| Getting your Trinity Audio player ready... |

Gemini’s founders are denying reports that the $282 million they withdrew from digital asset lender Genesis Global Capital shortly before it went belly-up was their corporate or personal cash.

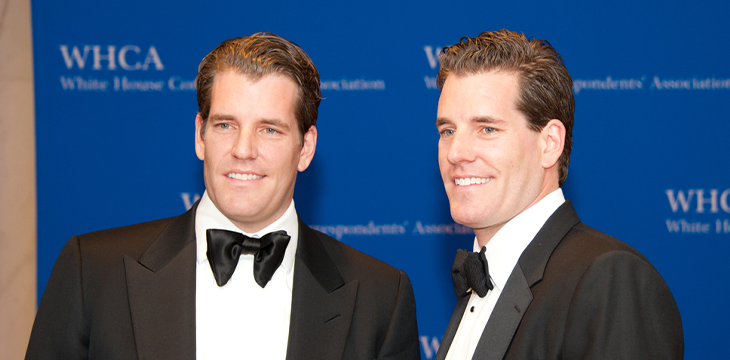

Late Wednesday, the New York Post reported that Gemini founders Cameron Winklevoss and his twin brother Tyler “secretly withdrew” around $282 million worth of digital assets from Genesis mere months before the lending platform halted withdrawals last November before filing for bankruptcy protection this January.

Winklevii v. Silbert continues to be very messy.https://t.co/5piThLcAPh

— Jacob Silverman (@SilvermanJacob) September 28, 2023

Citing internal emails and documents, the Post’s sources said Gemini’s mega-withdrawal occurred on August 9 and consisted of 3,120 BTC, 18,060 ETH, 142 million GUSD (Gemini’s in-house stablecoin), 49.6 million DOGE and a smattering of other tokens.

The Post claimed it couldn’t determine whether these holdings represented Gemini’s corporate assets or the Winklevii’s personal funds. But, the assets reportedly didn’t belong to customers of Gemini’s Earn program, which lent assets to Genesis in exchange for a higher yield. Nearly $1 billion of Gemini customer cash was stranded when Genesis went under, sparking a messy legal fight with Genesis’s parent company, Barry Silbert’s Digital Currency Group (DCG), that has yet to be resolved.

The Post’s source slammed the twins for having “pulled out their own money” while evidently being “comfortable” leaving Gemini customer cash on Genesis. Whether or not such a self-interested action was illegal, the immediate online reaction showed that it isn’t sitting well with Gemini customers.

The Post’s report was followed by a Bloomberg article in which a source claimed the $282 million was intended to ‘build out a reserve intended to ensure Gemini Earn customers could make immediate redemptions.’ This source further claimed that the withdrawn funds didn’t go ‘directly’ to the Winklevii.

So far, neither twin has personally commented on the reports. But both retweeted an official statement from the GeminiTrustCo account, which claims to be “disappointed” that the Post chose to “recklessly publish a completely misleading story.” The statement claimed that “everything the Post alleges in its story is the exact opposite” and that the withdrawn sum “was, in fact, Earn users’ money,” not Gemini corporate cash nor the personal funds of the twins or their investment firm Winklevoss Capital.

We are disappointed that the @nypost has chosen to recklessly publish a completely misleading story about the Gemini Earn program. Everything the Post alleges in its story is the exact opposite. The $282 million that was withdrawn from Genesis in August 2022 was in fact Earn…

— GeminiTrustCo (@GeminiTrustCo) September 28, 2023

Echoing the Bloomberg quote about rebuilding out a reserve, the statement claimed that this had proved a “wise and prudent decision” that reduced Gemini Earn customers’ exposure to Genesis. The statement further slammed the Post for “asking for comment right before their self-imposed publishing deadline.”

The statement went on to accuse Silbert and DCG of having “pre-packaged and handed” this “pure fantasy” to the Post to “distract from their fraudulent behavior that is currently under criminal investigation.” The statement accused the Post of being “willing to launder the lies” of Silbert/DCG “in exchange for clicks, even if it means deceiving their readership.”

No, you’re a big ugly doody-head

The animosity between the Winklevii and Silbert was on full display in the twins’ response to DCG’s latest proposal for restructuring what’s left of Genesis. On September 13, DCG submitted its latest filing to the U.S. Bankruptcy Court for the Southern District of New York in the hope of preserving the agreement in principle that DCG, Genesis, and the Genesis creditor committee reached at the end of August.

That deal would (allegedly) see Genesis creditors receive between 70-90% of their stranded assets in a mix of cash and tokens. But the deal relies on some iffy seven-year payments and contains a controversial clause that would exempt DCG from future legal liability.

DCG claims that the 230,000 Gemini Earn customers would fare far better than other creditors if the agreement in principle was accepted. The Genesis Debtors are expected to file their confirmation of the plan early next month, with distributions made “as quickly as possible thereafter.”

