|

Getting your Trinity Audio player ready...

|

David Rosenthal, OpenBSD hacker, employee #4 at Nvidia, hardware engineer, writer, and all around tech guru recently posted an excellent article detailing a lecture he gave at Stanford University on digital currencies and the problem he saw with it. It was an excellent lecture and had solid criticisms of blockchain utility and proof of work and proof of stake consensus systems, as well as the general impact on society which frankly is sorely lacking in the speculation crazed digital currency public sphere. I believe everyone who is a technical developer in digital assets should really read through it as it accurately portrays the ‘outside rational view’ that a technical person would have on bitcoin and blockchains, having lived through the hype and fall of the technology.

The article was extremely well researched and thought out, yet to be nitpicky lacked a couple of nuances indicative of someone who isn’t familiar with the BSV Bitcoin project could be forgiven not to be aware of, which I believe changes some of the conclusions that can be drawn. I think that with some small insights into BSV’s role to play in the future, can turn his critique piece into one more positive about the future of digital currencies and digital assets.

To make it an interactive experience, I’d like to go more or less slide by slide while adding my comments with respect to David so that he and others from the outside tech world looking in can get a view on how someone doing tech on the inside thinks. To establish context here, I have been in digital assets since 2014 and I have never thought of myself as a maximalist, revolutionary, anti-government, anti-bank libertarian. I have worked 14 years in banks myself as a technologist and is fair to say that I have a pretty good idea of the pros and cons of the current banking systems. I have always been interested in Bitcoin as the technical platform that could usher in a new model of internet perspective, not as a way to overthrow governments and banks perspective. And I think many in the space have a hard time differentiating the subtleties of these viewpoints. So while I consider myself libertarian politically, for many of the libertarian or anarchists in digital currency, I’m a ‘collaborator’. And to those on the outside, I am a radical. Cursed to be hated by all, I am without a tribe, but sound in the simple belief that Bitcoin and proof of work is the most misunderstood and underrated technological/economic invention of the Information Age. It’s just too bad the rational ones in this space are drowned out by the fanatics.

Let’s dive right in.

[Slide 2: Externalities]

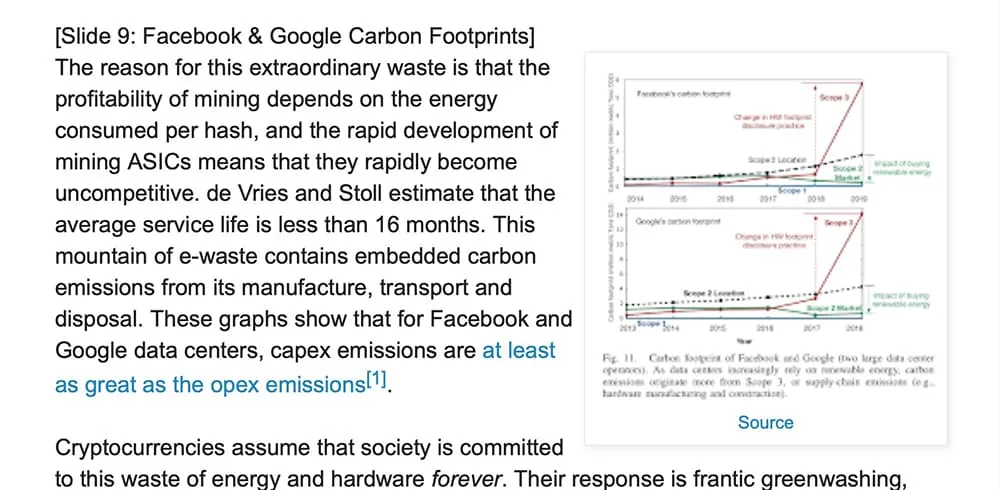

Bitcoin is notorious for consuming as much electricity as the Netherlands, but there are around 10,000 other cryptocurrencies, most using similar infrastructure and thus also in aggregate consuming unsustainable amounts of electricity. Bitcoin alone generates as much e-waste as the Netherlands, cryptocurrencies suffer an epidemic of pump-and-dump schemes and wash trading, they enable a $5.2B/year ransomware industry, they have disrupted supply chains for GPUs, hard disks, SSDs and other chips, they have made it impossible for web services to offer free tiers, and they are responsible for a massive crime wave including fraud, theft, tax evasion, funding of rogue states such as North Korea, drug smuggling, and even as documented by Jameson Lopp’s list of physical attacks, armed robbery, kidnapping, torture and murder.

