|

Getting your Trinity Audio player ready...

|

Tether and USDT have been a lightning rod for stablecoin criticism. As the longest-surviving, it’s by far the largest which also means the question of whether each coin is backed is highly important.

Given there’s no evidence that USDT are backed at anything close to a 1:1 rate (and certainly no evidence that the reserves are composed of cash in any significant way), Tether can create USDT, claim that each is worth US$1 and have almost the entire digital asset industry believe them.

Who wouldn’t like that power?

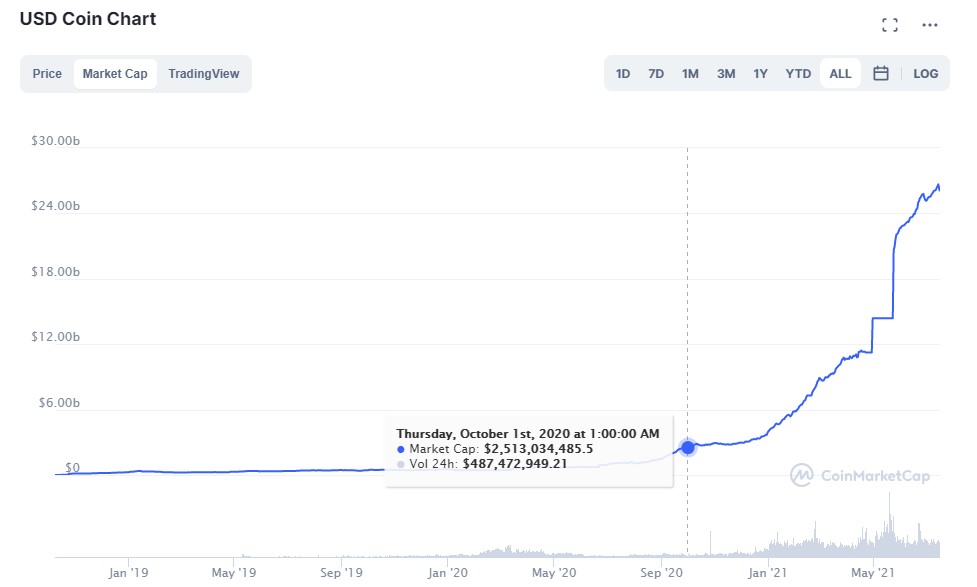

While the sheer size of the Tether and USDT scheme makes them lightning rod for stablecoin criticism, they aren’t the only stablecoin. The second biggest is USD Coin (USDC), and its $26.59 billion market cap is fast catching up to USDT’s $62.09 billion. What this should mean is that the operators of USDC should have $26.59 billion in reserve assets available to support the USDC in circulation; in theory, it’s worth US$26.59 billion, but more on that shortly.

If Tether is a concern, then USDC, which is run by Centre and Coinbase’s Circle, undoubtedly is, too. With the now-public Coinbase’s fate suddenly tied up in both—and with the announcement that Circle will be going public later this year—an enormous amount of other people’s money is at stake.

Who owns Centre?

USDC was launched in September 2018 by Centre, a consortium founded by Circle and whose only other member is Coinbase (NASDAQ: COIN). Circle is a payment technology company which at one point purchased beleaguered exchange Poloniex. The coin was initially marketed as the most transparent stablecoin on the market.

In that spirit, Circle has until recently made a point to publish monthly accountant attestations of its reserves on behalf of USDC, produced by respected accountancy firm Grant Thornton LLP. Like with Tether’s early stabs at transparency, the report is most notable for what it isn’t: it’s not an independent third party audit. At best, it’s a statement that on the attested date, the reserves backing USDC were enough to cover the amount in circulation.

Tether has already shown why these attestations are worthless as proof of reserves. The New York Attorney General’s investigation found that the company would funnel funds from affiliated companies to Tether’s bank account on the day of the attestation before then moving back out the very next day, giving a highly misleading illusion of constant backing.

Also like Tether, Circle has abandoned any claim that USDC is backed entirely by cash. Starting with the attestation report dated March 31, 2020, part of the reserves was allocated as “approved investments.” No details are given as to what shape these investments take and most importantly, we aren’t told how much of the reserves fall under this category. Conceivably, it could be 99% of them.

Still, next to the low bar set by Tether, the monthly attestations bought USDC some goodwill.

That is, until the attestations started coming late, and then eventually they stopped coming at all. As of the time of publication, the last attested month was for April 2021—and even that is dated June 9, 2021.

If this were happening in a vacuum, it might not be that big a deal. After all, the attestations reveal hardly anything anyway. But the attestations started slowing down almost exactly when the issuance of USDC started to balloon dramatically. Doomberg on Substack noticed that the first report to come substantially late was October 2020. November’s was on time, every report since has been released at least 30 days after the end of the month, with reports ceasing entirely after April.

What happened in October? Well, between 2018 and September 2020, the number of USDC in circulation grew from 0 to $1.5 billion. From the start of October 2020 to today, it grew from $2.5 billion to more than $26 billion. If each USDC truly is backed, that means in less than a year, over $23 billion has poured into Centre’s coffers from people wanting to purchase USDC.

That’s a hell of a time for Centre to start ignoring its commitment to being the most transparent stablecoin on the market. It appears that the attestation reports stopped coming more or less exactly at the start of an unprecedented run of USDC printing. Considering that means an added $24 billion worth of potentially worthless USDC is now propagating throughout the digital asset markets being used to pump the price of anything from BTC to ETH, that’s cause for significant concern.

Because the attestations are mostly a charade to begin with, it should be alarming that they are struggling to get them signed off in anything but a timely manner. All that needs to happen for the attestation to be genuine is for Grant Thornton LLP to be able to see that Centre holds enough assets—not even just cash—at the date of the attestation. Considering it’s unlikely Centre’s assets have grown by some $23.5 billion in under a year, it seems obvious what the problem is: there’s very little backing the massive new issuance.

It’s against this background that Circle will join its partner, Coinbase, in going public. For Circle’s current shareholders, there could be no better time: the abandonment of regular attestations is damning, but it only puts USDC on equal footing with USDT in terms of transparency, and that hasn’t done Tether any harm. The masses seem content with stablecoins being the rising tides that lift all boats, and as long as that keeps happening, who cares?

The digital asset industry’s exposure to Tether is bad enough. With the USDC printer now giving USDT a run for its money, the bubble is only growing. All it will take to pop is for enough people to want to redeem their stablecoin for USD at the same time, and all that will take is the inevitable regulatory crackdown which truly got underway with the NYAG’s fine of Tether. When that day comes, the innocent investors who swapped their dollars for USDC will discover there is nothing to redeem, and their money has simply disappeared into the ether. USDT and USDC will go up in smoke, together with every project that has relied on the injection of fake money to sustain themselves.

Coinbase stock will crater, along with the rest of the market—if not right away, then under a sea of law enforcement and private legal action for getting into bed with not one, but two stablecoin scams.

Not that Coinbase’s executives care: they’ve already cashed out. When Circle eventually goes public, you can bet their executives will do the same.

Note: USDC’s the attestation for May was eventually released on July 16 and unlike previous reports it provides more detail on the breakdown of the reserves: 61% are cash and cash equivalents, while 2% are from commercial paper ala Tether. It is still a simple attestation as to USDC’s reserve assets on a single day way back in May.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple and

Ethereum—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

03-04-2026

03-04-2026