|

Getting your Trinity Audio player ready...

|

A few things get under my skin in the Bitcoin space: when people say “Satoshi said” and then misquote him, or when people say that Bitcoin was designed to be slow and/or expensive… The next one is tangential to slow and expensive, but “I run my own node” also requires so much mental deprogramming, and therefore, it persists.

How about “Bitcoin doesn’t do smart contracts.” That one has largely been buried with the advent of Ordinals, Fractal Bitcoin, and a bunch of other things shaking up the BTC economy over the last two(ish) years.

All that to welcome you to my next series! “Hodling Breaks Bitcoin,” where I will go into the economics and social dynamics of the various spill-over detriments of not using Bitcoin as an electronic cash system.

Today, we will cover one of the most egregious: when people say, “Bitcoin is not private.”

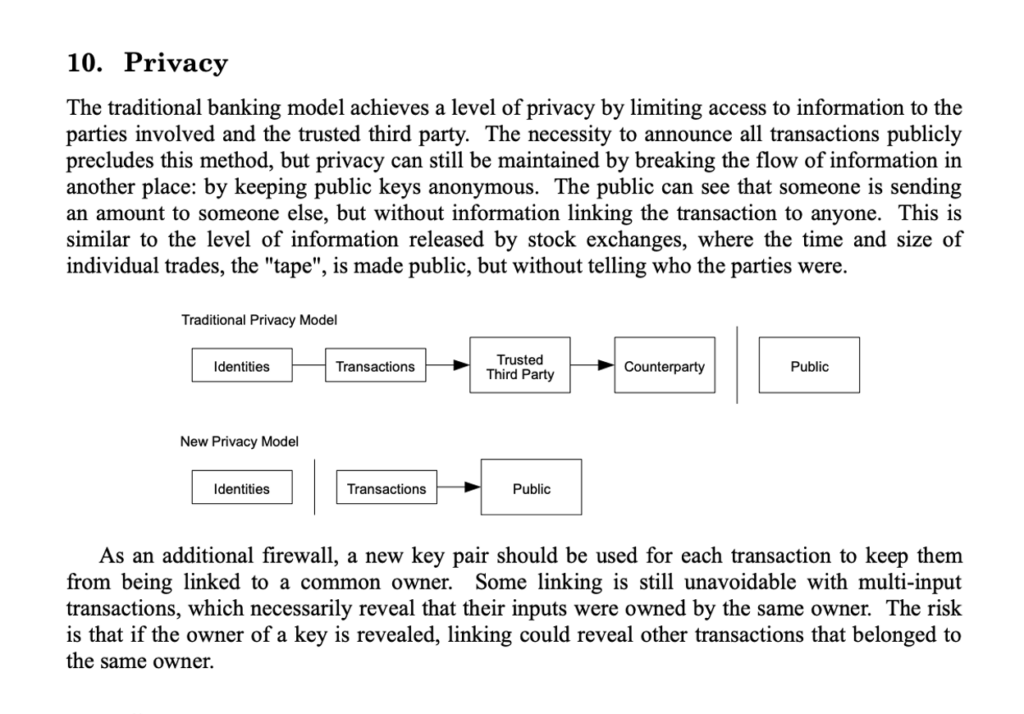

Privacy is often considered a core principle that must be implemented in Bitcoin (typically when discussing BTC) to protect users from surveillance and censorship. However, privacy is fundamentally misunderstood by most players in the discussion. Contrary to the popular narrative perpetuated by BTC maximalists, Bitcoin is not inherently private if it is only used as a store of value or “HODL” asset. In fact, for Bitcoin to achieve true privacy, it must be used as an electronic cash system with billions of daily transactions. This is not just an opinion but a direct reading from Section 10 of the Bitcoin white paper, which explicitly details how Bitcoin achieves privacy through frequent, pseudonymous transactions.

However, that vision is far from reality in today’s BTC landscape. The small block philosophy and the pressure to use custodial solutions to access the convoluted Lightning Network have done more to strip away privacy than to preserve it. When users are funneled into centralized exchanges that require KYC/AML compliance and subsequently use custodial wallets, any notion of inherent privacy goes out the window. Instead, we have a BTC that is surveilled, controlled, and increasingly resembling the very financial system it was designed to disrupt.

