|

Getting your Trinity Audio player ready...

|

Even though a majority of blockchain networks have zero utility, I think they have the ability to stay afloat for a long while.

Although some of these networks are technologically restrictive, economically unfeasible ghost ships, they have enough wind in their sails to keep them going for many years into the future.

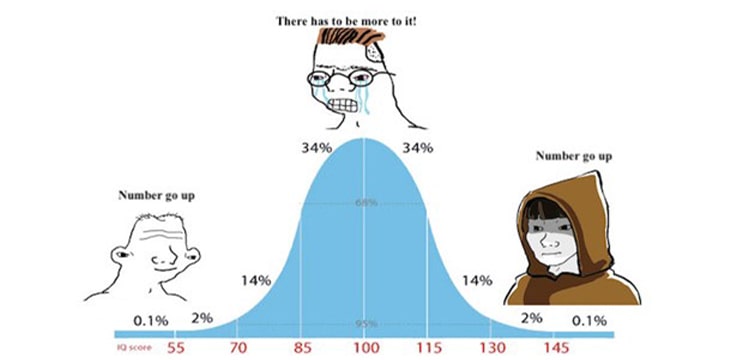

Over the last few years, we learned that there is more than utility at play when it comes to blockchain network valuation, price action, and lifespan. At the moment, investors are valuing community, robust developer environments, and a healthy war chest more than they are valuing a working protocol that scales and works at an enterprise level.

I’m not sure if it will be this way forever, but I know the world will continue like this in the short to medium term.

The hyper-positive feedback loop

Big Bankrolls: Some early Bitcoin investors made a lot of money from being one of the first to put funds in an experimental technology with an uncertain future. While some of these early investors left the market, others re-invested their newfound wealth into other early-stage projects, which made even more money.

This cycle continues today, with some “crypto OGs” giving every new product, platform, or service a try, even if it is a blatant scam or relies on Ponzi economics. Although some of these efforts are unlikely to make a profit, there is also the possibility that the investor hits a home run. In addition, there is often more risk in not exploring these new market opportunities than there is in giving them a try with a small amount of money that you can afford to lose.

This leads to massive amounts of wealth and deployable capital accumulating in a handful of blockchain networks. It has led to the creation of digital currency VCs and investors with vast amounts of money that they can keep shoveling into the ecosystem to keep it alive, even if the activity taking place within the ecosystem does not have a sustainable future.

The piles of money that live in some of these ecosystems attract both engineers and consumers. Regardless of how you feel about this growth model, it creates a community and network effects.

Community: Ultimately, the massive amount(s) of money that continually circulate on a protocol attract developers that are looking for investment, speculators that are looking for others to pump their bags, and consumers who are drawn in because there are many different businesses operating in the protocol whose apps and services they can use or that they hope they can use in the future.

Having this large community creates a network effect, where the various groups that have come to the protocol spread the word and promote the protocol as well as its apps and services.

We are at a point where even celebrities are endorsing protocols and letting their audiences of 1 million+ know that they should use whatever blockchain network that the celebrity has some kind of stake in. This results in new user acquisition and even more people joining these blockchain networks and putting their money into the protocol. This gives the protocol even more fuel to persist into the future.

Developer environments: But for an ecosystem to have an investor/speculator/consumer community and boatloads of money, activity needs to be taking place on-chain—or it needs to look like it’s possible for activity to take place on-chain and that it’s possible for viable businesses to be built.

That being said, the protocol needs to be attractive to developers. Developers build the crucial infrastructure that allows a business to be accessible/usable or lets the developers who come after them have an easier time creating.

The protocols that attract the most developers typically have the best development environments. They make it possible for developers to build or act like they’re building apps and services on-chain in programming languages that they already know vs. forcing developers to learn new, obscure languages before they can create.

The easier it is for developers to build, the more developers that will want to build on the chain. The more developers that build attractive solutions using the protocol, the more investment dollars, speculators, and consumers will flow into the protocol; the more people there are on a protocol, the more significant the network effects will be, and the more resources the protocol has overall, whether that be money, developers, or consumers, the longer it can continue to live, no matter how technologically restrictive the protocol may be.

Watch: CoinGeek New York panel, Blockchain for a Better Supply Chain & Sustainability

Recommended for you

The views expressed in this article are those of the author and do not necessarily reflect the position of CoinGeek.

03-09-2026

03-09-2026