|

Getting your Trinity Audio player ready...

|

Global asset manager ARK Invest has specialized in disruptive innovation and recently made headlines for their bull case scenario concerning Tesla.

ARK Invest also keeps an eye on the digital asset sphere (so called “cryptocurrencies”), but is ARK on point there, too?

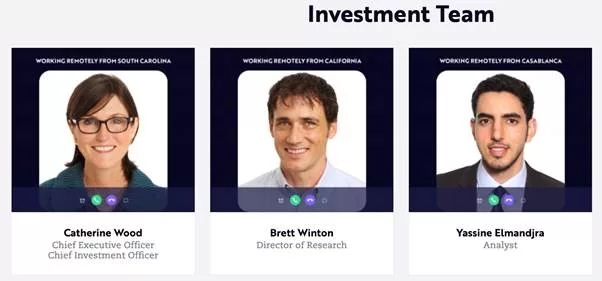

ARK Invest has a whole team researching digital assets

Being specialized on disruptive innovation, it is a no brainer for ARK Invest to have a research team dedicated to the digital asset area:

ARK has also been debunking common myths about Bitcoin in general, advocating for more open mindedness from the financial world concerning Bitcoin.

However, reading through the ARK Invest material concerning digital assets, one is astonished that there seems to be no focus on Bitcoin SV. Since Bitcoin SV is the only digital asset that scales and has a set in stone protocol, it should very well be the main focus of an investment firm that specializes in disruptive innovation.

It is no coincidence that famous economist George Gilder delivers the education necessary to understand Bitcoin SV and has appeared as a keynote speaker at the Bitcoin SV dedicated CoinGeek conference in London 2020. Gilder will also attend the next CoinGeek conference.

https://www.youtube.com/watch?v=kUwlYlM4t2U

Disruptive innovation in the digital asset sphere: Is ARK Invest missing out on Bitcoin SV?

ARK Invest offers an ETF solution called “ARK Next Generation Internet” that is described as consisting of

“(…) companies focused on next generation internet. Companies within this strategy aim to capture the substantial benefits of new products and services associated with scientific research and technological break-throughs in internet-based products and services, new payment methods, blockchain technology (…)”

Exploring this ETF, one does not find any hint on Bitcoin SV and associated business models such as blockchain transaction processing, Bitcoin SV driven applications and more. Even transactional world records being made on Bitcoin SV seem not yet acknowledged by ARK Invest:

So ARK Invest might be missing out on Bitcoin SV totally.

That would be no surprise though, as the digital asset sphere suffers from a severe case of information asymmetry and even professional investors struggle to understand Bitcoin SV’s role in the blockchain ecosystem. Part of the problem is the so called “crypto cartel” that hinders real innovation in the digital asset sphere for their very own reasons.

ARK Invest does not yet seem to look through the deception of “hodl BTC”—there is a reason why the “hodl narrative” is being pushed aggressively in the digital asset sphere.

Bitcoin is not in existence to be “hodled”, but to be used—it is about utility, because utility is value. Bitcoin is not digital gold, but a way to value data:

https://www.youtube.com/watch?v=wVbLyUWmCHU

The crucial information concerning Bitcoin SV is out there already

Bitcoin SV has had a brilliant year from an investment perspective as CoinGeek’s Mohammad Jaber pointed out. Jaber also explained how Bitcoin SV is uniquely positioned to become the dominant digital asset. There are reasons for Bitcoin SV’s meteoric rise.

Digital assets make no sense if they have no use case. That simple fact is still overlooked by investment firms and digital asset enthusiasts in general. Businesses prefer Bitcoin SV already and will continue to do so, as only Bitcoin SV is technologically and economically capable of serving as a global ledger.

Worth mentioning is the fact that Bitcoin SV’s roadmap is protected by a vast patent portfolio of nChain, leaving competing digital assets utterly behind in the long run:

https://www.youtube.com/watch?v=_wXBAgCuyQM

Should ARK Invest consider Bitcoin SV? For sure. Will they though? Depends.

If ARK Invest is looking for disruptive innovation, Bitcoin SV should be their main target of research.

If they instead prefer to follow the masses concerning BTC, ETH etc., another investment firm might outcompete ARK Invest in this area very fast.

02-20-2026

02-20-2026