is crucial to the adoption of new technologies adoption.

According to the London Blockchain Conference “Visionaries Stage” panel, a shared ledger can enable improved data, which in turn enables better products and services.

What’s important about traditional financial institutions is the customer trust built up, thanks to stability, transparency, and accountability— without this, the integration of new technologies that many consumers don’t trust, such as blockchain and DLT, becomes impossible, or at least pushed to the peripheries of finance.

Marcus Van Abbé, Head of Digital Market Infrastructures at R3, says that TradFi firms increasingly dipping into DeFi is a necessary transition period before “getting everything on chain.”

Insights Stage: Blockchain fuels accurate reporting

Blockchain as a verifier of charity.

Speaking about his work at Philanthrify, back-end engineer Joshua Rees says they use blockchain to ensure that the information being used is useful throughout an organization.

Thanks to blockchain, it stays transparent and immutable, allowing charitable organizations and other parties to verify that everything they’re saying about their charitable work—including where donations go and how they’re processed—is accurate.

Insights Stage: No government? Embrace blockchain

No government, no problem with blockchain.

Genevieve Leveille, CEO and principal founder of AgriLedger, discusses AgriLedger and their work with agriculturalists in Haiti. Haiti’s government was in the process of collapsing at the time, which makes one of blockchain’s key selling points—the potential for decentralization—critical.

“Someone suggested blockchain because the Haitian government no longer existed,” she says.

The question of who to hand control over, say, citizen data to under those circumstances is answered relatively smoothly thanks to blockchain: the data of any given project can be held collectively.

Insights Stage: Getting decision makers on board with blockchain

Moderator Louisa Richmond-Coggan asks about barriers to acceptance in the sustainability industry.

James McBreen of ICUN says he thinks there’s a mismatch between the conservation outcome approach we all understand—livelihoods, ecosystem, health—and if there’s not a clearly identifiable and obvious role for blockchain, it can be difficult to get decision makers on board.

He also says that for a given project, there must be a clear off-ramp for the technology, meaning that once the project is finished, there’s a path for the technology to continue to deliver benefits perpetually.

Insights Stage: Plan ahead or lose value

“The biggest risk isn’t Bitcoin, it’s to not plan for the future.”

Ismael Dainehine, co-founder and CEO of EverGive, says the case for Bitcoin makes itself the barriers within the charity sector are often cultural.

“Built on survival, it’s natural for charities to think quite short-termist.”

“With Bitcoin, through logic and technology, you can create quite robust, strong, and compelling rational arguments for how Bitcoin really is the best asset to preserve charity, to preserve the value of donations.”

“What we find to be the biggest risk isn’t Bitcoin, but to not plan for the future.”

Visionaries Stage: Blockchain’s role in democracy

Lord Holmes: Blockchain can empower our democracies.

Christopher Holmes, also known as Baron Holmes of Richmond, helps round off the final day of the London Blockchain Conference by enthusiastically sharing his vision for how blockchain can transform public services.

Speaking from the Visionaries Stage, Holmes, a member of the United Kingdom House of Lords, tells the eager audience about the “extraordinary potential” of blockchain technology.

“Imagine a very system blockchains solution to validate the claims of politicians around the world, imagine blockchain being used for the very act of making your vote, and imagine the electoral roll itself,” says Holmes. “Supported with a blockchain application, all of that could have been delivered.”

Blockchain, says Holmes, could “empower our very democracies themselves.”

Visionaries Stage: Blockchain in public innovation

Fireside Chat: Blockchain in public innovation.

The final session of the London Blockchain Conference 2025 is about to begin, and it’s a tremendous note to end on: Siim Sikkut, former CIO of the Government of Estonia, is sitting down for a fireside chat.

He’ll be giving his first-hand experience in bringing blockchain to the governmental level, from the things that went well to the things they wish they’d known going into it.

Visionaries Stage: Fail, scale, convince, and win

Siim Sikkut is the Elon Musk of digital government.

Our final fireside chat is being moderated (once again) by the BBC’s Mark Lobel. He’ll be guiding the conversation with Estonia’s Siim Sikkut.

“How to fail, how to scale, how to convince, and whether it’s worth it—there’s no man on the planet better to ask this about than Siim Sikkut.”

As Lobel puts it, Sikkut is the Elon Musk of digital governance. He could be right. Siim Sikkut’s first-hand experience makes him a unique pool of knowledge.

