|

Getting your Trinity Audio player ready...

|

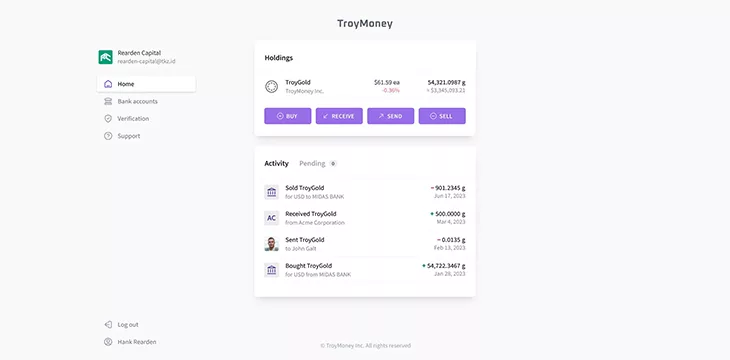

Smart contract platform Tokenized teased a screenshot of a TroyGold token, which is real tokenized gold on the BSV blockchain. The project is led by Garrett Krause, with the intention to offer investment, ownership and spending via micropayments of vaulted precious metals including gold, silver, platinum, and palladium.

👀#GOLD #Tokenized #TroyMoney #RWA #Bitcoin #tokenization pic.twitter.com/6breTUNnzT

— Tokenized (@Tokenized_com) June 27, 2023

I had the opportunity to interview Garrett on why he chose BSV blockchain and the Tokenized platform to launch his project.

You have mentioned that TroyMoney was going to launch on another blockchain—which one and why did you switch?

Garrett Krause: Initially, TroyMoney started as a concept to leverage our current gold production and export infrastructure giving great investor access to our long-term business relationships with trusted counterparties required for my investor syndicate to move out of their Fiat to Gold and other precious metals. So, at the beginning, the primary aim was not to use Gold as a currency or utilize it for micropayments or even create a new monetary system to be used as money.

The initial plan was to marry current trusted counterparty relationships allowing investors to purchase vaulted gold and other precious metals while recording their ownership on a blockchain which would make it an easy transaction to access and purchase precious metals such as Gold, Silver, Platinum, and Palladium.

Originally, I considered utilizing other Security Token protocols on Ethereum or Layer 2 blockchains as they would suffice for the initial and very simple purpose of recording ownership on the blockchain.

However, my perspective started to expand after researching Stellar as a viable option, which offered some micropayment capabilities. This discovery sparked a shift in my ideas, envisioning the possibility of “Metals as Money,” and opening new possibilities that lead me to Bitcoin Satoshi’s Vision using Tokenized Smart Contracts as the ONLY VIABLE OPTION.

How do micropayments factor into your decision to switch blockchains?

Garrett Krause: The micropayment capabilities enabled by using BSV blockchain through the Tokenized platform became a significant factor in my choice of BSV as the blockchain for TroyMoney. The impressive performance, scalability, and transaction economics unlocked the opportunity to establish a new Private Monetary System, effectively separating Government from Money. This concept takes inspiration from the old-school approach where Money was represented by USD or Gold Notes, backed by physical vaulted gold.

With the integration of blockchain and micropayments into the system, “Metals as Money” is now a reality, enabling the utilization of Precious Metals as a means to pay for goods and services through wallets. This integration brings the concept to life, facilitating real-world transactions with precious metals in a digital and efficient manner.

How did you find BSV blockchain?

Garrett Krause: I watched every video I could find on BSV, Craig Wright and CoinGeek conferences and I must admit it was a big eye opener as I didn’t realize Bitcoin was good for any type of smart contracts until I spoke at length with James Belding who educated me on the power and performance of BSV. Once I understood the power of Tokenized in combination with BSV’s capabilities, it all clicked for me, and I was all in on BSV.

Many of the people I asked about BSV had negative reactions and I heard many comments about BSV being a scam and full of controversy and it’s a bad decision. After all my research and I am glad I didn’t listen to all the noise and hearsay on the street which was the product of the past “Chain Wars” where the most powerful were protecting their crappy slow first generation “me too” blockchains against the emergence of the power and performance of BSV as in the original Bitcoin white paper protocol.

Why did you choose Tokenized as the platform and protocol to launch on?

Garrett Krause: I contacted James Belding after doing a comprehensive due diligence and research process on BSV blockchain and the different vendors and found James had a similar vision on what tokenization and a smart contract should be and after hours of discussions we found we were totally in sync.

His understanding of the technical and business details and my real-world project and overall business experience made it easy for the collaboration on TroyMoney as the first project on Tokenized. As we talked during my due diligence, I realized that we were in sync on an ISSUER SOLUTION and ECOSYSTEM for smart contracts that would be needed to be a dominant player in the Tokenization of Real-World Assets.

