|

Getting your Trinity Audio player ready...

|

Bitcoin is worth something if it is used. The BSV blockchain contains the original Bitcoin and has nothing to do with the so-called ‘crypto’ space.

At the London Blockchain Conference, Elas Founder and CEO Brendan Lee explained the true capabilities of Bitcoin—but also revealed that BSV-powered apps are already buying BSV satoshis to be prepared long-term.

Elas ensures that derivate trading platform Tokenovate has enough BSV to perform

Tokenovate is a new derivates trading platform with real trades on the BSV blockchain. Elas purchased 32 coinbase outputs for Tokenovate, which were approximately 200 BSV. According to Lee, the amount of 200 BSV is sufficient for Tokenovate to process up to 1 billion trades.

“Tokenovate is set up to make many millions of trades per day, so this is a really great way for them to strictly control the resource they use and ensure that they can continue to provide that service in a reliable way,” Lee said.

When Lee mentioned “resource they use,” he referred to BSV as a commodity. This is interesting because Tokenovate is just getting started and already purchased enough BSV to make sure it owns the satoshis needed in the foreseeable future of its business model.

In other words: 200 BSV was taken off the market supply due to one single app such as Tokenovate.

Do not get me wrong, though. The 200 BSV purchased by Tokenovate is not “burnt” or “gone,” as they will be used sooner or later in their derivate platform. So, these BSVs will return to the market, as in paying miners with sats, for example, who then may sell them again to someone else.

But for now, the 200 BSV are in Tokenovate’s digital storehouse, so to speak. Think about this further. Take BSV as a commodity seriously.

What if more and more BSV apps need more and more BSV?

Imagine Tokenovate would need way more than 1 billion trades. Imagine Tokenovate’s competitors joining the BSV blockchain-powered derivate trading. Then we are quickly at way more BSV taken off the market, as companies must ensure they get the BSV commodity—at a conveniently low price, if possible.

Another scenario: what if Tokenovate would not have bought the 200 BSV already, and then the BSV price increases due to speculation or any other reason? Right, Tokenovate would have to pay way more to get the necessary resource to run its business.

That is not different from any other business model we know that relies on any commodity. For example, a jeweler needs gold. The jeweler better buys enough gold to produce what the customers ask for —rather now than “maybe later.”

BSV is a commodity, which means BSV apps will need these sats. Not to hoard them, not to speculate with them, but simply to have them in store—ready to use.

Another example: A bakery has wheat, buys wheat, and produces with wheat. The difference to BSV is that satoshis are a digital commodity, or an informational commodity, as stated by Dr. Craig Wright. That is unusual, unheard of even! An electronic resource, which sounds strange, but we will get used to that.

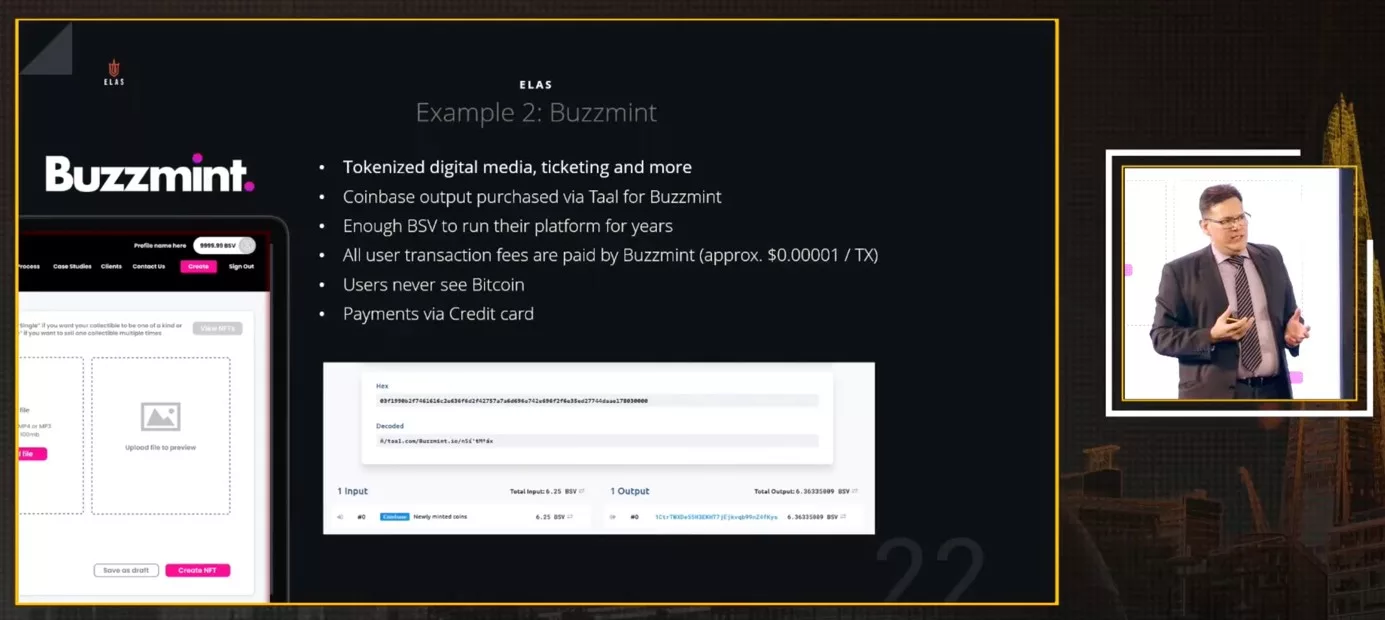

Web3 platform Buzzmint also buys BSV, so the customers do not have to!

Lee’s presentation showed more of that phenomenon. For example, ELAS assisted the BSV-powered platform Buzzmint and ensured that Buzzmint had purchased enough BSV to run their Web3 communities and related services for several years.

Why did Buzzmint want to have BSV in store? As explained by Lee, Buzzmint pays all user transaction fees. Users of Buzzmint apparently never see or touch BSV via Buzzmint on their own. So, Buzzmint purchased a bunch of BSVs, and once that was done, Buzzmint was all focused on delivering its service.

See where we are going with all of that? Will other BSV-powered apps do the same? Imagine you run a company that relies on BSV as a resource, but you have not stocked up on it. There will be buying pressure far aside from the nonsensical crypto speculation.

Bitcoin Dr. Craig Wright’s comments on BSV price

Usually, Dr. Craig Wright, is cautious about price forecasts concerning BSV. At The Bitcoin MasterClasses, Dr. Wright was specifically asked, though, and has answered according to his personal estimation.

“I don’t think it will ever get to a million pounds a coin in reality. (…). I think it is more likely £10,000 – £20,000 (…). It won’t be people holding it; it will be people using it. I don’t think it will ever be more than that,” Dr. Wright said.

Dr. Wright is focused on enabling digital ownership with the BSV blockchain. The price of each BSV sat has little to do with this mission.

Elas is pioneering the purchase of BSV as a commodity

We recommend watching the whole presentation by Brendan Lee at the London Blockchain Conference, where he explained Bitcoin precisely.

Furthermore, Elas is not simply buying “any BSV” for their customers, such as Tokenovate and Buzzmint. Elas makes sure it purchases coinbase outputs directly from BSV miner TAAL, which means “clean coins,” so to speak.

The reason behind focusing on coinbase outputs is probably the fact that with these fresh BSV sats, Elas customers have kind of a blank piece of digital paper to write onto concerning the transactional history of the coins.

03-04-2026

03-04-2026