|

Getting your Trinity Audio player ready...

|

Ethereum is fundamentally broken, and many of us have been saying so for years.

However, it wasn’t until this current digital currency bull market that many Ethereum loyalists began to realize it. Unlike other digital currencies, such as Solana and various memecoins, ETH has stagnated, and the Ethereum blockchain has failed to scale despite years of efforts and multiple pivots.

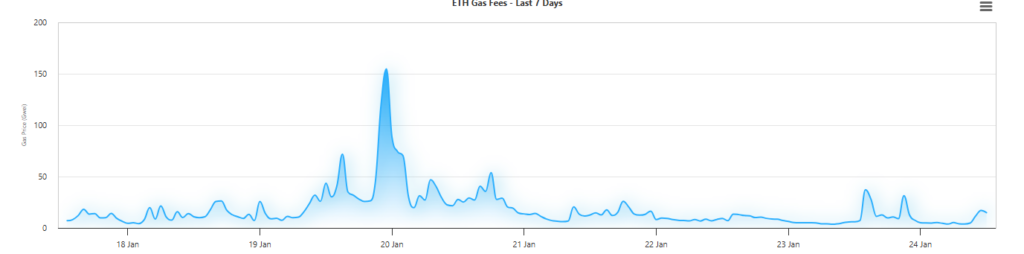

Understanding the pointlessness of using Ethereum for anything other than small-scale hobby projects, United States President Donald Trump launched his memecoin on Solana, but even that caused Ethereum fees to spike massively as traders tried to cash out of ETH tokens and move over to where the action was.

Angry about all this, some ETH holders have called for the scalps of Ethereum Foundation leadership, particularly Aya Miyaguchi. This prompted Vitalik Buterin to respond, claiming total authority over Ethereum Foundation leadership and chastising those calling for changes for making his job harder.

Whether the Ethereum Foundation listens to the community or not, a reshuffle or change in leadership won’t fix Ethereum’s fundamentals. Ten years of failure is compounding quickly, and we may be about to see the moment of truth dawn upon frustrated supporters of the world’s most overrated blockchain.

Why Ethereum can’t scale

There have been some fundamental changes to the Ethereum blockchain in its failed quest to scale over the past decade. Setting aside the decentralized atonomous organization (DAO) rollback that revealed the lie of ‘code is law,’ Ethereum has undergone the Byzantium & Constantinople upgrades (2017-2019), the Beacon Chain (2020), EIP-1559 (2021), the Marge (2022), the Surge (2023), and various other minor forks and changes.

Despite all this tinkering and pivoting, including an ill-considered move from proof-of-work (PoW) to proof-of-stake, Ethereum still cannot handle even relatively minor transaction demand. Time and time again, fees spike to tens or hundreds of dollars, and the blockchain reaches a standstill. Those who wish to bridge up to layer two solutions like Polygon still have to pay the gas fees, leaving many trapped until things cool down again.

CoinGeek’s Kurt Wuckert Jr. and others have repeatedly explained why Ethereum can’t scale. The UTXO model Bitcoin uses is far superior to state machines. The proof is in the pudding—while Ethereum buckles under pressure a decade in, the original Bitcoin protocol has successfully scaled to one million transactions per second (TPS) with fees of $0.000001 even when demand is high.

The truth is, there’s no saving Ethereum. Even flawed blockchains like Solana are being chosen over it, and serious projects by banks are choosing alternatives like Hedera over Buterin’s broken brainchild. Some day, they’ll all realize the power of the original Bitcoin (BSV), but that’s another story for another day.

Opinion: So, what should Ethereum supporters do?

It’s not on me or anyone else to tell anyone what to do with their ETH bags, but those who have stayed loyal all these years should realize three things:

First, Buterin is a dictatorial control freak who has shown his true colors more than once. He sees himself as Lord and sovereign of Ethereum, and that’s hardly in alignment with its decentralized ethos.

Second, Ethereum is practically useless even after all these changes and forks. In fact, it’s more broken and complex than ever. Currently, swaps cost over $15, and the Ethereum gas fee heat map, which tracks the averages, considers that cheap. That’s about as useful as a chocolate teapot for most people worldwide!

Third, builders and developers have been moving on for a long time, and it’s time to consider doing the same. After all the broken promises, failures to scale, and creating an irredeemable mess, those with their eye on the future should consider building elsewhere before the ship sails without them.

Perhaps someday, Ethereum will get its act together, and I’ll have to admit I was wrong. However, I see no evidence of that as things stand, and apparently, more and more Ethereum diehards are reaching the same conclusion.

Watch: Teranode is the digital backbone of Bitcoin

03-01-2026

03-01-2026