It is my view that other platforms and ecosystems for the Tokenization of Real-World Assets being developed on other blockchains are failing to deliver on the promise/vision of a securities solution that issuers have been waiting many years to be delivered. Instead of sitting back, I saw an opportunity to work with James to be part of the Future of Finance and Investing and bring my value in the creation of a whole ecosystem and comprehensive solution around Tokenized Smart Contract Protocols for use in real world assets which is projected to be a $16 trillion Industry by 2030.

WorldVest has introduced TroyMoney as its first project, and will soon mint MineralCoin on BSV, and tokenized projects to give other global issuers confidence that Tokenized and BSV is better solution to tokenize their projects on a performance blockchain that is reliable, scalable, safe, with compelling transaction costs.

I don’t believe any other chain can compete with the value proposition, and not by a wide margin.

So here we go, Real Tokenized Assets on Bitcoin Satoshi’s Vision Blockchain “RTA on BSV” is set for a global launch.

Will customers be able purchase Gold with BSV and vice versa seamlessly?

Garrett Krause: You will be able to purchase gold with BSV, BTC, other cryptos, stablecoin, a check, wire transfer and all gold or precious metals can be sold immediately on London Metals Exchange into many different global fiat currencies and sent to your bank account or crypto wallet of your choice.

We will offer immediate liquidity options through the London Metals Exchange which is the most liquid gold and precious metals market in the world.

What are the benefits of tokenizing gold as opposed to simply holding the physical metal?

Garrett Krause: It’s not just tokenizing gold as an investment but turning gold and other precious metals into real money and creating an alternative monetary system where it can be used to pay for goods and services. Gold and other precious metals in a vault is the ultimate real store of value, but hard to use and typically lacks the liquidity necessary to make it viable.

If you saw Peter Schiff, in his London Blockchain Keynote, which I totally loved, and he was so on point with the TroyMoney Vision as has become a reality today.

Will holders of the token be able to redeem for physical gold?

Garrett Krause: Yes, you can sell your gold for instant cash paid in many different global fiat currencies, but you can also order your gold and it will be delivered to your door by Brinks. I don’t feel that many investors will want physical delivery of their gold because vaulted gold at Brinks is a very trusted counterparty.

Can you explain how the Line of Credit against TroyMoney gold tokens work?

Garrett Krause: Have you ever tried to get a Home Equity Line of Credit to pull money from the equity in your house? Well, it is very difficult and time-consuming process if you even qualify.

So, we worked out a program where all TroyMoney that is backed by Gold, Silver, Platinum of Palladium comes with an automatic 80% TELOC (Troy Equity Line of Credit) that will allow you to draw cash against your TroyMoney without selling. This gives holders of TroyMoney the instant liquidity that might be needed at a moment’s notice for any purpose while keeping the upside investment exposure to Gold or other Precious Metals.

Do you plan to integrate with other BSV blockchain wallets such as HandCash? For example, allowing sends and custody of the gold token outside of the Tokenized platform?

Garrett Krause: We have had conversations with HandCash and a few other wallet service providers and everyone is excited and encouraged to integrate TroyMoney onto their platforms.

Hopefully by our initial launch we can offer TroyMoney to all BSV wallets, so they offer their customers the opportunity to buy and hold TroyMoney and soon after, used to complete transactions to merchants that accept TroyMoney as a form of payment.

In the MetaNet ICU Slack, you alluded to bringing MineralCoin which is currently tokenized on Ethereum currently over to BSV. Where does that fit in with the TroyMoney project?

Garrett Krause: See this press release. There is no direct link between Mineralcoin and TroyMoney except that WorldVest is the primary investor and sponsor of both projects. MineralCoin is a royalty paid on actual mineral production and was one of the first few security tokens ever to be minted on Ethereum, but the promised platforms and overall ecosystem has not developed to my satisfaction or standards so at this time I have chosen to move MineralCoin to the BSV Blockchain and mint using the Tokenized platform.

I also believe that BSV blockchain with platforms like Tokenized has the potential to be a leader in the global momentum for the Tokenization and Trading of Real-World Assets and WorldVest will focus on building a global securities token ecosystem around Tokenized and BSV as a necessary alternative to the current platforms currently being offered global issuers.

When will the project launch?

Garrett Krause: We are in the development stages of TroyMoney, and we anticipate being live with basic onboarding, purchase, and sale of Gold by September while we continue to add more precious metals including Silver, Platinum, and Palladium and with a roll out “Money as Metals” payment features by year end.

Additionally, we are looking into adding a TroyUSD and TroyEU stablecoin in addition to some other cool offerings that investors will be interested in holding.

This project has become a large than originally anticipated, but with the amazing development team at Tokenized together with the WorldVest team, we are working hard and making great progress towards our launch.

Thank you, Garrett, for taking the time to answer my questions. I hope the readers learned more about TroyMoney and its efforts to tokenize gold on BSV.

This article was lightly edited for clarity purposes.

Watch Peter Schiff at the London Blockchain Conference 2023: How a ‘digital gold’ system should really work

09-04-2025

09-04-2025