|

Getting your Trinity Audio player ready...

|

When checking my HandCash payments (as I do every day) I had a realization about the micropayment economy.

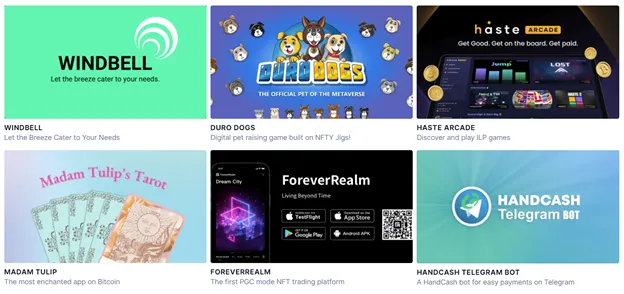

Shown above are interactions with four different applications that overall net myself around 47 cents. The only 3 debits are paying a penny for each bookmark uploaded on-chain via Windbell. The others happened passively from being on the leaderboard in the Haste Arcade, earning a revenue cut of tarot readings via ownership of a Madam Tulip Tarot Card NFT, and being friends with someone who Pew-Pew’d 1/5th of a penny to his friends.

Typically, when we spend money, we are conscious of the source we are spending from, whether the source is our recurring paycheck, a bonus or for example when making a larger purchase, savings. In the micropayment economy where the stakes are much lower, we can unexpectedly earn 1, 10, 50 cents from past interactions from several different applications.

However, when we spend money that we unexpectedly earn, that tends to be more fun as we do not scrutinize that spending activity as much.

I recall on my first (of many) trips to Japan in 2014, I attended a meet-and-greet at a bar in Tokyo. Japan’s highest coin denomination is 500 yen (~$5) instead of 50 cents (as in the U.S.). Since I was on vacation, I had budgeted to spend a certain amount of money. Also, since I was spending coins instead of paper bills, I spent the coins much more loosely on drinks than I would have otherwise. I did not care if I spent them all because I had already considered them to be gone. I believe the micropayment economy will function in the same way for people.

The immaturity of this market does not yet give us context of which coins from what income we are spending. Therefore, when we see a sudden credit of 10 cents in our Bitcoin wallet, (which is not enough to speculate on the Bitcoin SV price), spending it on the many apps in the HandCash App Gallery is the next logical step. Given the lack of context of earning, we do not necessarily care about losing it, which leads to less hesitation and expectations on returns when spending, incentivizing more and more use of different applications.

Given the rampant inflation in the traditional economy, 10 cents are nearly worthless by themselves. Online services do not support such small transaction amounts, and you cannot even buy gum or candy with a dime anymore. Yet so many services are available to spend 10 cents and much, much less on in the Bitcoin SV economy.

Additionally, as of writing, transaction fees are decreasing on BSV, where prices everywhere else in the world are rising. As the fees decrease further, more applications will be incentivized to be built that were not possible, giving more users options to spend those tiny amounts of coins on.

Such an unseen force is how Bitcoin as originally designed cannibalizes the entire economics of the Internet.

And it is not just because of the natural ignorance of the market, but more importantly because the disruptive power of the real Bitcoin (not BTC, but BSV) threatens the entire current Internet economic model,

— Zem Gao (@zeminggao) April 4, 2022

07-11-2025

07-11-2025