|

Getting your Trinity Audio player ready...

|

2020 has been a turbulent year. With global economic disruption to every part of the supply chain, bundled with record levels of inflation to the money supply as a result of the coronavirus pandemic. It has coincided with a key quadrennial Bitcoin economic event where the block reward miner’s profitability from the fixed economic subsidy was cut in half.

This has placed further scrutiny on what the real value of Bitcoin is outside of being a speculative asset and whether there is any usefulness in its utility.

This report will take a look at the metrics of three chains (BTC, BCH and Bitcoin SV) in the eventful year so far looking at the technological, economic, legal capabilities and usage metrics of the network to see the impact of consumer behaviour of the networks.

|

|

BTC |

BCH |

BSV |

|

Market Cap* |

176 Billion (1st) |

4.4 Billion (5th) |

3.4 Billion (7th) |

|

Price* |

$9,559 |

$236 |

$183 |

|

Hashing function |

SHA-256 |

SHA-256 |

SHA-256 |

|

Total Supply |

21 million cap |

21 million cap |

21 million cap |

|

Max block size limit |

1 megabyte |

32 megabytes |

Unlimited |

|

Max Tx/per block |

2000 tx |

166,000 tx |

Unlimited tx |

|

Max Tx/second |

7 |

160 |

10000+ |

|

OP_RETURN data capacity |

0.08 KB |

0.22 KB |

100KB |

|

Instant transactions |

No, due to RBF |

Yes |

Yes |

|

Total transactions in 2020* |

62 Million |

7 Million |

129 Million |

|

Average daily transactions in 2020* |

306,154 |

36,406 |

636,632 |

|

Average daily transaction fee* |

1.43 USD |

0.024 USD |

0.002 USD |

|

Largest block generated in 2020* |

2 megabytes |

3 megabytes |

369 megabytes |

*Data is for the period of January 1, 2020 – July 24, 2020 at the time this article was published. (Source: Blockchair)

Transactional volume and usage of the networks

Even with the restrictions to the connectivity of the global economy in many ways, in theory it shouldn’t disrupt Bitcoin if it is to be used digitally as cash in commerce or with the unique and frictionless transactional use cases that it brings that conventional methods do not bring today.

