|

Getting your Trinity Audio player ready...

|

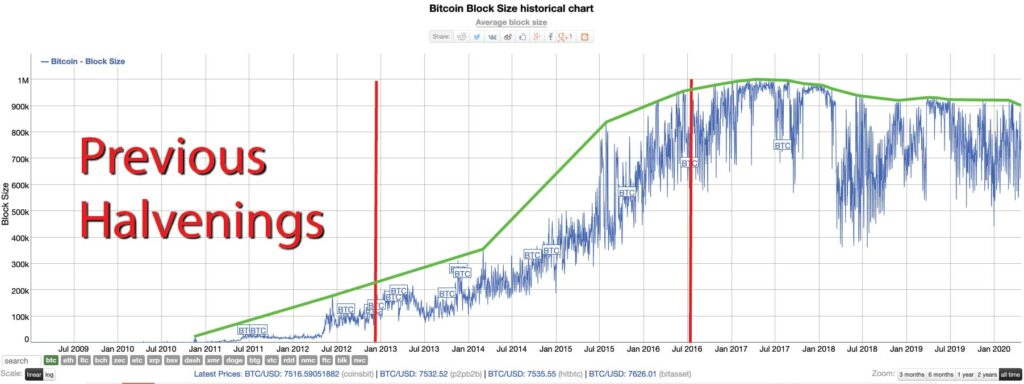

The halvening is a guide stone in the history of Bitcoin: a time to reflect on the advancement in block size, transaction processing profitability, and progress of the Bitcoin economy as a whole. Bitcoins, though issued by Satoshi Nakamoto in 2009, are emitted on a predictable schedule that cuts in half every 210,000 blocks, or roughly four years. While the countdown to zero emission is generations long, the point at which the network needs to become self-sustaining by generating large blocks full of fees will occur during the 2020’s. As network security makes its punctuated transition from the subsidy to standing on its own, we will discuss the history of the major eras of the protocol in a multi-part series with a focus on how block size and progress have always been intrinsically linked.

The period before the first halvening in late 2012 was a time of exponential growth in transactions and block size. Newcomers spilled in from the far corners of the internet. All nodes mined, most miners were developers, and a desktop PC could build blocks with ease.

Most miners charged no fee at all, and every hour, about 300 Bitcoins were mined—except that one time Jeff Garzik discovered billions of bitcoins in circulation. In 2010, due to a bug that printed billions of extra Bitcoins, Satoshi Nakamoto had to organize a majority of honest nodes to orphan the longest chain with the most proof of work in order to follow the shorter (but more “valid”) chain to maintain the original protocol! A few days later, all was back to normal because open conversations with Satoshi were frequent and fruitful, and there was an open dialogue among all early Bitcoiners.

That was not the first major change to Bitcoin though! In the twilight of 2009, famed cypherpunk and software wiz, Hal Finney, advocated for a block size cap to stop the potential for denial of service attacks. According to now-retired bitcoin developer, Mike Hearn, he and Satoshi Nakamoto only reluctantly obliged Finney, with the caveat that the limit would be temporary so that bitcoin could compete with Visa as the network grew and fees began to come into play.

According to Hearn, “The block size limit was a quick safety hack that was always meant to be removed” so that Bitcoin could scale organically with the market forces. Hearn is one of the few people that can speak authoritatively on the subject as he was one of the first (and arguably the most thorough) people to ask Satoshi about his intentions with Bitcoin.

In his first email response to Hearn, Satoshi stated:

The existing Visa credit card network processes about 15 million Internet purchases per day worldwide. Bitcoin can already scale much larger than that with existing hardware for a fraction of the cost. It never really hits a scale ceiling. If you’re interested, I can go over the ways it would cope with extreme size.

Even if Bitcoin grows at crazy adoption rates, I think computer speeds will stay ahead of the number of transactions.

Eventually, most nodes may be run by specialists

The transition is not controlled by some human in charge of the system though, just individuals reacting on their own to market forces.

It is important to note that Satoshi always considered “nodes” and “miners” to be synonymous terms. In the Bitcoin protocol, nodes were designed to mine, and he envisioned them ultimately consolidating into commercial entities so that all data on the network could scale on chain. He stated this numerous times in public forums, private emails and the whitepaper itself that Bitcoin nodes must render proof of work and mine blocks. Section five of the Bitcoin whitepaper is dedicated exclusively to the description of a Bitcoin node on the network where he clarifies with no ambiguity that nodes must work and build blocks on the Bitcoin network—reiterating the facts multiple times:

“The steps to run the network are as follows:”

1) New transactions are broadcast to all nodes.

