|

Getting your Trinity Audio player ready...

|

Why did anyone need Ethereum?

Ethereum was a solution to a problem that only existed in people’s minds. Bitcoin was given to the world in 2009 with a Turing complete stack of scripting language capable of deploying virtual computers, smart contracts, tokens and so much more with unbounded scaling potential for the world. But it was quickly subverted by con artists who convinced people that bitcoin should not scale on chain. While bitcoin was mired in the scaling debate of the Bitcoin Civil War, Vitalik Buterin created Ethereum: a ‘Turing complete’ global state machine capable of a maximum of fifteen transactions per second globally.

In 2015, this was roughly 250% faster than Bitcoin, but in 2020, the Bitcoin protocol has shown the world that it can settle blocks over 350 megabytes in size, which is good for about 2,500 transactions per second. The Scaling Test Network indicates that blocks well into the gigabyte range are also ready to go on the mainnet which would mean that spikes up to 10,000 transactions per second are well within the realm of possibility on Bitcoin SV today.

All that to say, there is no technical reason for Ethereum to exist. It filled the role of a parenthetical era in Bitcoin’s history, but has been made obsolete, and that is why Ethereum 2.0 has been in the works for years now.

What is Ethereum 2.0?

“ETH2.0” is a brand new network with completely different consensus rules, validation methods and governance structure. Rather than being governed by honest nodes who contribute hash power to the network to secure it, it will be governed by whoever holds the most Ether: the in-built currency of the network. These governors of Ethereum will be granted more Ether relative to the amount of Ether they already have, building a parabolic wealth pyramid for large holders on the network, generating a sort of oligarchal governance system for Ethereum 2.0.

The new network will be called “Ethereum” by the decision-makers of the Ethereum economy, and the current Ethereum network will likely be put permanently to rest. But don’t be fooled! Ethereum 2.0 is a new network with a new genesis block. Tokens will be distributed to old holders in a 1:1 ratio so that the average investor won’t even know that the Ethereum they invested in had died, and they are now holders of tokens on a new network.

The reason for the change is that Ethereum’s fundamental scaling limitations needed to be mitigated. By a process called “sharding,” the new Ethereum will break up consensus into various pieces and have them separately validated: an attempt to mimic bitcoin’s parallelization in the UTXO model across validating nodes. But where bitcoin retains its security, the shoe-horned sharding model of Ethereum lowers security by making nodes dangerously disconnected from each other. As we have seen many times in the past, Ethereum is a complex machine, which leads it to break down on a regular basis. Adding this complexity and security risks of sharding will only make that worse.

So, for the price of an unbreakable oligarchy and reduced security, what are the benefits to using Ethereum 2.0 at all?

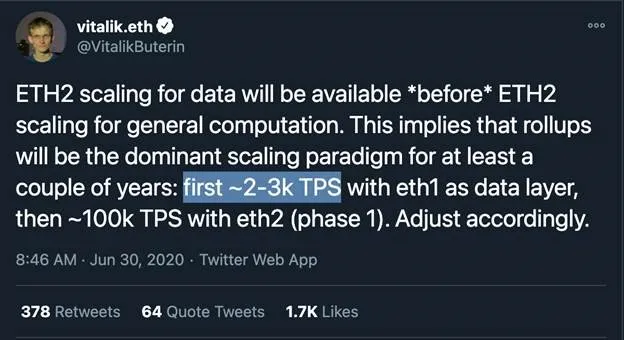

According to Vitalik Buterin, founder of Ethereum, these changes will allow Ethereum to process two or three thousand transactions per second—the same as Bitcoin SV has been able to process for years.

First, let’s not minimize the problems of the oligarchy built in Ethereum’s new proof of stake system. That’s a major economic problem, which extrapolates out various security problems in a similar vein to what occurred on EOS as exchanges used their clients’ stake to become the consensus validators of the whole network—leading to splits and years of in-fighting.

Secondly, sharding and Ethereum’s various “second layer” networks are a major cause for concern about security. Furthermore, second layer solutions in the digital currency space have become a simple side-step to answering the questions about why blockchains don’t seem to scale. So far, they have mostly been vaporware, and if Ethereum’s history is any indication (remember Plasma, anyone?) nobody should be too optimistic about ZK Rollups or any of the other fancy sounding solutions to Ethereum’s scalability concerns.

A third consideration is that Ethereum has been notoriously plagued by bad decisions, rickety code, missed deadlines, unintentional splits of the network, and tons of theft by the gaming of poorly implemented smart contracts. No Ethereum developer, investor or advocate with a shred of rationality should have any confidence that Ethereum 2.0 will roll out in a way which is secure and stable, and I have a nagging suspicion that the scheduled debut may get postponed for one reason or another.

Another concern that is conveniently ignored is that while the Ether currency might be able to benefit from some of the clever scaling solutions that have been theorized, the popular tokens will not ever be able to benefit from them on any version of Ethereum. That is because smart contracts need to be settled in Ether, and therefore the maximum scalability of Ethereum 2.0 will be maybe 3000 transactions per second on anything connected to a smart contract (which is most Ethereum traffic), and that is still woefully short of anything that deserves to be called a “world computer.”

So, the bottleneck will get wider, but not nearly wide enough for continued growth in DeFi, token issuance, or any other kind of transactions at an enterprise level.

Can I suggest that serious, business-minded Ethereum developers tokenize their projects onto Bitcoin SV? Perhaps the entire Ethereum network should be run in a virtual machine on Bitcoin SV so that it can scale infinitely and with greater security!

But the required Ethereum stake has been collateralized!

Yes, the official word from Ethereum developers on November 24 is that, at the final hour, the required amount of stake has been locked up for Ethereum 2.0 to replace the existing Ethereum network on December 1.

However, the technical and security concerns that are created by this transition should be concerning to everyone, especially because the requirements for global scale are still so utterly far away.

Oh! And one last thing: According to William Hinman of the SEC, “Central to determining whether a security is being sold is how it is being sold and the reasonable expectations of purchasers.” Ethereum narrowly passed the Howie Test on the last round of audit from the SEC specifically because of the decentralized nature of proof of work mining in balance with development decision-making.

However, the big change to the new network represents a unilateral shift from decentralized planning by miners and developers, and it shifts that power pointedly to Vitalik Buterin and his subordinates. It also changes the expectation of purchasers to be the recipients of dividends relative to their held stake in the network. So, rather than a decentralized network currency, Ether will become much more akin to an investment security, and it would seem that the SEC would have a very different opinion about holdings, in that regard.

So what to do?

As was said in the opening: Ethereum was a solution to a problem that only existed in people’s minds. But it never solved those problems very well, the road has been extremely bumpy, and there is a much more stable, scalable solution available today in Bitcoin SV.

Developers and entrepreneurs should be asking themselves how much longer they are willing to wait for Ethereum to be stable and scalable enough to allow millions of people to be using the network all the time, because that is the [broken] “world computer” promise of Ethereum that has been made whole today on Bitcoin SV.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift and Ethereum—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

09-18-2025

09-18-2025