|

Getting your Trinity Audio player ready...

|

Blockchain-based investing has gotten trickier thanks to ‘crypto’ criminality and a broader economic slowdown, but some venture capital figures see undeniable benefits in the current climate.

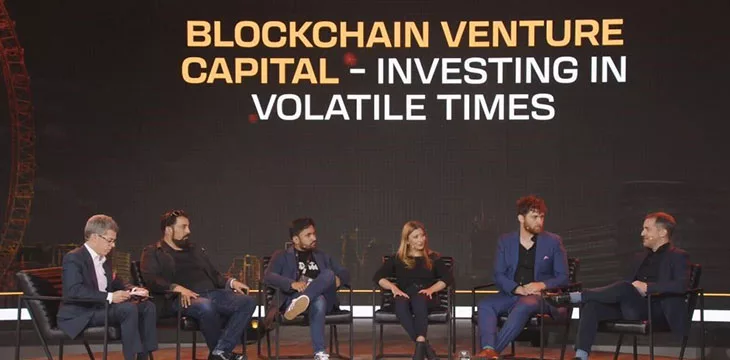

The final panel of Day 2 of the London Blockchain Conference 2023 was titled, “Blockchain Venture Capital – Investing in Volatile Times.” Moderated by Ayre Ventures’ Managing Director Paul Rajchgod, the panel assembled five prominent VCs with experience in blockchain investing, including many with portfolio companies building on the BSV blockchain.

Rajchgod asked each member to offer their company’s areas of focus and perspectives on the current VC climate. Mona Tiesler, Investment Manager at Tokentus Investment AG, noted that her company was publicly traded in Germany, meaning anyone can buy shares in Tokentus, “so we try to create a lot of symbiosis within our whole stakeholder network.”

A Tokentus portfolio company that Tiesler was eager to discuss was Transak, a fiat on-/off-ramp that works with over 160 different tokens and 75+ blockchains, helping customers in over 150 countries transition from Web2 to Web3. Tiesler called Transak “a real-world use case that’s helping onboard people into the space and helping the industry grow.”

Farid Haque, General Partner at Systema Nova, said his group was focused on B2B applications, “anything that can make businesses more efficient, help them be faster/better/cheaper.” Haque urged founders to highlight these types of benefits in their pitch deck, calling it “a great call to action” for any VC who sees promises of 10x cheaper and 20x faster.

Haque’s company takes “a market-first approach,” recalling the legendary tech VC icon Don Valentine’s strategy of investing “firstly in very large markets.” Haque said market size was “a huge determinant for us.”

Among the companies Haque is excited about is CUR8, which provides curated investments for ethical investors, and for which Systema Nova just announced a funding deal alongside Google Ventures. CUR8 is a “full-stack finance business for carbon removals,” and Haque said, “A lot of the rails for that type of stuff have to be blockchain-enabled.”

Ray Sharma, Founder/Partner at Extreme Venture Partners, detailed his company’s interest in Africa, with a current focus on Nigeria and a longer-term expansion goal into Egypt, Kenya, and South Africa. Sharma said around 80% of start-up activity in Africa is in fintech, which isn’t surprising given that “50% of mobile transactions on the planet happen on the continent.”

Sharma likened Africa’s penchant for innovation to China’s approach to messaging apps. At first, China was simply mimicking Western products, but soon integrated gaming, payments, and other innovations, to the point where the West is now playing catch-up.

However, Sharma urged caution regarding “overselling” blockchain’s ability to transform business sectors. While there are undeniable benefits from incorporating blockchain tech, Sharma said it was “just one of a checklist of items…maybe one of 10” that companies looked to employ when crafting solutions. Blockchain can help, but it’s not a magic bullet.

SNGLR is, according to Rajchgod, “the newest kid on the block” when it comes to blockchain VCs, having previously established longevity, smart cities, and smart mobility as its prime areas of interest. But Co-Founder & General Partner Patrick Sutter said SNGLR was interested in “technologies where we expect the most growth,” and SNGLR determined these were blockchain and artificial intelligence (AI).

SNGLR, which has a partnership with Ayre Ventures, expects to make its first closing this summer, but Sutter detailed SNGLR’s experiences with a couple of companies. One, a drone infrastructure provider, was highly regarded by drone makers, but its preferred revenue model required a micropayment solution (that only a low-fee blockchain like BSV blockchain can provide).

Sutter was less enthusiastic about another company that resisted embracing blockchain to the extent that SNGLR felt was warranted. In the end, SNGLR decided not to proceed with the investment, saying, “If you’re not going to the blockchain, we’re probably not the right fit for you.”

Unbounded Capital is no stranger to the BSV blockchain ecosystem, and Managing Partner Zach Resnick was keen to stress that his group is looking for projects “where blockchain isn’t a checkmark.” Unbounded seeks “technical founders that are leveraging blockchain to do something that wasn’t possible before without blockchain, or something that we know is an established market today but do it at least 10x faster or cheaper as a result of using blockchain.”

An example of the former is DXS, which allows individuals to invest or trade U.S. equities and derivatives “in increments as low as 1¢.” An example of the latter is RF Labs, run by “an incredible 19-year-old out of Atlanta who figured out how to manufacture RFID cards about 8x cheaper than anyone had before because he needed to make the economics work for his business.”