2) Each node collects new transactions into a block.

3) Each node works on finding a difficult proof-of-work for its block.

4) When a node finds a proof-of-work, it broadcasts the block to all nodes.

5) Nodes accept the block only if all transactions in it are valid and not already spent.

6) Nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash.

Nodes always consider the longest chain to be the correct one and will keep working on extending it. If two nodes broadcast different versions of the next block simultaneously, some nodes may receive one or the other first. In that case, they work on the first one they received, but save the other branch in case it becomes longer. The tie will be broken when the next proof-of-work is found and one branch becomes longer; the nodes that were working on the other branch will then switch to the longer one.

Source: Bitcoin: A Peer to Peer Electronic Cash System – Section 5, “Network”

Satoshi did not view Bitcoin as fundamentally flawed in any way, nor was there any aspect of the network that he intended to reveal at a later date. He clearly saw it as a functionally complete design that could scale as it was designed due to what he called “market forces”. As he stated to Hearn, he believed that these forces would push nodes to become more efficient, connected and cooperative over time.

Obviously, Hearn understood Satoshi’s thinking on the subject, later stating to a pack of small blockers in 2013:

You want to keep the block size limit so Dave can mine off a GPRS connection forever? Why should I care about Dave? The other miners will make larger blocks than he can handle and he’ll have to stop mining and switch to an SPV client. Sucks to be him.

For full clarity, this is what Satoshi had to say to future BTC Core lead developer, Gavin Andresen, on the topic of Bitcoin’s fundamental design and the canonized nature of the network and script:

However, despite his clarity, there were detractors to on-chain scaling even early on. The fact that the whitepaper was released on Halloween 2008 on “the brink” of a worldwide economic crisis made it the centerpiece for sound money activism among the fold of the anarchist communities that created Occupy Wall St, Anonymous and Wikileaks. Satoshi Nakamoto did not fancy himself as much of a monetary activist in the vein of Timothy May, David Chaum or Julian Assange. In fact, in regards to politics, it is quite hard to catch Nakamoto saying anything at all, aside from this quick quip from the Cryptography Mailing list in November 2008:

It’s very attractive to the libertarian viewpoint if we can explain it properly. I’m better with code than with words though.

But the early monetary activists focused on the need for human intervention rather than Bitcoin’s inherent ability to scale up. James Donald, Hal Finney and others advocated for lots of low value nodes and the necessity for an intelligentsia to lord over the network—ironically so that it could remain “decentralized” as they envisioned. While their suggestions opened up the bitcoin network to some social subversion and sybil attacks, their views persisted in opposition to this crucial line in the whitepaper:

The proof-of-work also solves the problem of determining representation in majority decision making. If the majority were based on one-IP-address-one-vote, it could be subverted by anyone able to allocate many IPs.

Source: Bitcoin: A Peer to Peer Electronic Cash System – Section 4, “Proof of Work”

Along with the whitepaper, Satoshi also clarified many of his own thoughts about the topology that he envisioned as well as the progress that he designed for the network to make over time.

Only people trying to create new coins would need to run network nodes.”

At first, most users would run network nodes, but as the network grows beyond a certain point, it would be left more and more to specialists with server farms of specialized hardware.

A server farm would only need to have one node on the network and the rest of the LAN connects with that one node. November, 2008

In 2010, Mike Hearn wrote another series of questions to Satoshi. Among several other topics, the final question focused on the (at the time) 500kb block size limit:

Mike: “Is this 500kb a temporary limitation that will be slowly removed over time from the official client or something more fundamental?”

Satoshi: “A higher limit can be phased in once we have actual use closer to the limit and make sure it’s working OK.

Eventually when we have client-only implementations, the block chain size won’t matter much.

With very high transaction volume, network nodes would consolidate and there would be more pooled mining and GPU farms, and users would run client-only. With dev work on optimising and parallelising, it can keep scaling up.”

Whatever the current capacity of the software is, it automatically grows at the rate of Moore’s Law, about 60% per year.

Also in 2010, the future creator of Steemit, BitShares and EOS: the enigmatic Dan Larimer, was lamenting that the math just simply did not work out for a global payments system given the limitations and the current network topology of bitcoin.