True. BTC does use a lot of electricity at the moment, and IS very disruptive to existing supply chains. But this isn’t going to be the case forever. The current over supply of hashpower is directly due to the excessive speculator markets driving up the price of BTC irrationally (due to some form of fear of missing out degenerate-gamblers effect). Also important is that David’s comments are true only for BTC. Bitcoin SV (BSV) which has returned to the original Bitcoin protocol of unbounded block size means that hashpower (miners) can shut off their hashpower to cut costs when the transactional fees of the network isn’t enough to justify keeping the machines on. This means that transactions will just queue up until there is enough revenue to justify it. At that point, machines will switch on, mine 1 block which will include ALL the queued up transactions over the fallow period of time, and the network can continue in this manner indefinitely, where all of the backlog transactions are cleared once enough transaction fees have accumulated to justify the hashpower energy costs. As most businesses in BSV are building using proper simplified payment verification (SPV as per white paper) they rely on businesses and actors to be beholden by existing legal systems, all that is needed to confirm a payment is a signed transaction with a merkle proof that the coins being spent are existent. Confirmations from the miners are just the ’confirmation’ layer, not ‘settlement’ layer and not immediately required (my Goldman Sachs trade processing shop terms are resurfacing, apologies). There is little risk of double spending (writing a bounced cheque) if you are fairly certain that the other party will be prosecutable in the law if they do write one. Writing a bounced cheque in bitcoin is publicly provable.

Secondly, Bitcoin doesn’t put any stress on GPU markets. Bitcoin uses ASICs to mine, and hasn’t interrupted GPU markets since 2015. This is ideal, because you want mining companies to fully commit to hardware which is completely useless save but for to mine and process bitcoin transactions. That way they have an economic incentive not to misbehave (as their capital investments will be rendered worthless), which is the fundamental security model of the Bitcoin Proof-of-Work system. Loss of revenue is the best incentive not to be dishonest.

He’s bang on correct here. The whole El Salvador play was a popularity and marketing ploy, and it is no surprise that only the BTC community thinks that it was a good idea or that it is a success story. It was definitive proof of how an unscalable bitcoin that isn’t useful can’t be forced onto a society, and that only rich westerners think that ‘owning your own keys’ matters at all to real life impoverished people.

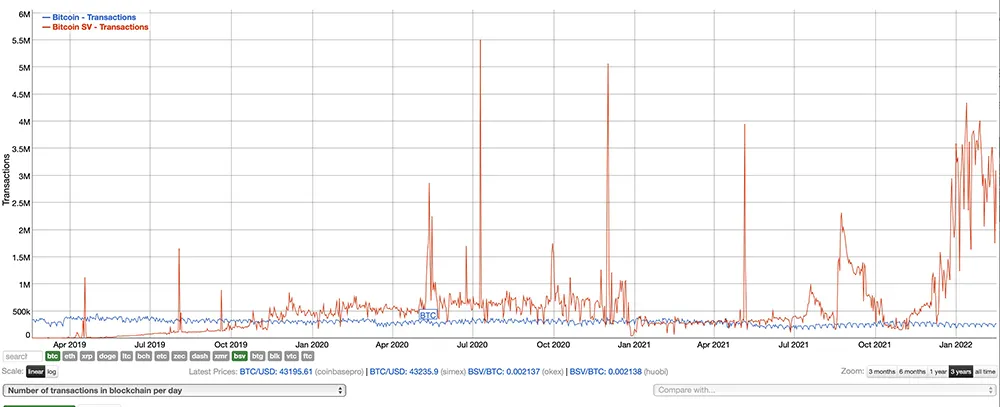

Absolutely right. Once again this is why many of us left BTC’s scaling model because we saw early on that it could never work at scale. We moved onto BSV, which is currently the proof of work public blockchain that can process the most transactions per second. I think the current record is ~4GB of txns in 10min, which works out to be more than 6m txn/s. That’s a peak measurement, yes, but without any protocol imposed limits, really the sky is the limit for BSV (or more accurately, how much the market demand is will drive the limits, not the protocol). As the below chart indicates, while there were some ‘stress test’ days in 2020, the average daily transactions on BSV is now more than 5x that of BTC this year so far.