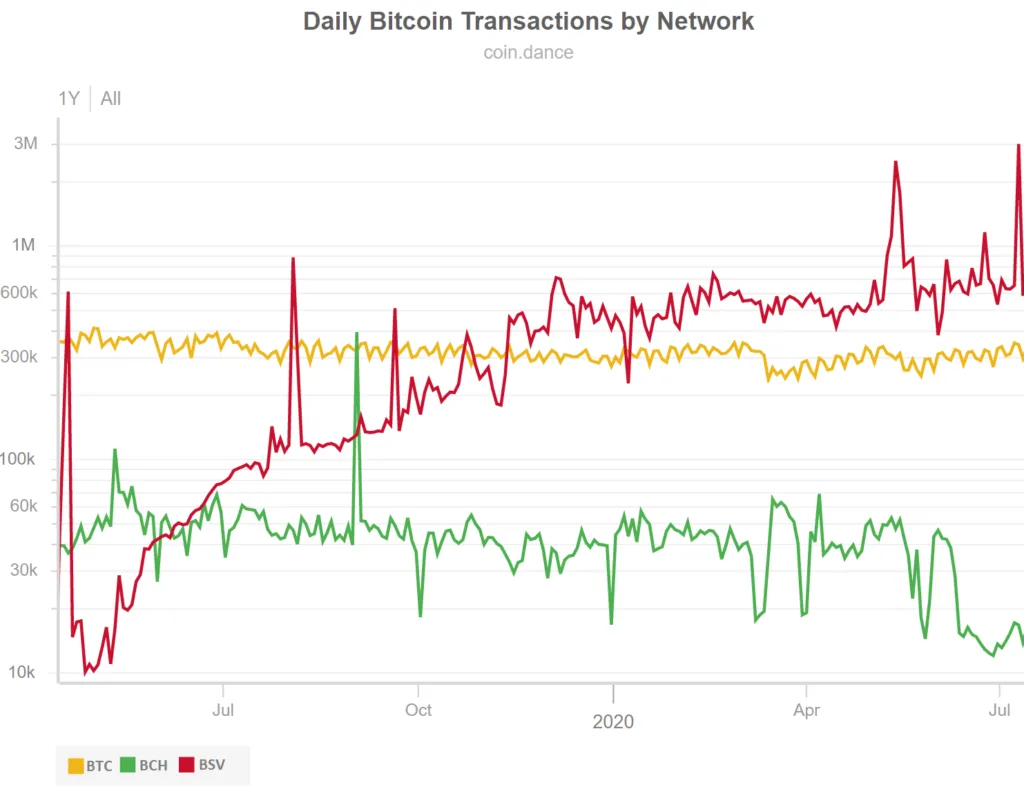

Looking at the transactions from last year heading into this year with the global economic crisis and Bitcoin halvening event has shown to have had no impact on Bitcoin SV which has continued to rise rapidly, whereas there is clear stagnation on BTC and a steady decline on BCH.

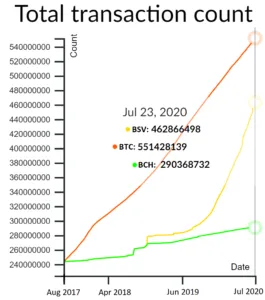

The cumulative transaction account since the inception of the genesis block in 2009 paints a picture of the trajectory of where we are heading.

Since the original Bitcoin protocol was able to be restored and scaling limits removed, BSV has seen a spectacular rise and it is only a matter of months before it accumulates the highest total transactional count.

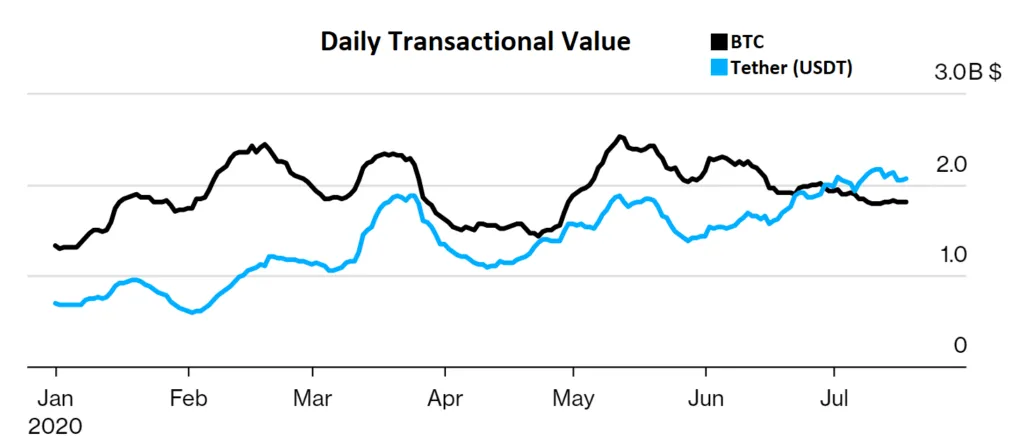

Not only has BSV passed BTC in terms of total transactions per day and on the verge of eclipsing the total transactions recorded on the ledger, but now the stablecoin Tether (USDT) has passed BTC in total daily transactional value being sent daily.

This is embarrassing and shows that BTC is less valuable in terms of sending money than an illegal and unregulated version of USD. One that is currently the subject to investigations of fraud that could collapse the token at any moment.