In response, Satoshi clarified his position on nodes, mining pools and block size yet again, stating:

The current system where every user is a network node is not the intended configuration for large scale. That would be like every Usenet user runs their own NNTP server. The design supports letting users just be users. The more burden it is to run a node, the fewer nodes there will be. Those few nodes will be big server farms. The rest will be client nodes that only do transactions and don’t generate. July, 2010

Just a few months later, GPU mining would start to replace CPU, and by the end of 2010, mining difficulty would suggest that it had become the standard until FPGA mining rapidly replaced GPUs in early 2011. This was a healthy signal for the rapidly approaching halvening of 2012, and FPGA would remain the standard mode of mining until the mighty ASIC miners would begin to arise around the time of the first halvening, but that is getting a little ahead of ourselves.

During his tenure, Satoshi focused almost exclusively on the economics of the network: debugging software and making bitcoin more efficient and valuable. This included some very early indications that he wanted to build a new internet of value around (and inside) bitcoin; pointing to the earliest inklings of the metanet concept.

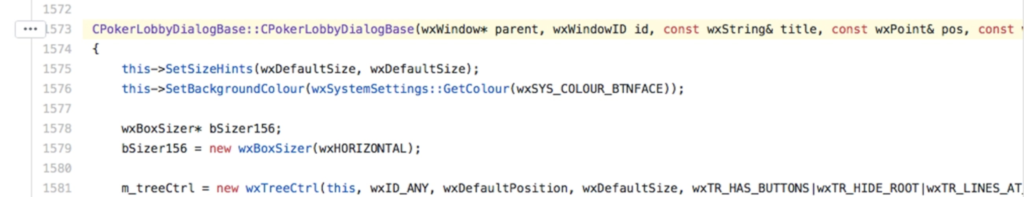

The code itself gives some interesting clues, as the first implementation of bitcoin had no block size limit, a transaction data size limit of four gigabytes per transaction, the framework for an on-chain poker app, an IRC chat client and a P2P marketplace all built into the mining node software.

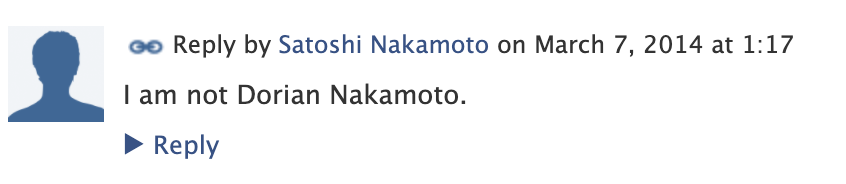

Satoshi was clearly hunting for ways to put more business, more data and more transactions on the network so that it could grow out of the subsidy phase. But in late 2010, Satoshi suddenly disappeared from the development scene and from his public exchange of ideas in the forums. He would only be heard from one more time when he decided to dispel some media uproar about a Japanese American who lived in the same neighborhood as Hal Finney.

He had left the keys to the Bitcoin repo in the hands of Gavin Andresen who was firmly aligned with Satoshi’s vision of Bitcoin and closely allied to Mike Hearn and Jeff Garzik who all saw on-chain scaling as inevitable. However, things began to change rapidly in the vacuum that Satoshi’s absence created. Not long after his exit, new developers like Gregory Maxwell and Peter Todd quickly became quite active, and they pushed themselves into positions of influence by debating the fundamental principles of bitcoin. Everything from questioning the protocol, debating the security model and criticizing the lack of altruism in mining; nothing about bitcoin was sacred to them.

Nonetheless, by the 2012 halvening, the block size had grown to hit a maximum peak of about 200kb, and was growing smoothly to supplement the loss of the 50 Bitcoin block reward subsidy. It was around this time that transaction fees started to come into play for security of the network. The game theory of halvenings, fees, fiat price, hash rate and mining difficulty would start to become more hotly debated, but the growth of bitcoin was exponential on all fronts!

The parabolic growth signaled great strength for the network going forward as an economic tool for business, payments and more abstract transference of valuable data. Security was rising with block size and both the number and value of individual paid transactions, confirming that bitcoin was on a healthy path toward the next halvening! But a time of great malaise was just around the corner. 2013 would see another critical inflation bug in the software and the rise of the small blockers. Their advent would lead to the creation of AXA Investment’s Blockstream Corporation which was established in an attempt to recreate bitcoin as a controlled protocol guided by their defensive patent strategy. The new era leading into the second halvening would see the last growth in block size and a successful take-over of bitcoin. Elimination of all on-chain scaling in exchange for high fees and proprietary off-chain solutions would all come into play for the 2016 halvening.

But that will be the subject of Bitcoin History Part 2: ‘We Were All Big Blockers, Except Greg.’

02-18-2026

02-18-2026