|

Getting your Trinity Audio player ready...

|

This is an excerpt from John Pitts’ blog post, Commodities vs. Assets—BitCoin as computational commodity. Read the full piece on PowPing.

What are commodities?

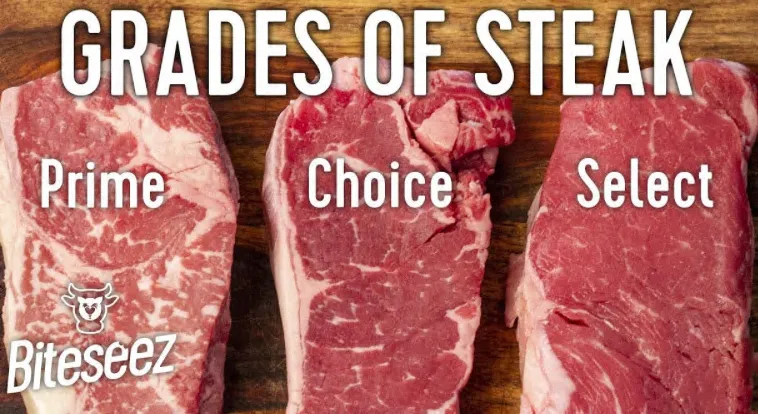

Oil is an asset; a barrel of oil is a commodity. A silver spoon, a silver ore nugget, and the Queen’s silver crown are silver assets; the Roman denarius, the Spanish “pieces of 8” coins, and the American silver dollar are commodities. When you slaughter a cow on your yard to slice up and have your family eat it for sustenance, that’s an asset. When the USDA grades a huge slab of beef “Prime” in a Chicago meat-packing plant, it’s using a fat-marbling PROTOCOL to create a commodity. Commodities are supposed to be interchangeable for a reason: efficiency.

What are some of the most important ways to measure commoditization efficiency? Cost, Speed, Security & Universality

Cost: How cheap can we send value? What’s more attractive: a $20 fiat Wire Transfer, or $0.0002 BitCoin transaction fee? Here’s a simple question: If a monetary transaction costs a lot of money, and the main expense of computers is electrical energy, can that transaction network possibly be energy efficient?

Speed: How fast can we move an asset? Did the Fortnite Tournament prize money go to the best player, or was the match decided by the difference in network latency for the Florida player versus the Vietnamese player whose avatar didn’t get his winning shot off even though he clearly pressed the trigger before his opponent? A transaction can have a large negative value, in something like eSports, if it cost a player a $1 million prize because it was too slow.

Security: How much waste and/or pilfering can be eliminated? If a central authority can decide that an investment product was hacked, but its solution is worse than doing nothing at all—wouldn’t it be better to have a system which can democratically make fast decisions based upon a pre-agreed protocol? Barrels carrying oil should not break easily, should not be easily stolen/siphoned, and should be easy to verify as carrying oil and not heroin by measuring a uniform weight without opening the bunghole. Security in BitCoin means knowing the money you received wasn’t double-spent—like knowing your husband isn’t maintaining a second wife and family on the other side of the river.

Universality: What percentage of a worldwide system can be made low-cost, high-speed, and with top notch security? If you have to pay $20 to your bank for a wire transfer of US$1,000 to Coinbase, then $50 mining fee plus a $14.90 variable Coinbase fee to convert the $1,000 into BTC, plus another $50 mining fee to transfer BTC to another exchange such as Bittrex, plus yet another $50 mining fee to trade the BTC for an digital good which is less “fee-happy”, then even small costs tend to build up over time. Likewise, if you’re using BitCoin and it is accepted by only 1% of the world’s businesses, you’re going to spend a lot of wasted fees and time on-ramping and off-ramping to fiat. Did you ever have the wrong currency in your pocket at a Swiss train station when you needed to use the wash-closet? Universal acceptance matters!

To read the rest of John Pitts’ piece, head over to PowPing.

07-18-2025

07-18-2025