|

Getting your Trinity Audio player ready...

|

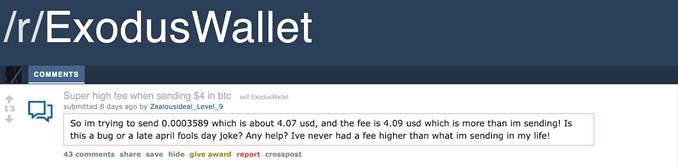

If I had to summarize why BTC fails, I would choose this recent Reddit post to make my point:

Someone complained in the Exodus wallet’s Reddit forum about high fees transacting BTC. The person tried to send 0.0003589 BTC (about $4) and had to face the fact that the transaction fee to do so would be more than what he was going to send.

So the 0.0003589 BTC cannot be moved unless he gets more BTC.

Is it a bug or a late April Fool’s Day joke? This is what the person is asking the other Reddit users there. Good question.

No, it is not a bug, it is a feature of BTC:

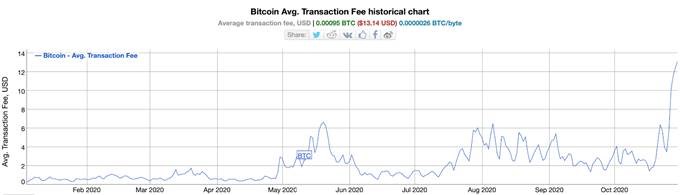

In the chart above, you will see rising transaction fees in BTC since January 2020. BTC users pay more and more to move their BTC.

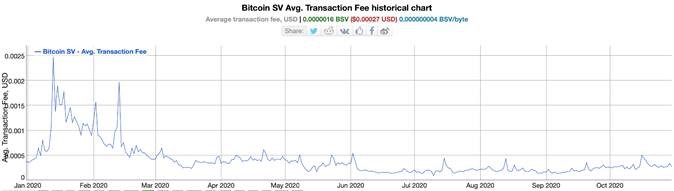

In comparison, if you send 0.0003589 Bitcoin SV (BSV) instead of BTC, you would not even notice the transaction fee. No wonder Bitcoin SV beats BTC in transactions and block size already and brutally dominates BCH, too:

The minimal fee is intended in BSV, as Bitcoin is an electronic cash system according to the original Bitcoin whitepaper and cash should not only be easy, but cheap to transact with:

As one can see, the chart above clearly shows how Bitcoin SV’s transaction fees are decreasing. So BSV users enjoy cheaper and cheaper fees to move their BSV.

This is crucial, as Bitcoin’s real power is in usage, not in “hodling” it. Only recently, Bitcoin SV powered social media platform Twetch celebrated 1 million transactions being made on chain by its users:

We started this company with a dollar and a dream.

Thank you all for supporting our vision for a brighter future.

1,000,000 TRANSACTIONS ON CHAIN!!! LETS GOOOOO 🥳 pic.twitter.com/VevOFllkxK

— Twetch (@twetchapp) October 27, 2020

Exactly that kind of real Bitcoin usage via micropayments is not possible with BTC due to ultra high fees.

Ultra high fees? I have to be exaggerating, right? Let us see how much more you pay in BTC compared to BSV:

As of writing this article, it is a staggering 73,789x more expensive to transact in BTC than in BSV.

You read that right, 73,789 times more on transaction fees in BTC than in Bitcoin SV. This is just one of the reasons why businesses use Bitcoin SV and have abandoned BTC.

Now it makes sense why PayPal—after recently announcing to let its users buy and sell cryptocurrencies on their platform—has added this sentence into their terms:

You currently are NOT able to send Crypto Assets to family or friends, use Crypto Assets to pay for goods or services, or withdraw Crypto Assets from your Cryptocurrencies Hub to an external cryptocurrency wallet. If you want to withdraw the value from your Cryptocurrencies Hub you will need to sell your Crypto Assets and withdraw the cash proceeds from their sale.

So PayPal users will be able to buy and sell BTC but not actually use it.

PayPal has no choice though, as people that buy small amounts of BTC would not grasp why their BTC cannot move.

Can you imagine PayPal customer support trying to explain why $4 in BTC cannot be sent because of ultra high transaction fees?

To fully explain that, PayPal would have to refer its customers to the ongoing war on Bitcoin, the crypto cartel, and the plan behind crippling BTC’s capabilities. And they will not be able to communicate all of the reasons in to an easy to understand few sentences.

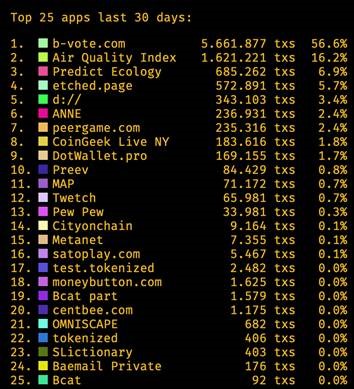

While BTC is busy damaging the Bitcoin brand, Bitcoin SV dedicated apps and services generate more and more transactions on-chain, creating real value for Bitcoin:

See also: One World, One Chain presentation by Jimmy Nguyen at CoinGeek Live

https://youtu.be/1qzTi6PiM8E

02-21-2026

02-21-2026