|

Getting your Trinity Audio player ready...

|

The smallest individual unit in Bitcoin is often called the “satoshi” or the “sat” for short. This is in homage to bitcoin’s creator: Satoshi Nakamoto. Does every sat matter if not every sat can be used equally on the network?

In BTC, there is actually a notion that some sats matter less than others; that some deserve to be transacted on the ledger and secured with proof of work while others should be moved around outside of the ledger or locked up to rot forever. Thinking about the destructive nature of small blocks and the endless malaise that exists when a protocol can be undermined by soft forks and trickery by dev teams, it is an interesting dilemma that arrives as maximalists claim that they must simultaneously stack every sat while also banishing many into various levels of purgatory. And the value of the sat is measured in quantity. If you have many sats, you are valued highly, but the individual sat is relegated to a lesser position than those held in large quantity.

What does this mean, Kurt?

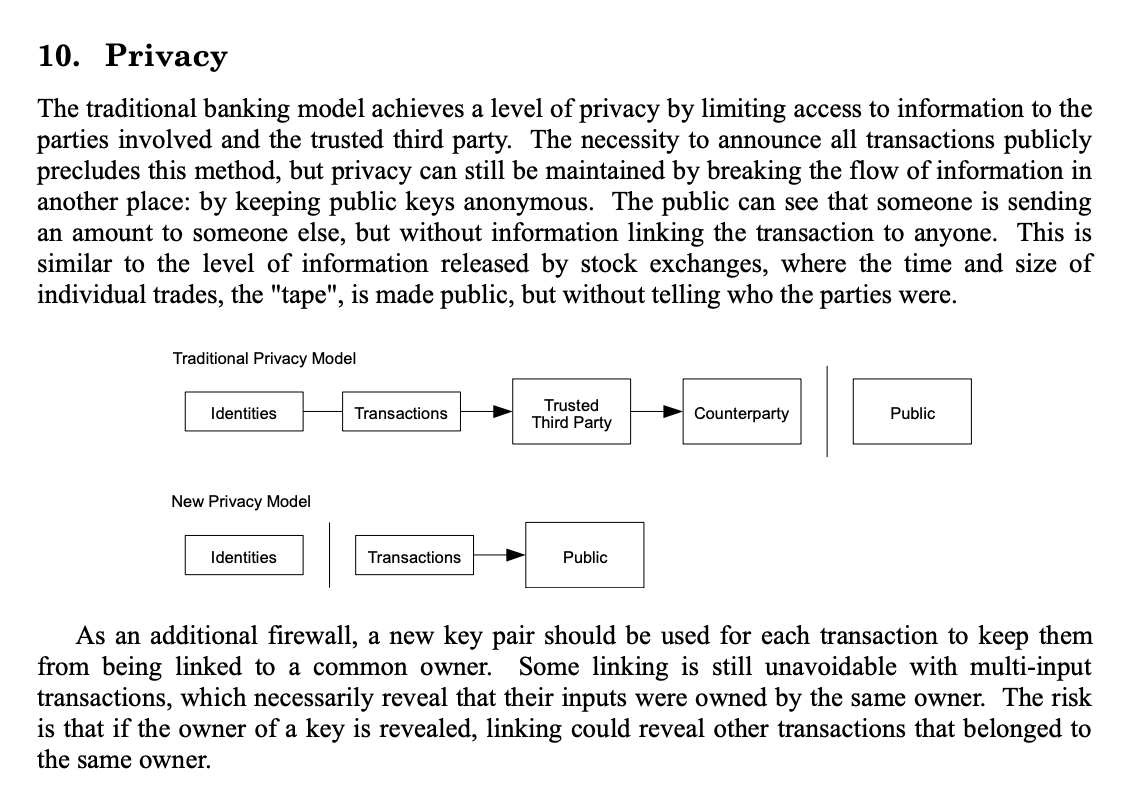

Let’s look at Bitcoin’s privacy model, first.

Satoshi Nakamoto explains the wisdom of using a different key pair for every transaction. Rather than having a billion dollars in a single address and when you spend a dollar, the recipient then knows your wealth at a glance, imagine storing a billion dollars in a billion public keys. That way when you spend $1.00, the recipient only sees as many addresses as was necessary to make the dollar.

The problem is that as fees rise on the network (and on BTC, they will rise forever by design) it becomes impractical to store anything near the average fee in a single public key address. If the average fees on BTC are $0.10, then you cannot possibly have addresses with $0.10 or less in them lest they become practically censored from use. Over time, more and more addresses become the de facto property of whoever mines them rather than those who hold those coins on the ledger. The way around this increasing problem is to consolidate holdings into fewer and fewer addresses—breaking the Bitcoin privacy model. But those Bitcoin holders who took Satoshi’s advice have now been harmed by the changes to the Bitcoin protocol which have made their sats less valuable than larger groups of sats that have been consolidated.

Forked coins

Another example of second class sats would be those which are sitting in outputs managed by soft fork rules. The most obvious would be Segregated Witness hashes of signatures, but there are many more sats stuck in all kinds of locking scripts which subvert the bitcoin governance model of proof of work. Instead of being validated against bitcoin rules, their position on the ledger is replaced with a piece of code telling legacy Bitcoin nodes to ignore any rules which are broken and instead just read the soft fork rule which tells the node to trust that the new rule does not break an old rule. These sats might not even be bitcoins at all, if we’re going to get technical and philosophical, but they can’t be validated one way or another by nature of the fact that a legacy Bitcoin node can’t see the rules of a soft forked coin.

Offchain coins

If you thought things couldn’t get any worse, I introduce you to bitcoins transacted without any proof of work at all. If the above sats were examples of second-class coins, then these might be third class because their transaction history is not on the ledger. Transactions off chain do not get treated to bitcoin’s proof of work, and their existence is only validated parenthetically—if ever.

In Lightning Network, these coins are locked in a smart contract while being exchanged according to a completely different rule set and governance model. In the Liquid Network, their governance is managed by a federation of trusted exchanges—whatever that means!

So, make no mistake! BTC does not respect the smallest unit of Bitcoin at all!

Is BSV better?

It’s hard not to be better than BTC when comparing implementations of the Bitcoin protocol, but some of the above criticisms exist in BSV as well. While fees on BSV are low, there are still dust limits, minimum relay limits and minimum processing fees enforced at the policy level of all nodes. We expect these prices to go down—liberating an increasing number of sats—but for now these problems still exist as an inherited legacy from BSV’s past life living within implementations of Bitcoin ABC and BTC Core.

While it is good to be better than other Bitcoin implementations, I challenge honest nodes not to rest. For BSV to be a global data management tool. Electronic cash for the world, or as file management for increasingly large and powerful sets of data, these limits truly must be eliminated. Nodes need to communicate, cooperate and find more ways to entice business to the BSV blockchain now, and liberating the single, individual sat is one of the best ways to do it.

If for no other reason, the Satoshi Vision of bitcoin should treat the network as if every sat matters.

03-03-2026

03-03-2026