For the moment, RF Labs’ primary offering is a poker table that combines software and RFID to track analytics and automate live streams with the goal of reimagining how live poker is played. The ultimate goal involves incorporating this technology into any game with live players, including chess.

Resnick says RF Lab’s Atlanta wunderkind isn’t currently using any blockchain tech, but he hopes to eventually get his products into casinos, where Resnick says “security is extremely important. We’re very confident that he’ll end up needing to use blockchain as he scales and grows his business.”

‘Crypto’ baggage

The blockchain sector has endured no shortage of negative press over the past year or so. A seemingly endless series of high-profile collapses exposed the toxic mix of rampant criminality and downright ineptitude that soured both retail customers and institutional investors. Rajchgod wondered what impact all this negativity had on the blockchain VC sector.

Extreme’s Sharma took a contrarian stance, saying, “Criminal activity was important to get the industry off the ground.” Sharma likened it to the early internet’s first genuine commerce model being, pornography, which has its own “negative connotations.” But this helped “push the technical envelope and find applications that are useful that then become the basis for more traditional applications.”

Tiesler said there was definitely a loss of institutional confidence for blockchain investing based on “not enough education and knowledge out there about the differences between efficiency-creating blockchain technology and speculative ‘crypto’ or negative actors.” However, she expressed confidence in the survival of companies with real-world solutions to offer.

Resnick agreed, expressing disappointment that, for many investors he speaks with, “blockchain and ‘crypto’ are basically synonymous.” But he doesn’t believe entrepreneurs will be distracted. “People that want to build great things are going to build great things.”

However, Resnick added a specific observation for the BSV blockchain community, saying there’s “often an elephant in the room” when he connects with investors or companies that have yet to integrate blockchain technology. Resnick said he’s had entrepreneurs tell him that other VCs have warned that “if you build on BSV, you won’t get our investment.”

BSV blockchain’s “poor reputation” is all the more annoying to Resnick given that “empirically this blockchain is the only one that’s gotten faster and cheaper over time—literally the only one.” Long-term, BSV blockchain’s positives outweigh this negative perception, but it’s something BSV blockchain-based start-ups need to keep in mind.

Resnick advised any BSV blockchcain entrepreneurs in attendance not to “worry about explaining the technology” when pitching investors. “We think it’s great, but try to talk about it as little as possible with investors. Do as much showing versus telling…showing what blockchains can enable while abstracting away as much of that as possible. Maybe it comes up in due diligence, but it’s not a core part of the pitch. I think that would serve folks well.”

Half-full or half-empty?

In terms of the overall climate out there for blockchain-focused VCs, Haque said the ‘crypto’ antics of 2022 and the broader economic downturn had definitely caused problems for new VC managers looking to raise funds as “the number of sourcing wells has dried up a little bit.” However, those funds that were able to raise pre-crash have “a lot of dry powder” at the moment.

Haque also found some positives in the current situation, including “slowing the pace of deployment… There’s really no light under my ass to do more than one deal a month.” Haque found that the environment was “less transactional, much more about building relationships, getting back to the basics, the way VC was…I’m quite enjoying it, to be honest.”

Sutter noted another perk of the downturn, namely that the dearth of VC interest was compelling startups to downgrade their valuations. Tiesler echoed this view, joking about “discount shopping” in evaluating target companies.

Sharma suggested entrepreneurs should stop pushing to maximize valuation from investors. “It sounds counterintuitive, but with great valuation comes great expectations and therefore great responsibilities.”

Resnick said there was “always an inverse relationship between how people are excited about an industry and how profitable it is to invest in those industries.” Looking at VC funds that were invested in 2010 in the wake of the global financial crisis, Resnick said they drastically outperformed both investments made in the years leading up to the collapse or those made in 2014. Resnick expects similar positive results from investments made in 2023.

Resnick said the current environment is also different in that VCs invest in fewer companies but take a bigger chunk of the equity. Far from being morose, Resnick called the current situation “the best investment environment I’ve seen since starting Unbounded.”

A delicate dance

Rajchgod closed by querying the panel on their interest in AI. Sharma hailed the ability of AI to do much of the early grunt work of programming. Sharma used the example of a company that gets $500,000 from a VC, of which $300,000 would traditionally go toward software development. With AI, that cost might now be only $30,000, so you can either reallocate the leftover $270,000 to sales or simply raise less cash and retain more equity.

Sutter acknowledged that AI was undeniably impressive in terms of productivity gains, but the missing element was trust. “Everything that is data-driven can profit from the trust layer that blockchain can provide. AI needs the blockchain to really gain that trust level.”

Tiesler agreed, citing a company using “core blockchain technology” to develop a mechanism for verifying the data sources that AI uses to produce the answers to text queries. Tiesler called this a “very interesting intersection of how these two technologies can dance with each other to make mass adoption more available.”

While Resnick also believes AI would benefit from the trust aspects that blockchain can provide, he also thinks “micropayments will be at the core of the future of what AI looks like.” With BSV blockchain being the most cost-effective means of transacting via the blockchain, intelligence—human or artificial—indicates that BSV blockchain-based investments remain a very good bet.

Watch Day 2 Highlights: Reducing risk & improving trust with blockchain

09-05-2025

09-05-2025