|

Getting your Trinity Audio player ready...

|

Last week, the long-awaited Ethereum “Merge” finally arrived, switching Ethereum from a proof of work to a proof of stake consensus mechanism.

So far, it appears to have made the switch without major technical problems. Although, it’s still early days, and it will be some time before we know for sure that the Merge hasn’t introduced new vulnerabilities as happened with the 2019 Constantinople update.

However, technical vulnerabilities are not the main focus of this article. Here, we’re going to look at whether the ETH token is a security. I’ll argue that, if it wasn’t before, it most certainly is now.

SEC Chairman Gary Gensler speaks on the issue

In the United States, the principal authority on what is and isn’t a security is the Securities and Exchange Commission (SEC). Its current chairman, Gary Gensler, said staking via third parties could implicate securities laws.

“[Staking services] look very similar—with some changes of labeling—to lending,” he said.

Last Thursday, Gensler said that any digital currency networks or intermediaries that allow users to stake their coins might be deemed securities using the Howey Test. The test is commonly accepted as a way to determine what is or isn’t a security by examining whether investors expect to earn a return from the work of third parties.

“From the coin’s perspective… that’s another indication that under the Howey test, the investing public is anticipating profits based on the efforts of others,” Gensler said.

Indeed, it would be difficult to argue that ETH stakers are doing any work of their own. Whereas proof of work miners do demonstrable work to solve hash puzzles, stakers merely park their coins and expect the profits to flow. It’s a lot like investing; therefore, it’s highly likely that ETH is now a security.

Those who think Ethereum is too big for the SEC to take on should think again. It has successfully slapped both Kik Interactive and the Telegram Group down before and has shown a willingness to take on even the biggest, best-funded entities in the industry with its lawsuit against Ripple Labs. In light of Gensler’s comments, you can be sure that the SEC is at least looking closer at Ethereum now that the Merge has occurred.

Is the new ETH the same as the old ETH?

When major hard forks of blockchain networks occur, it’s arguable that a new token has been created. We saw this in 2017 when BTC forked away from the original Bitcoin protocol when it implemented the SegWit hard fork.

While BTC kept the ticker, it undoubtedly created a new token (with financial value) and airdropped it to Bitcoin holders. This contrasts Satoshi Nakamoto’s original issuance of bitcoins at zero financial value and his contractual agreement to distribute them to miners for doing work.

While the narrative is that the new proof of stake chain is the original Ethereum “upgrade,” a hard fork did occur, leading to EthereumPOW and the ETHW token which changed its ticker to ETF. Some might argue that ETHW is the original since it is the proof-of-stake system that deviated from the original Ethereum protocol. This would almost certainly mean that, despite keeping the ETH ticker as BTC did in 2017, the new Ethereum token is a security.

Once again, we should not confuse tickers with protocols. It is the proof-of-stake version of Ethereum that is new, and even if its associated token is called ETH, that doesn’t necessarily mean it is the same token.

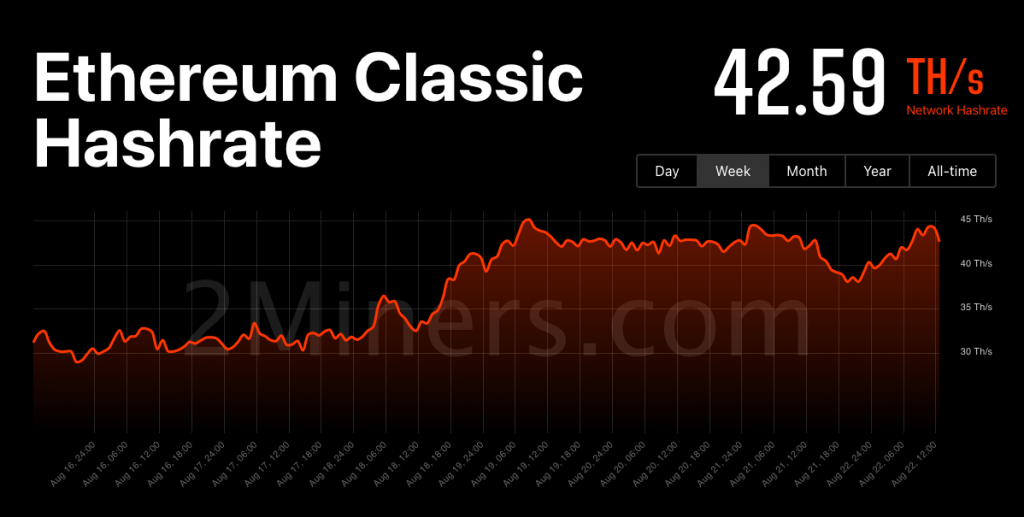

Note: At the time of writing, the EthereumPOW network has around ⅓ of the hash rate of Ethereum Classic, which has seen its own hash rate skyrocket to almost 200 TH/s post-merge.

Source: 2miners.com

What does this mean for third-party staking services?

Major digital currency exchanges like Coinbase (NASDAQ: COIN), Kraken, and Binance have stated that they will support ETH staking. According to Gensler’s statements, they will violate established securities laws unless they register and take the appropriate steps.

Coinbase, in particular, has form here. In 2021, the Silicon Valley exchange found itself in hot water with the SEC over its LEND program, clearly demonstrating in a blog post that it did not understand the basics of securities laws. Platforms like Kraken and Binance have shown themselves to be equally clueless, with the former allegedly under investigation for sanctions violations while the latter has been chased out of every country it set up shop in for violating various rules.

CoinGeek contributor Johnny Jaswal has already written a detailed piece on the risks to digital asset exchanges that violate regulations. Should the SEC come after them for flouting securities regulations due to their support of ETH staking, it could get even messier and riskier for the already endangered exchanges.

Not only a security, but a tyranny into the bargain

While it will ultimately be determined in court whether ETH is a security, whether the old ETH is the same as the new ETH, and what, if any, regulations exchanges that support ETH staking have violated, one certain thing is that Ethereum is one a one-way train to tyranny.

The optimal governance structure for early-stage projects is founder dictatorship.

The optimal governance structure for mature projects has large user/stakeholder involvement.

"Exit to community" continues to be underrated as a way to get both.https://t.co/8bnTvyytDX

— vitalik.eth (@VitalikButerin) August 22, 2020

While Vitalik Buterin and his cohorts attempt to shift the focus to Ethereum’s environmental friendliness, what is going on is the Ethereum Foundation and other large ETH holders are cementing their positions of power over the network. It’s well known that the top 100 holders of ETH hold 40% of the tokens, making it both centralized and already virtually dominated by the wealthiest holders. This situation will only worsen as they collect staking rewards, consolidating their positions, and allowing them to eventually have total domination over Ethereum.

Who are these holders? While large exchange addresses are known, we have no idea who the others are, and this is one of the major problems with the proof-of-stake consensus mechanism. Aside from the fact that it ignores the Byzantine Generals Problem originally solved by Satoshi Nakamoto, there is no way to know who the staking whales are. In contrast, proof-of-work miners are identifiable and thus can be held accountable by the law (by design).

So, Ethereum is not only almost certainly a security now that it has shifted to proof-of-stake, but it is a threat to freedom, liberty, and a truly open peer-to-peer network. With wannabe dictators like Vitalik Buterin at the helm, that should concern everyone.

Watch: Marketing with blockchain—here’s how you do it

02-22-2026

02-22-2026