The original vision: privacy through usage

Satoshi Nakamoto’s original vision for Bitcoin was a decentralized, peer-to-peer electronic cash system where transactions flowed freely, unencumbered by third-party intermediaries. In Section 10 of the white paper, Nakamoto outlines a model for privacy that relies on generating new key pairs for each transaction, ensuring that identities are not linked. The key here is in the volume—billions of transactions moving through the network, creating so much noise that identifying any one user becomes impractical, and even if a single public address is doxed, the breadth of any individual’s holdings can only be speculated upon, but never proven.

But there’s a catch: this model only works when Bitcoin is used as a true cash system, circulating continuously as value is exchanged. If users merely “HODL” and never actually transact, then the privacy model breaks down. Linking UTXOs (or Unspent Transaction Outputs) back to individual users becomes trivially easy without sufficient transaction volume. Privacy is not just an option in a cash system; it is a feature that emerges from the very nature of how that system operates, but it has to be operated in order to benefit from it!

The malicious retooling of Bitcoin

Yet, here we are in 2024, and the Bitcoin that Satoshi described is a distant memory for small blockers. High fees and low transaction volumes have created a situation where privacy is not only eroded but nearly impossible. The pressure to consolidate UTXOs when fees are low—because high fees make it uneconomical to maintain a large number of small UTXOs—further degrades privacy by making transactions easier to trace. This is the sad irony of BTC maximalism: it clings to the idea of small blocks and high fees, claiming it ensures decentralization and security, but it ends up degrading privacy, making users more vulnerable.

Worse still, the proliferation of KYC/AML requirements and custodial solutions like Coinbase (NASDAQ: COIN) and the popular Lightning Network wallets means that most users are not even controlling their own keys. In this setup, privacy is an illusion at best. Transactions can be frozen, accounts can be blocked, and every movement is monitored. The move to Layer 2 solutions like Lightning—despite the promises of scalability and speed—only exacerbates this issue. It’s a bait-and-switch; the promise of privacy in Bitcoin has been replaced by a surveilled, gated system that resembles a digital version of traditional banking.

The true incentives: velocity over HODL

Bitcoin, as originally designed and only truly implemented in the BSV blockchain, incentivizes saving, but not in the way that Bitcoin maximalists interpret it. Bitcoin should be saving in the sense of prudently managing resources and wealth through a robust and efficient cash system. The very idea that one should “HODL” and never spend misses the point entirely. A currency that doesn’t move, that doesn’t circulate becomes useless both in an economic sense, but also in being able to benefit from the inherent feature set of Bitcoin.

In short, a body of water that doesn’t flow becomes stagnant.

If Bitcoin is to be the revolutionary tool it was designed to be, it must have velocity. It must flow through the economy, passing from hand to hand, wallet to wallet, as a medium of exchange. Without a high volume of transactions, the entire privacy mechanism of Bitcoin fails along with the economic security model—eventually. When we only HODL, we create an environment where all our transactions are mapped, all our addresses are linked, and all our activities are monitored. Privacy dies in stagnation.

A call for real Bitcoin privacy

We must return to the principles of Bitcoin as a cash system if we want to preserve its promise of privacy. This means pushing for larger blocks, lower fees, and more transactions as a concept that we value, but also using that system in the way it was designed! It means rejecting custodial wallets and centralized exchanges that strip away the privacy and autonomy that Bitcoin was designed to provide. Bitcoin is a tool that incentivizes us to save wisely, but we must remember that saving wisely includes using Bitcoin as it was meant to be used: as a medium of exchange.

The future of Bitcoin depends on our willingness to let it flow. If we continue to stifle its utility by holding it in tight hands, hoping only for its value to rise without any activity, we will destroy the privacy we seek to preserve. It’s time for small blockers to rethink what they want Bitcoin to be—a stagnant store of wealth or a living, breathing system of economic freedom.

Thankfully, as new people come to Bitcoin, they see what we have been saying for a decade now about the need for big blocks, unbounded scale, distributed computation, smart contracts, and the value of Bitcoin the way it was always envisioned.

What other problems caused by HODLing that you would like me to cover?

Watch: Breaking down solutions to blockchain regulation hurdles

03-07-2026

03-07-2026