The transactional cost of the network

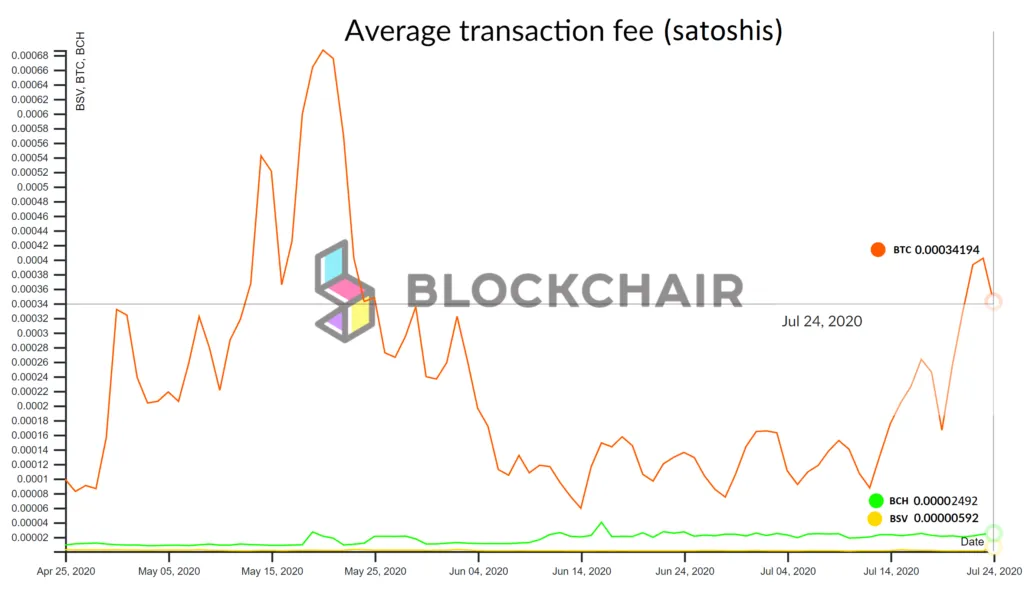

In simple terms, it is the cost for a user to be able to write onto the ledger. The type of transaction and size will determine the total cost to user will need to pay the miners. On average the floor of a transaction is about 0.5 to 1 satoshis per byte, however with scale and volume the minimum floor on Bitcoin SV will drop over time as the miners compete to set the lowest amount.

The fees of the network can be easily comparable in satoshis.

Using the averages on the most recent day, the average fees come to the following in order of cheapest to most expensive: BSV 0.001 USD, BCH 0.005 and BTC 3.27.

This displays that the cost of the network has everything to do with the ability to scale and generate more volume. Not only does the low cost of transaction on Bitcoin SV open up a plethora of new business ideas to enable users to earn and spend microtransactions at a more granular level, it will disrupt the legacy payment models of today.

