|

Getting your Trinity Audio player ready...

|

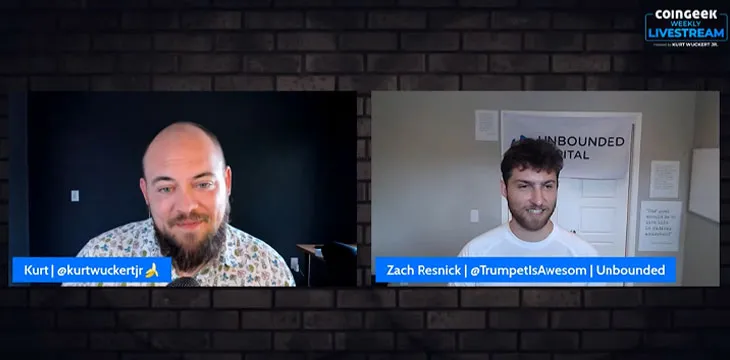

Unbounded Capital co-founder Zach Resnick is a man who wears many hats. He is known to be a successful investor, entrepreneur, and innovator in the Bitcoin space. But before taking on these roles, he was an avid online poker player in his teenage years.

Zach’s first encounter with Bitcoin during his online poker days opened his eyes to opportunities he can do with Bitcoin. While playing, he noticed several poker sites that gave players an option to withdraw and deposit in Bitcoin. Zach was intrigued after seeing other players profit from their Bitcoin earnings.

Zach was again reminded of the digital currency in 2016 while living in Tel Aviv. He met Yuval Roth of Bits of Gold, a company that converts bitcoins to Shekels in Israel. The two chatted about Bitcoin for hours, which prompted Zach to explore the technology further.

As founder of Fly Flat, a discounted biz/first class flight concierge service, Zach decided to utilize his entrepreneurial background to form another business, this time involving Bitcoin. Zach, who is of Jewish descent, set out to partner up with some members of the Jewish community in Buenos Aires to establish Argentinian exchange accounts. Why Argentina? Due to the country’s high inflation rate, Zach saw the price of Bitcoin routinely average to about 40% to 50% higher in Argentinian exchanges.

He also noticed the difficulty of taking pesos out of Argentina, and saw an opportunity to profit by catering to Bitcoin buyers in the country. He sold lower-priced Bitcoin, which he obtained from the United States or other exchanges, withdrew the pesos from Argentinian bank accounts, and waited several days before receiving a wire transfer from banks abroad. It was a cheaper alternative for Argentinians to acquire Bitcoin, and with a much quicker turnaround—a win-win situation for Zach and his clients.

Zach’s Bitcoin journey continued to unfold after moving to the San Francisco bay area, where he immersed himself in the Bitcoin and blockchain community. As he tells Kurt Wuckert Jr. on this episode of CoinGeek Weekly Livestream, his success in trading and managing people’s money led him to a rather different route: investing.

“I realized that, you know, there’s lots of room to innovate on being an investor,” he says.

Launching Unbounded Capital

After continued success in investing, Zach launched Unbounded Capital in 2018 along with like-minded entrepreneurs. Unbounded Capital describes itself as “a blockchain investment firm built by technical founders that understand the entrepreneurial journey; former poker pros that know how to analyze risk; and investors that understand that early-stage investing is not a passive activity.”

When the firm first started, Zach admits funds were scarce. “We didn’t have a lot of capital, but we had a lot of ideas, a lot of energy,” he says. He and his partners, Jack Laskey and David Mullen-Muhr, invested a lot of their time putting their ideas into writing, which in turn were used in Zach’s sales pitches.

As Zach explains, his pitch used to focus on Bitcoin’s superior powers and scalability. But for his part, discussing factors like the digital currency market has proven to be very effective. In his new and improved pitch, he is keen to point out the vast majority having exposure to a speculative ‘crypto’ market is not always ideal. As he explains, “Exposure to these things going up and down either directly in tokens or you have exposure with these poorly levered bets on the crypto market like exchanges, prime brokers and miners.” Unlike speculative investments, he says Unbounded Capital exclusively backs founders trying to solve big problems.

Unbounded Capital is currently raising its second fund with a more traditional venture capital fund structure. “We’re going to raise around $70 million over the next year and then we’ll deploy that over about three years into some of the top startups that are building on Bitcoin SV,” Zach reveals.

What are the main criteria to qualify for a VC, for those asking? Zach notes, “We want to back folks that are building for the long term and that are solving big problems.”

Zach also offers a piece of advice for startups looking to consider taking venture capital.

“You should really do your diligence and what that portfolio looks like and what that says about their vision… I think you want to make sure that they’re not backing competitors,” he says.

As far as Zach’s view on VC, he says, “Venture capital serves a really great need in the world, which is basically getting more capital from incredibly rich investors and institutions that have more money than they know what to do with. And putting that rather into mature companies, but into kind of the next innovative wave of companies changing the world.”

Watch: CoinGeek New York panel, Investing in Blockchain Ventures

https://www.youtube.com/watch?v=SdWurEo58ok&feature=youtu.be

Also, don’t miss out the first ever BSV Global Blockchain Convention taking place at the Grand Hyatt in Dubai on May 24 – 26. Book your tickets today!

09-16-2025

09-16-2025