Visionaries Stage: Digital ID drives government progress

Digital ID a ‘critical first step’ for digital government.

The BBC’s Mark Lobel asks Siim Sikkut, managing partner of Digital Nation, about his opinion on the U.K.’s digital ID initiative:

“First of all, it’s about time,” laughs Sikkut.

“The fact is, you need some way to authenticate securely and to give signatures.”

His response is understandable: Estonia has had a digital ID for over 15 years. It was the cornerstone of their digital government policy: it’s a critical first step.

Visionaries Stage: Driving productivity in digital governance

Digital government is about productivity.

Estonia’s Siim Sikkut is asked why that country in particular was so far ahead in digital government: “It goes back to another factor we didn’t mention—it’s a country of 1.3 million people.”

“This really was the beginning that—at the same time—the government had to have a strong defense. People look up to the Nordics; they want good welfare and spending in government.”

However, without a natural resource like oil to rely on, productivity—getting more with less—is going to be the key.

Visionaries Stage: Human-led, tech-driven

Lord Holmes: We must shape our digital future.

In his keynote from the Visionaries Stage, Lord Holmes, Member of the U.K. House of Lords, speaks of the benefits blockchain can provide to supply chains, international aid, and public services, such as the NHS.

“Look to supply chains,” says Holmes. He described them as “notoriously opaque.” But through blockchain, every beat, every point of the supply chain, including all legal, customs, and financial data, can be tracked in real time.

More broadly, Holmes suggests that “of course, any government wants growth, but if you want growth, there has to be an unflinching, consistent and coherent approach to it, and so much of it can come, and must come, from all of these so-called new technologies, not least blockchain and distributed ledgers.”

In this effort, Lord Holmes says that “we all have a key role to play.”

He rounds off his keynote with something of a call action: “Blockchain isn’t just a supreme means for the exchange of value. It’s a very value creator in chief. What must ask what we can do to transform, to reshape, to reset our economies, and our societies, for the benefit and the betterment of citizens and state alike.”

“It’s our data, our DLTs, our decisions, our Digital Futures together, our human-led Digital Futures,” says Holmes.

Visionaries Stage: Open source tool boosts data sharing

The Estonian data sharing tool is open source.

Siim Sikkut explains that one of the most impressive aspects of Estonia’s digital government push is X-Road, a tool that enables secure data exchange between government departments. The productivity savings should be obvious: individuals don’t need to input redundant information in multiple locations, and government departments don’t need to ask for it.

X-Road is now open source and has been adopted by 25-30 other governments worldwide—including in Ukraine, where the government represents over 40 million people.

Visionaries Stage: Leaders matter

For Sikkut, the Estonian government’s willingness to experiment was key and should serve as a lesson to other leaders.

“We have the privilege of having leadership willing to take a risk and try things out.”

Many facets of Estonia’s digital government began as experiments—putting tax declarations online, the interoperability of X-Road. These all started as the government express a willingness to try something differently.

Visionaries Stage: Keep experimenting, embrace failure

Visionaries Stage: Failure is okay—keep trying things out.

Experimenting inevitably means some degree of failure. BBC’s Mark Lobel asks Siim Sikkut what these failures meant in the context of experimenting with new ways of doing government:

“In my work, all my political masters have been careful to make a difference between failures – is it because of ignorance or recklessness, or is it because you legitimately tried stuff out and didn’t’ work?”

The latter isn’t a problem. One of Sikkut’s ministers made clear to him that failure is okay: keep trying things out.

Visionaries Stage: Estonia’s digital edge pays

For Estonia, digital government means savings that can be spent on defense.

Recklessness is another matter, though. Every country has its unique risks, but Estonia has a very aggressive nation as its neighbor—one that will take advantage of any weaknesses in a digital governance initiative.

But Sikkut looks at things another way: as long as it’s done responsibly, digital government will deliver massive cost savings and productivity improvements. Sikkut says that Estonia has saved around 2% of its GDP just by moving signatures to digital. That’s about what Estonia spends on defense every year.

It’s hard to see that as anything other than a benefit.

That’s a wrap for the London Blockchain Conference!

London Blockchain Conference 2025 has finished!

We hope you’ve enjoyed these two days as much as CoinGeek has. Take a look at CoinGeek’s coverage of the key sessions from the London Blockchain Conference 2025, and look out on CoinGeek for more incisive analysis on the same topics you’ve heard about over the course of the event. Until next time!

02-21-2026

02-21-2026