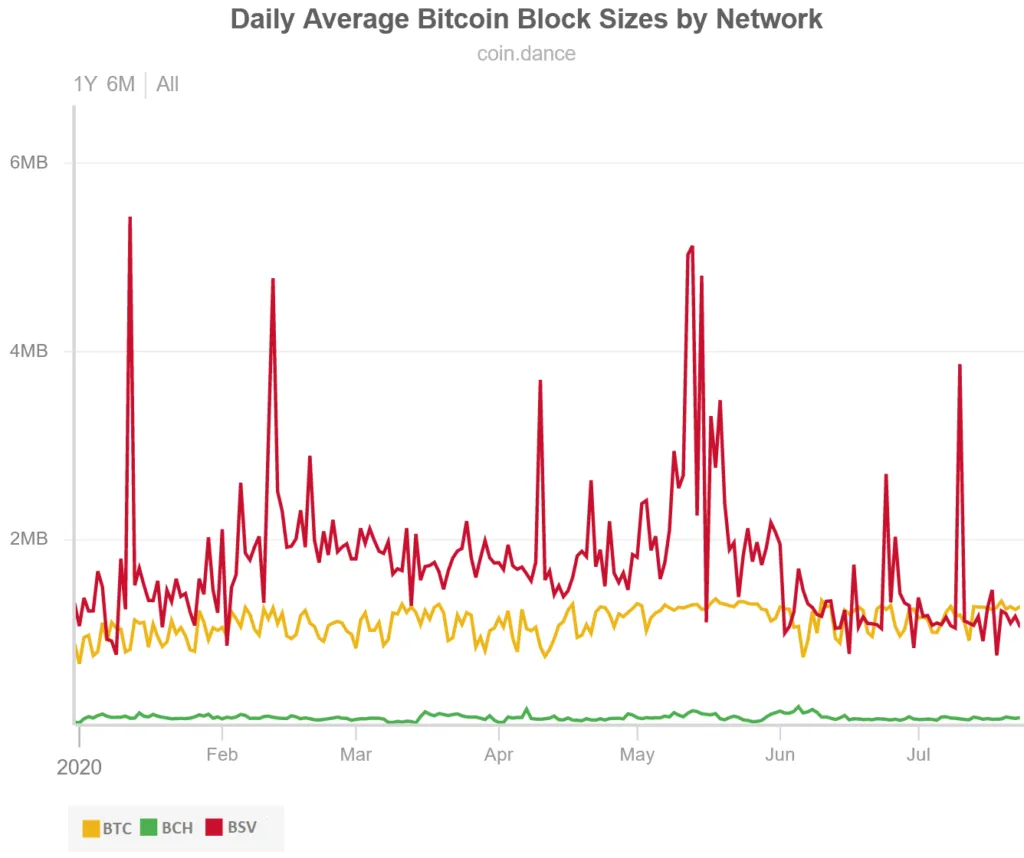

The size of the blocks generated by block reward miners

The larger OP_RETURN limits on Bitcoin SV give users more ways to be able to utilise the ledger to store data like videos, images, websites and various pieces of information.

The block sizes generated are a long way from being where they need to be, but it is clear to see which network is pushing the envelopes of what is technically possible. The Bitcoin SV Node team focused on locking down the protocol and engineered it to scale efficiently. This has allowed entrepreneurs to creatively utilise the immutability and power of the ledger without having to ask anyone for permission to raise block size limits.

The largest blocks in 2020 also tell a big story.

The largest BTC has been able to create is 2.4 megabytes and for BCH 2.8 megabytes.

BSV has broken records on several occasions this year and the biggest block so far has been a 369 megabyte block. BSV has mined over 100 megabyte blocks on hundreds of occasions this year.

