|

Getting your Trinity Audio player ready...

|

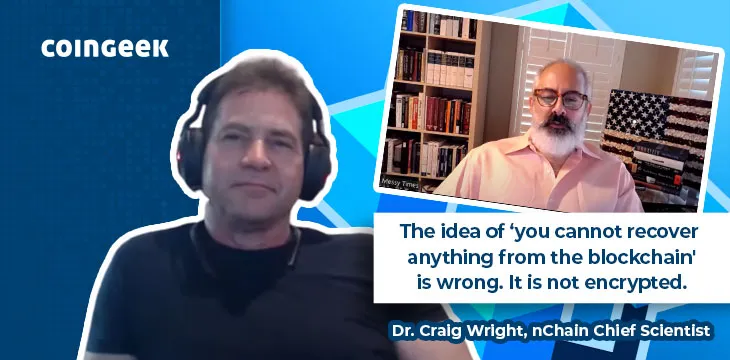

Interviews with Dr. Craig Wright can be messy, but they are always enlightening. Interestingly, the show Messy Times on YouTube invited Wright once again to discuss the “variable moral frameworks behind people’s economic assumptions.”

Messy Times’ video description of the Dr. Wright interview is thoughtfully crafted:

Purely atheistic thinkers focus on the division of material goods, as there is no higher moral consideration at hand. Those coming from a religious tradition often have clearly developed philosophies on what constitutes “proper” economic activity, including whether usury is a sin, what level or type of interest would constitute usury, whether all lending should be forbidden or just whether lending be made more equity-like in its shared risks. Many people fighting their corner are not even aware of the intellectual traditions that spawned their deepest if inchoate convictions.

That is food for thought, because we know Dr. Wright is of Christian faith and advocates for European culture as in Western philosophy. In an interview I took part in, Dr. Wright specifically talked about his moral values in general and about Bitcoin, too.

The show’s host Christopher Messina opened up a wide range of topics with Dr. Wright, from medieval German “Zinskauf” to Islamic Finance, Bitcoin, the democratization of finance, and more.

The purpose and meaning of economic activities

In the introduction, Dr. Wright stated that rationality died in the United States around 30 years ago. Messina agrees and adds, “it is on life support and got a faint heartbeat.”

“Most people don’t even know the difference between a republic and a democracy anymore,” Wright said.

However, the discussion quickly went deeper when Messina questions whether it is right to charge interest if there is a “permissible economic activity” and what Dr. Wright’s findings in these areas are. Recently, Dr. Wright completed a dissertation on the topic of late medieval history, studying the German principalities and the “Zinskauf” (which is a German word and can be translated as “interest purchase” or “purchase by interest”).

“The concept [of Zinskauf] was creating a sort of a way around interest by having repayment schedules that had you buy and sell everything back. Like Islamic Law, people find a way. Contracts will always exist,” Dr. Wright said.

“In Arabic it is Ribā, in Hebrew it is Ribbit,” Messina explains and points out the purpose and meaning of economic activities, as the West, with its Judeo-Christian influence in the past centuries, did in parts rely on Biblical concepts concerning charging interest. The same questions arise in Islamic Finance, as in Islamic Law, it is prohibited to charge interest the way we do nowadays in the West.

Why is charging interest partly prohibited and, in general, considered questionable in the three religions of the Book? Messina argues that the idea of an economic increase without taking the will of God into consideration is the problem here.

“There are also other interesting Christian arguments, for instance, the Parable of the Talents. So raising money and putting the money to work. It depends on how you do it. The difference in early Christian and also Islamic Law wasn’t the notion of interest or more compound interest. The notion of not having a share of the risk if you are getting the profit. (…). It is the concept of integrating risk,” Dr. Wright said.

By the way: for anyone who would like to know more about the Parable of the Talents, specifically concerning Bitcoin, John Pitts has published a remarkable article on that.

Digital asset market crash and ownership with Bitcoin

Messina took the discussion to the topic of the current digital asset market. The Messy Times host is wondering whether the “crypto market” is going to crash the way markets crashed in 2001, where at least some companies came out of it profoundly in the long run, or if everything gets flushed out altogether.

“The good stuff will just be bought up. (…). It will take a little bit, and everyone will panic for a while, but everything will be fine. I don’t know if you remember, but travel.com went bust. And then they got remodeled. But before that, there was a company called dogfood.com, and at one stage, they were actually trading for more than Amazon. They never actually sold anything,” Dr. Wright said.

Messina then explained that he, with his real-world physical mining company, is exploring non-fungible tokens (NFTs) to issue bundles of certificates concerning buying commodities.

“I decided to put it into an NFT structure, mainly because that is just a convenient carrying mechanism in order to transact. To me, that is all it was. A number of investors I spoke with said, ‘Oh, don’t touch NFTs!’ and I thought: this is fascinating. Because that is like saying Elron went bankrupt, so I don’t touch equities,” Messina said.

Dr. Wright explained how his vision of the original Bitcoin, as in the Bitcoin SV (BSV) blockchain, is partly about ownership. According to Dr. Wright, it may take time, but eventually, we will have the physical world mirrored in the cyber world to create individual items that one literally owns.

“That is why we have recently released a [Bitcoin] Notary Tool and the [Bitcoin] recovery system. One, the idea of ‘you cannot recover anything from the blockchain’ is wrong. It is not encrypted. Secondly, it gets rid of all these problems. So the anarchists out there go, ‘oh, you can’t trust courts.’ But courts are actually quite decentralized,” Dr. Wright said.

Scaling Bitcoin and the democratization of finance

The discussion went to the topic of how Coinbase (NASDAQ: COIN) was just hit with a multi-billion-dollar lawsuit, and according to Dr. Wright, that happened without Coinbase properly informing the shareholders. Messina seemed very interested in that and wanted to hear more.

“Passing off [Bitcoin], database rights, all that sort of stuff,” Dr. Wright said. He is referring to the fact that huge digital asset exchanges deliberately pretend that BTC is the original Bitcoin as envisioned by Satoshi Nakamoto, which it is not. The original Bitcoin nowadays is known under the ticker symbol BSV—the BSV blockchain.

Messina and Wright also discussed nChain’s innovations in the blockchain space. Dr. Wright said that apart from the merging of physical and digital, nChain is currently working on scaling—and the London-based tech firm has “very aggressive targets” concerning the scalability of Bitcoin. Dr. Wright sees a million transactions per second on the BSV blockchain soon, with way more transactional volume ahead in the future.

At the end of the discussion, Messina and Dr. Wright discussed the problems with the so-called democratization of finance. While easy access to financial products is positive, it also needs the appropriate financial education.

Dr. Wright pointed out that the first real “democratization of finance” happened in the 1920s, when share trading was available for basically everyone. However, most common investors never made the profits they hoped for. The host and guest agreed that the financial world should strive for the democratization of finance education.

See Craig Wright’s other appearance from four months ago at Messy Times here.

Watch: The BSV Global Blockchain Convention presentation, BSV Blockchain: A World of Good

07-11-2025

07-11-2025