|

Getting your Trinity Audio player ready...

|

Remember when Bitcoin SV won the protocol war? It was spring 2020, which means it was book-ended by the threat of war with Iran, the entire continent of Australia on fire and the worst pandemic in a generation, so it is ok if the Genesis upgrade feels like it happened a lifetime ago!

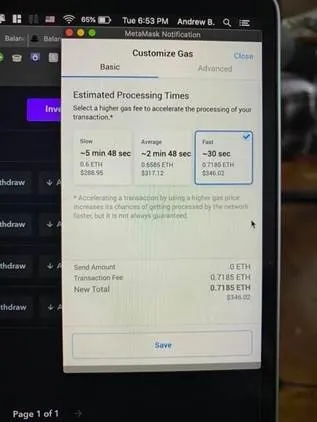

But it is important to remember that the limitations of the obsolete Ethereum protocol have not been solved, and that Ethereum 2.0 is about two years behind schedule now. Contrasted against the limitless scalability of Bitcoin SV, it’s fascinating to see digital currency trading markets on fire for Ethereum token trading in the new “DeFi” space while network congestion has ETH gas fees in the range of hundreds of dollars!

So what is DeFi?

The buzzword stands for “decentralized finance,” which, in the most basic sense, is a subset of services that Bitcoin was created to enable: “banking the unbanked.”

But in the Ethereum world, it typically describes a token-based business model that enables various lending services to provide high levels of interest for staked collateral (typically ETH or stablecoins) in exchange for allowing some custodian to lend to various entities against the total stake. In short, give your money to a shifty startup, let them do whatever they do, and you earn a percentage.

The staked ETH (and tokens) allows simple financial services such as bankless banking and insurance products to exist on the Ethereum blockchain while skirting KYC/AML as well as money services business (MSB) regulations and a whole host of other issues with the law. Of course, some small subsection of these DeFi concepts are actually good ideas, and if we lived in Utopia, maybe the token issuers would just be going fast to try to front-run the law and create so much disruption that the fines would be irrelevant to the profits and the benefit to humankind, right? Maybe they are like Uber? Go fast, break stuff, profit? Well, not exactly…

Vitalik’s Vision

DeFi is largely a scam predicated on multiple levels of assumptions about blockchains and tokenization which simply are not true.

Ethereum is a globally distributed computer that cannot handle global use.

That’s right! Despite popular belief that ETH can replace BTC, the obsolete Ethereum protocol cannot even handle the volume that this little boom cycle has created, so let’s not even bring up what this would look like at a global scale.

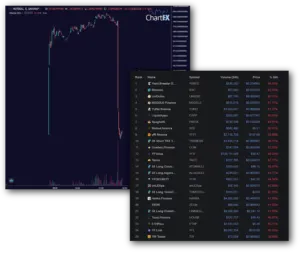

With tokens like yEarn (YFI), YAM, HOTDOG and SUSHI blasting up 3500% in August, Ethereum has been pushed to its limits, and the network is breaking apart at the seams with congestion. This is not some kind of bug. It is a fundamental design flaw of the global state model of reaching consensus. It will not be fixed with sharding or proof of stake either. It will never scale! THE GLOBAL ECONOMY CAN NOT BE REVOLUTIONIZED ON ETHEREUM.

Ethereum tokens are just money printing.

In nearly every case, there is no reason for the token that has been created except to print money out of thin air so that it can be sold to pay artificially high interest rates to depositors. An honest business would just use the base asset.

In the BSV economy, that would be Bitcoin, but these new players cannot just use the base asset because the Ponzi doesn’t work without a controlled token. Think about it: how does a brand new platform have the liquidity to pay out huge profits to account holders? Did they get a business loan or VC backing in order to float their business? No. They printed tokens out of thin air and marketed them so that fools assigned them an arbitrary value. The tokens can be inflated at will and dumped on decentralized exchanges (DEXes) for stablecoins which are paid out as profits to people who continue to make deposits to yield the gains. It is a classic Ponzi scheme.

The tokens are just pump and dumping.

It would be one thing if these scammy tokens were actually being used to facilitate business. Maybe an argument could be made that the law just needs to catch up. But that is not the case. With very limited exception, these tokens are just being pumped and dumped. Period.

“The Wheels of Justice Turn Slowly, But Grind Exceedingly Fine.”

The YFI token was one of the biggest winners in the August DeFi pump, but it was described as a “completely valueless 0 supply token,” by its creator Andre Cronje.

“We reiterate, it has 0 financial value,” Cronje wrote in a Medium post. But this bonkers market persists with amateur traders paying triple digit fees to trade worthless tokens for obscene profits on a network that cannot even handle the uptick in business. Unaccredited investors are risking their hard-earned money at the behest of snake oil salesmen with a shiny new idea!

What is YFI’s business model? Let them stake your coins. They allegedly lend to people, and give you a cut of the profits. They also grant a bonus if you hold their token which was created with an extremely low total supply, so while the creators may claim the token is valueless, it went from under $1,000 to nearly $40,000 in about forty days—making millionaires overnight.

But the chickens are already coming home to roost. With YFI token creating accidental wealth for people on Uniswap DEX, the bottom has already fallen out of projects like “HOTDOG” which represent the financial destruction of the unsophisticated investor. And this is where the law would normally step in, raid the offices and the bad guys would pay some fines, set up a fund to pay back burned investors, and a few nefarious parties would go to jail.

But with some careful planning of the exit scam, many of these tokens are too small to cover the minimums for the FBI to open up a case, and the ill-gotten gains will just be rolled into another scam until people wake up. But the law is certainly looking at this frothing market as a whole, and the regulators are building a framework upon which to close down shop on this madness forever. The details are being discussed behind closed doors, and it would seem impossible that this cabal of scammers is not taken down once and for all.

But then what? A novel solution

Bitcoin SV has been built from the ground up (since 2008) with scaling and compliance in mind so that businesses can issue real tokenized securities and utility tokens on chain. Instead of seeing a giant list of exit scams that were built on the promise of banking the unbanked, actual decentralized finance could be built to leverage the base asset (BSV), and actual bearer shares could be issued as tokens.

A few million transactions per second could be occurring between sovereign individuals for less than a penny per trade, and an immutable trail of evidence could allow criminals to be punished while also liberating the developing world to use truly decentralized finance.

Banks, currency exchanges, insurance products and tons of financial instruments can be issued today on the global ledger that scales. But the lack of maturity in the market, as illustrated by this latest exit-scam hype cycle, is a discouraging segue. If the entrepreneurs in the Bitcoin space can buckle down on business development, and perhaps even pursue some of the good ideas from this last, crazy bubble, we could build a revolutionary new economy.

It will just take a little bit of honor and courage.

07-03-2025

07-03-2025