On resiliency,

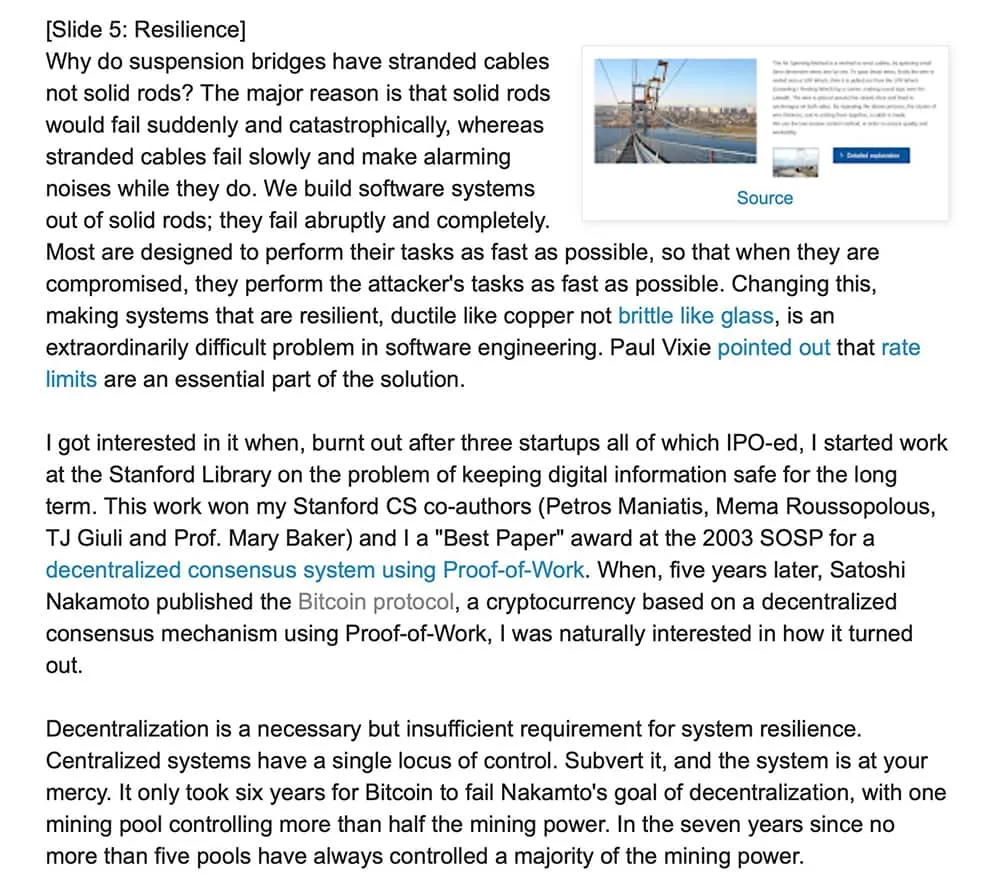

This slide was so true that I had to do a mental AMEN, when I read it. It truly is hard in this space to find other smart folks who come to the same conclusion. Firstly, I love the bridge cable analogy, and as an engineer myself, I can relate (how many of us had to watch the whole Tacoma Narrows Bridge saga in engineering ethics class?).

Decentralization is a LIE. It was NOT something that Satoshi even put into the Bitcoin white paper. That crazy notion was spun off from those who struggled with the problem of how to keep control of the network and the project with developers and not allow the economically driven miners ‘take over’. They contrived this notion of decentralization to be the mantra of Bitcoin, and fabricated hand wavy ways to measure it to justify the need for small useless (RPi) nodes, so that they could exert soft people power in that they could control the masses and social media.

There is no proof of work model that doesn’t result in a handful (let’s say less than 20) nodes in the system full stop. It is just not economically sensible for it to be otherwise. However, it is advantageous to try to trick many people into thinking that running their own basement non-mining RPi nodes matter, so that you can use this as a bluff against miners who do not wish to capitulate to the wishes of autocratic developers or cartels. At the end of the day, it doesn’t matter that decentralization (as defined by popular culture) cannot be achieved, because resiliency can still be achieved. The trick of Bitcoin ‘decentralization’ is that while it is impossible to avoid a small handful of mining pools (nodes) having control, the key is that they are also held accountable, and any misbehaviour by any of them will result in them losing revenue and possibly their whole business because of the constant competition with other nodes. Simply put, it is in every miners profit incentive to rat out bad or dishonest behaviour of their peers. So greed or fear of loss keeps them acting honestly, according to the rules of the system, and the rules of their jurisdiction. It is, in effect, the inverse of the Byzantine Generals problem. Instead of never knowing when your peers are being honest, you are actively forced to be honest, or face boycott. The key to decentralization is that any dominant player can be replaced, will be replaced once they can be shown to be untrustworthy. That is why having the ledger transparent, immutable and public is important.

Yep. Few people know where the origins of ‘blockchain’ come from, and it ISN’T with Satoshi. In fact, he called bitcoin a “time chain server” initially. No comments here except for, Yep!