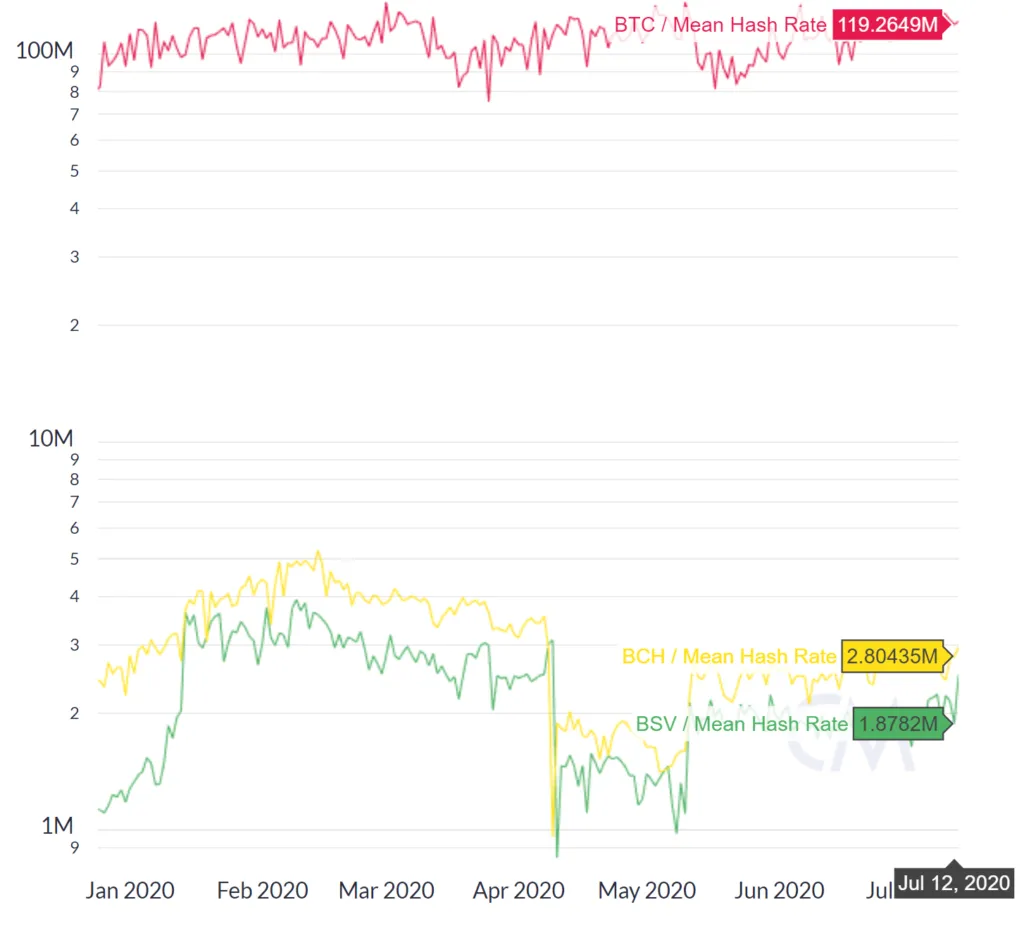

The demonstrated capability has not resulted in a change in the hash rate, which at the present is dominated by BTC. Block reward miners have continued to follow the price in the short term and this indicates that the majority of miners do not yet realize their own interests in the long term yet.

This spells a warning to miners who do not adapt their hardware and software. Soon enough they will not be able to sustain the technological capabilities required to propagate larger blocks that will be essential for their earning ability moving in the future. The block reward was a diminishing subsidy created in the original Bitcoin protocol, it was never meant to be a permanent revenue stream, instead transaction fees were envisioned as the future revenue stream for miners now known as transaction processors.

Bitcoin is secured by economics

Mining pools who have been vocal against BSV have joined the party recently. This is a clear indication that the security of the system will be secured by economics and that includes the utilization of the ledger through transactions. Block reward miners that recognize that shift will need to turn into transaction processors in order to sustain their business profitability.

Scale also means the inclusion of all parties participating in the network which is only possible by being compatible within the legal framework of society and having the same level of protection that all assets have today with property rights.

BTC and BCH have ruled themselves out from being inclusive of all participants of the economy through developer changes to the protocol. Their intention to align with anarchist ideologies by making their protocol anonymous and illegal, implementing things like SegWit, Schnorr signatures, coin mixing and off-chain solutions like Lightning Network means they will never be able to comply with law and regulations.

The recent actions by the IRS targeting BTC and BCH show that their decisions will continue to cost them whereas BSV has not been mentioned. Other directives like AMLD5 will make it illegal to operate wallets and exchanges without complying with the KYC requirements.

BSV has remained compliant with the legal framework whilst also successfully working towards scaling the network to ensure it reaches global adoption. Protecting the intellectual property of these capabilities is also a necessary element to all of this. nChain who is a leading the blockchain company with over 1,000 applications lodged already, are intending to use the largest blockchain patent portfolio for the purposes of ensuring BSV is able to fulfil this goal.

Only one version of Bitcoin can survive

The capabilities of the three chains during this eventful year are telling for what the future holds.

“I’m sure that in 20 years there will either be very large transaction volume or no volume.” – Satoshi Nakamoto in 2010

BTC users are discouraged from using the coin with scarcity in the blocks creating an artificial fee market, and are told that by doing so the price will continue to appreciate as a store of value whilst being told to wait for the future.

BCH users are still facing internal power struggles about the protocol and any serious business looking to build cannot do so with confidence that it will be able to scale or even be legally compliant.

BSV users who want to use and build on Bitcoin are encouraged to participate and compete in the digital economy without needing to ask for permission to scale or worrying about whether the protocol will change and become illegal tomorrow. As a result, it has seen an explosion of new applications providing the utility required to provide new and creative ways to earn and spend Bitcoin.

#BitcoinSV ecosystem continues to grow – now 428+ projects & ventures globally. That's because #BSV solves scaling problems faced by other chains – enabling greater data capacity, high txn volume, low txn fees + micropayments. https://t.co/yZWPM16ni6

— Jimmy Nguyen (@iamJimmyWIN) July 19, 2020

The value of Bitcoin comes as it gives you permission to write on the ledger in any use case possible, whether that is uploading and owning your data immutably forever or paying for the right to access exclusive content directly.

The value also extends to entities like governments, central banks and enterprises who will be looking to acquire Bitcoin in order to be able to tokenize fiat and real-world assets.

The velocity of usage collectively will be the tipping points when the demand to acquire more Bitcoin will come with the need to use it for utility.

All the above is only possible on the original Bitcoin design which has the incentives baked into the protocol whilst remaining legally compliant.

BSV is uniquely positioned to not only survive, but to be able to become the dominant force in the digital currency world.

07-09-2025

07-09-2025