|

Getting your Trinity Audio player ready...

|

This post is a guest contribution by George Siosi Samuels, managing director at Faiā. See how Faiā is committed to staying at the forefront of technological advancements here.

Capitalism is often celebrated as the engine of productivity. It rewards innovation, incentivizes efficiency, and drives market-based meritocracies. But if capitalism is meant to benefit the most productive members of society, there’s a critical caveat—one embedded deep in the very fabric of modern economies: the way we issue, use, and save money.

This is not a fringe critique. It’s a systemic concern—especially for enterprise leaders navigating inflationary cycles, global volatility, and digital transformation. At the heart of the issue lies fiat currency and its long-term impact on capital preservation, decision-making, and wealth distribution.

The fiat dilemma: Erosion by design

Using monetary historian Mike Maloney’s framing, most national currencies are debt-based instruments. Their value is continuously diluted by inflation—a feature, not a bug, of the current monetary system.

Central banks expand the money supply to stimulate growth, fund deficits, or stabilize markets. But the cumulative effect is clear: those who earn and save in fiat see their purchasing power decline over time.

In short:

- Productivity is rewarded with devalued money.

- Savers are penalized while asset holders gain.

- Inflation shifts capital from the bottom to the top.

This isn’t just an economic glitch. It’s a misalignment between effort and reward, a fundamental distortion in how capitalism is supposed to function.

Caveat or flaw? Reframing the systemic impact

So, is this a flaw of capitalism or a caveat of the monetary system that underpins it?

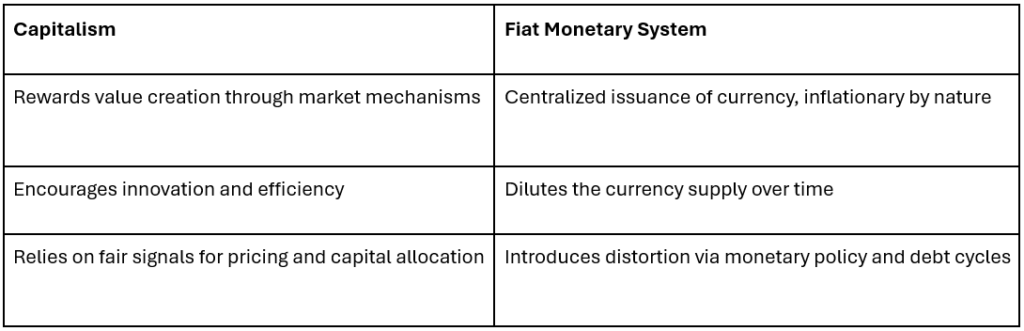

Let’s distinguish the two:

Capitalism—when truly free—doesn’t inherently require inflation. But when paired with fiat currency regimes, it creates a paradox: value creators are often outpaced by value extractors.

For enterprises, this plays out in balance sheets, long-term investment strategies, and even employee retention (as wages lag behind real cost-of-living increases).

The productivity tax no one talks about

Inflation acts as a silent tax on enterprise operations:

- Salaries require frequent upward adjustments, adding friction to HR and budgeting.

- Cash reserves depreciate unless aggressively reallocated into higher-risk assets.

- International expansion is fraught with foreign exchange risk, policy uncertainty, and capital leakage.

For high-performing teams and departments, this means that outperformance doesn’t necessarily translate to prosperity—unless executives are savvy enough to hedge against systemic erosion.

This is not just a financial issue but a cultural one. When productivity is disincentivized, enterprise morale and alignment degrade.Enter Bitcoin (and enterprise-grade blockchain thinking)

This is where Bitcoin, in its original form (as understood and championed by the BSV ecosystem), offers more than just a store of value—it represents a re-engineering of foundational systems.

Unlike fiat, Bitcoin:

- Is deflationary by design.

- Has a fixed supply, restoring trust in value measurement.

- Operates on a public ledger, increasing transparency and reducing inefficiencies.

For enterprises, this opens the door to:

- Stable, predictable units account for long-term planning.

- Programmable money for automated compliance and microtransactions.

- New forms of compensation, savings, and value capture aligned with productivity—not speculation.

Fortunately, 2025 is the year of stablecoins, as mentioned by Deloitte.

More critically, it aligns monetary systems with meritocratic principles, fulfilling capitalism’s original promise.

Strategic implications for enterprise leaders

Whether you’re a CFO recalibrating treasury strategy, a CHRO trying to retain top talent or a CIO rethinking tech infrastructure, here’s the bottom line: fiat inflation is a strategic drag on productivity, alignment, and innovation.

Enterprises serious about long-term value creation should consider:

- Integrating blockchain-based accounting systems to track real vs. nominal performance.

- Experimenting with crypto-based incentives or savings programs tied to real productivity metrics.

- Exploring sound money principles as part of broader environmental, social, and governance (ESG) and risk frameworks.

This isn’t about abandoning the old system overnight. It’s about recognizing the caveats that come with it—and adapting accordingly.

Final thought: Systemic clarity as competitive advantage

In a world of compounding complexity, clarity becomes a strategic differentiator.

Understanding the systemic caveats of capitalism—not just the surface-level mechanics—empowers enterprise leaders to navigate change with foresight. It reveals where value is leaking, where incentives are misaligned, and where the next frontier of trust and efficiency will be built.

And it just might start with rethinking what you’re actually earning—and what you’re really saving.

Want to explore how your enterprise can align productivity with purchasing power? Let’s map your current financial stack and assess strategic alternatives. Reach out via Faiā or connect with me on LinkedIn.

Watch: Determining blockchain’s economic value

02-27-2026

02-27-2026