But DCG also took a dig at Gemini for “not contributing a single penny to provide Gemini Earn users a better recovery,” while “wasting its money on attorneys’ fees to mount an expensive opposition campaign.” Gemini’s failure to “put its money where its mouth is” was “inexplicable,” and DCG added that the Winklevii had yet to make good on their earlier promise to provide an additional $100 million to help Gemini customers “achieve a full recovery.”

Gemini was already vocally opposed to the “wholly insufficient” agreement, as well as a mid-August deal that saw DCG let off the hook for billions it withdrew from Sam Bankman-Fried’s FTX exchange and Alameda Research market-maker shortly before those entities filed for bankruptcy protection last November.

Gemini’s response to DCG’s filing accused Silbert’s company of continuing “its campaign of contrived, misleading, and inaccurate assertions in an attempt to gaslight creditors.” Gemini likened DCG to “a cornered wrongdoer attempting to intimidate the victims of its fraudulent actions.”

After reiterating that DCG’s proposed settlement won’t deliver “anything close” to the full value of Gemini customers’ frozen assets, Gemini accused DCG of trying to “bait the Gemini Lenders into accepting a deal that would allow DCG to pay far less than it owes.” Gemini insists its customers won’t take DCG’s bait and “become desperate enough to take a significant haircut just to move on.”

Genesis marked itself for death by lending billions of dollars to ‘crypto’ hedge fund Three Arrows Capital (3AC), which went belly-up in May 2022 following the implosion of Terraform Labs’ algorithmic stablecoin UST. DCG kept Genesis afloat by issuing a ‘promissory note’ with a 2032 maturity date that the Winklevii claim amounts to a worthless IOU.

The Winklevii further claim that Silbert misrepresented Genesis’s financial condition before they transferred their Gemini Earn customers’ assets to Genesis. The Federal Bureau of Investigation (FBI) is reportedly investigating the Winklevii’s claims, joining the Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) in probing DCG’s activities prior to the Genesis bankruptcy.

Bad to the bone

While the Winklevii appear dedicated to sounding the alarm so the ‘crypto’ masses understand that Silbert is a criminal, their abhorrence of criminality appears far more selective than they’d likely prefer to admit.

For instance, the Gemini exchange surprised many in January by listing USDT (the stablecoin otherwise known as Tether) in January. Previously, Gemini had shown little inclination to add such a major competitor to its own GUSD stablecoin. But with trading volume having plummeted following 2022’s string of ‘crypto’ insolvencies, it was clear that sticking with the tried and true wasn’t cutting it.

There were a few caveats for Gemini users, including the fact that New York customers couldn’t trade with USDT following Tether’s $18.5 million settlement with the state attorney general’s office in 2021. Tether had been caught lying about its lack of cash reserves backing USDT, a subterfuge that Tether never adequately atoned for, even as USDT’s market cap has more than tripled since that settlement was announced.

Bear in mind that the USDT listing occurred after the Winklevii had been badly burned by Silbert, who was only too happy to take advantage of their utter lack of due diligence. The twins can hardly claim to have been ignorant of Tether’s criminal history, which includes everything from bank fraud to money laundering to facilitating terrorist financing.

The twins also had to be aware of Tether’s pivotal role in the SEC rejecting all attempts to launch BTC-based exchange-traded funds (ETFs)—Gemini’s applications among them—because USDT is such an integral part of the wash trading that artificially manipulates the price of tokens such as BTC.

And where does most of that USDT wash trading occur? On exchanges like Binance, a charter member of the Crypto Crime Cartel. Binance is currently bracing for its own long-overdue criminal charges, and yet the Winklevii saw nothing wrong with traveling to Dubai in May to pose for a selfie with none other than Binance founder Changpeng ‘CZ’ Zhao.

Welcome to Dubai!

(Not AI, just wavelength of the energy level, or what they call lighting) pic.twitter.com/2u7HxsCNN6

— CZ 🔶 BNB (@cz_binance) May 29, 2023

Again, this selfie was taken two months after the U.S. Commodity Futures Trading Commission (CFTC) filed civil charges against Binance. The suit quoted Binance’s chief compliance officer admitting the exchange’s ‘know your customer’/anti-money laundering efforts were purely “fo sho” and that many of Binance’s Russian customers “are here for crime.”

The Winklevii have proven extremely adept at blaming others when they find their chicken coops covered in blood and feathers, only to turn around and roll out the welcome mat for local foxes. Perhaps all that headbanging in their cringeworthy ‘rock band’ gave them judgment-impairing concussions.

But in the end, it was their own greed that brought the Winklevii into Silbert’s orbit in the first place. Gemini offered ridiculously large rates of return to customers willing to lend their assets to the twins, who then had to punt these assets on to somebody offering even higher rates, a clearly unsustainable strategy that was never going to end well.

This whole inane merry-go-round was only necessary because tokens like BTC lack the capacity to do anything other than serve as chips in crooked crypto casinos like Gemini. And probably because the Winklevii were so determined to shift their narrative away from being known as Mark Zuckerberg’s bitches that they didn’t do the work required to ensure the safety of their customers’ assets.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of group—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple,

Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

New to blockchain? Check out CoinGeek’s Blockchain for Beginners section, the ultimate resource guide to learn more about blockchain technology.