Oh, okay, I can’t help but to throw in a comment about some public blockchains which claim to be permissionless but actually practically speaking are NOT, such as XRP (Ripple). Though they claim that you don’t need anyone’s permission to join (you don’t) that comes with a caveat. If you want to be a validator and you DON’T ask Ripple or other validators to add your node IP to their UNL (Universal(?) Node List (ask for permission or inclusion), then you will not be guaranteed to be in consensus with the rest of the network. Basically you can be forked off into your own ledger at any time without knowing it. In fact, it has happened before in 2018 and rolling back the ledger was a complicated mess. But nobody who wants you to buy their XRP bags will likely mention that. They don’t see these problems as a break of their consensus model though, as Ripple views setting of your UNL list to be different from other people is really just you wanting to run your own private XRP network where you can be the only validators, a deliberate fork of the network. So they claim they are ‘decentralized’ and exert no control over the network, but they don’t say that you don’t have any guarantees of being in a consistent state with the rest of the network if you don’t use their authoritative server list. Bait and switch.

Kudos for mentioning the original inventors of Proof of Work. It wasn’t Adam Back, who likes to perpetuate the myth that he invented it, just because Satoshi referenced him in the white paper.

This is once again criticism that is only valid if levelled against BTC. A blockchain which MUST keep processing transactions as they come, and has NO ability to queue up transactions until it is economically feasible to process them CANNOT be energy efficient. It is a one way-ratchet function. Hashpower expenditure can only go UP, otherwise the system crashes to a halt. This is not the case with BSV. So fair criticisms, it is too bad David doesn’t know about the unbounded (original) version of Bitcoin (BSV).

Most of the energy and energy economics comments are totally valid. Once again if you consider BTC as the only bitcoin under discussion.

YES! THANK YOU! He has the best breakdown of why proof of stake doesn’t solve anything. Better than I have ever been able to make myself. You can’t have a monetary system based on its own internal economics, because you build a giant economic bubble which encourages churn for churn’s sake. There must be tangible external costs to act as penalties for bad investments, and bad behaviour. Proof of Stake is an ouroboros eating its own tail.

Slide 17’s explanation of centralized mining is all true. Mining pools will be regulated under money transmitting services. This is why only a legal Bitcoin (BSV) will be able to survive in the long run, because you want those companies that provide these services to be accountable. Not shady.

This is exactly why if you flip this around and think of it as having bitcoin be accountable to law, and having illegal transactions reversible, (or lost coins retrievable), then this actually becomes a net good for society. Because we will have eliminated any incentive for most forms of fraud and theft. There is no reason to steal if you know there is a 100% chance that you will be caught eventually, and at the very least have all coins reverted to their original owners if you decide to hide away in a forest bunker somewhere. If stolen gold turns into lead, but turns back into gold if returned to the rightful owners, then who would want to steal?

Yes, DeFI is idiotic. But a ripe industry where fast talkers have the opportunity to liberate fools from their funds. I really don’t know why people buy into the need for financial products that have no insurance guarantees or even regulations. I guess the thought of getting rich without doing anything will always appeal to people. Every generation needs a get-rich-quick scam.

This is the BIG TRUTH that most people in digital currency don’t want to acknowledge. Geniuses at Tether have orchestrated the biggest ponzi …ahem… perpetual motion machine ever, as long as they can continue to print, they can continue to entice more people to join and support the scheme or fund their own secret exits into real property or USD. Unfortunately here, we are all along for the ride. Down. I avidly await the day when digital assets are valued like commodities. For their intrinsic value and utility.

This is why BSV promotes the protocol be pseudonymous and NOT anonymous. There is no practical legitimate need for anonymity. None. Nothing that can’t be achieved with just privacy. Privacy is not the same an anonymity. Privacy is private, but provable, and you always are answerable to the other party of any transaction. Anonymity is unprovable, and encourages illegal practices and behaviour. Ring of Gyges problem.

This is a legitimate problem. That is why we must push for the integration of the rule of law to rule over mining companies and operations providing the ‘money transmission services’ in digital assets. We can turn this dire situation from an “oh no, the world is in for a lot of hurt thanks to digital currency ” story to “we have effectively eliminated all crimes of theft and wire fraud” happy story. If you can’t keep what you steal, then stealing is no longer a profitable activity.

In the end, David Rosenthal’s article is excellent, and I hope to have a chance to discuss these and other future looking implications of bitcoin, technology and the impact on what we currently know of as the internet someday. It is really encouraging to see that forward thinkers and industry heavyweights such as David Rosenthal have taken the time to delve this deeply into the technical ramifications of digital assets, and I hope to have given you all (and perhaps him) a positive outlook on what the future may bring, if we only take the time to sift out the diamonds in the rough.

/Jerry

***

NOTE:

[1] Paraphrased from the writings of Craig Wright. https://craigwright.net/blog/law-regulation/if-gold-turned-to-lead/

07-13-2025

07-13-2025