|

Getting your Trinity Audio player ready...

|

When it happened, the Coinbase listing was the subject of much attention. One of the most recognizable digital asset service providers still left standing from a bygone era in crypto, Coinbase (NASDAQ: COIN) was going public at the tail end of a historic run-up in prices of digital assets almost across the board. For Coinbase, the result has been a staggering windfall for its executive team.

For other exchanges, it’s the firing of a starter pistol. Coinbase managed to pull off the seventh biggest new listing of all time just a month after they were fined by the Commodity Futures Trading Commission (CFTC) for failing to disclose that it was trading with itself and an employee who had been wash trading on the platform to inflate trading volumes. Add to that falling digital asset prices and the looming threat of a Tether catastrophe, and suddenly executives are highly motivated to cash in, as Coinbase has.

It’s a reckless game: Coinbase staff have made a lot of money, but mass insider selling has already left $COIN purchasers holding the bags. Their fees are vastly overinflated and ripe for competitive erosion, much needed legal and regulatory reform is only just getting started and as soon as Tether stops printing, the fever dream price run-up of the last year disappears and is replaced by something much worse.

None of that prevents the personal enrichment of digital asset executives via public listing, so get ready for a summer of stories about exchanges—both large and small—going to market.

Coinbase is often held up as the gold-standard for digital asset service providers (they certainly haven’t yet been subject to the same deluge of regulatory action and civil lawsuits as some of their competitors and colluders), and yet the path to Coinbase’s public listing and the aftermath was peppered with scandal and setbacks. What hope is there that the coming deluge of digital asset listings are any better?

History/Timeline

It’s been a long journey for Coinbase. Launched in 2012 by now-CEO Brian Armstrong, it secured $150,000 in investment funding in its first year. In 2013, the money began pouring in: first $5 million from Union Square Ventures, who later in the year contributed to another round of funding to the tune of $25 million, together with Ribbit Capital and Andressen Horowitz.

By 2014, Coinbase had 40 fulltime employees, a million users and were ready to expand and acquire. They purchased blockchain explorer Blockr (only to shutter it in 2017), and by the end of the year had another round of funding underway, which completed at the start of 2015 for $75 million. This time the funding was led by a group of banks, USAA and the New York Stock Exchange.

Around this time Coinbase launched Bitcoin Exchange, a more comprehensive service aimed at more professional traders. Bitcoin Exchange was renamed to Global Digital Asset Exchange (GDAX) in 2016 (before finally being rebranded in 2018 to the Coinbase Pro it’s known as today).

Coinbase continued to hit milestones: it acquired a New York BitLicense in 2017, created its own venture fund (Coinbase Ventures) and another $300 million funding round brought Coinbase’s valuation to a whopping 8.1 billion.

In 2019, Coinbase ran into scandal when it acquired blockchain analytics company Neutrino, whose founders also belonged to Hacking Team, a criminal enterprise masquerading as a security and surveillance company which was caught selling surveillance tools to vicious dictatorships and bugging the phones of journalists and activists. Leaked emails showed staff unconcerned about the nature of their clients and only worried about the lost revenue should they be forced to close their scheme. Coinbase eventually backtracked in a statement from Armstrong, where he announced that Coinbase would be parting ways with all Neutrino staff who had worked with Hacking Team. Ironically, the same year, Coinbase announced it was the subject of a ‘sophisticated’ hacking attack.

2020 was a big year for crypto—so too was it for Coinbase. According to documents from their S-1 filing, Coinbase’s net revenue was $1.14 billion across the year, a massive jump of $483 million from the year before. Coinbase also found itself in the news for a new policy: no political or social activist discussions at work, and anyone who doesn’t like it can take a severance package.

However, it was also the year Coinbase announced it would be going public.

Direct listing

The month or two preceding the announcement that Coinbase would be going public were uncharacteristically chaotic for a company that had managed to keep its nose clean relative to its competitors.

The no-politics policy had already cost Coinbase at least 60 employees according to Coindesk when Coinbase’s Chief Compliance Officer, Jeff Horowitz, suddenly left the company in October. Horowitz has a long history in compliance, but perhaps most significantly served as a banking regulator as a member of FinCEN’s Bank Secrecy Act Advisory Group, principally an anti-money laundering effort. The exit was apparently unrelated to the no-politics policy, but has gone unexplained. Though this wasn’t known at the time, Coinbase would have been right in the thick of preparing for its S-1 filing—certainly a strange time for your head of compliance to up and leave. Horowitz started working for BitGo in January of this year.

Around a month later, the New York Times published an exposé on employee discrimination at Coinbase on the basis of both race and gender. For example, women were paid 8% less than men in similar roles, while Black workers were paid 7% less than non-Black employees in comparable roles. The New York Times also reported that three-quarters of Coinbase’s Black employees quit through late 2018 and early 2019, with 11 complaining of racist or discriminatory treatment which was not actioned by management.

In a blog post pre-empting the publication of the story, Brian Armstrong explained that Coinbase had since hired an external consultant to conduct an investigation into the employee experience at Coinbase, focusing on diversity and inclusion. What this was supposed to do is unclear, because the report has never seen the light of day. Judging by the New York Times story, it never will. One has to imagine that internally, the damage of the report was limited by Armstrong’s no-politics policy.

Shortly thereafter, on December 17, 2020, Coinbase announced it would be going public, having officially submitted a registration statement on form S-1. It wasn’t obvious at the time what kind of listing Coinbase would be employing, but on January 28 they confirmed it would be a direct listing.

Direct listings are an alternate way for companies to go public. Unlike a traditional IPO model, a direct listing does not involve the creation of new shares. Instead, existing shares held by investors and employees are sold directly to the public. This also means there’s no lock-up period (a fixed period of time post-IPO in which existing shareholders cannot sell their stock): the shares that would go on to be offered on the NASDAQ are the holdings of early investors who bought in for a comparatively trivial amount.

The S-1 filing itself is revealing, both for Coinbase and the industry generally. In addition to the aforementioned financials for 2020, Coinbase makes the obvious disclosure that if BTC and Ethereum prices decline or the markets deteriorate, their business will be adversely affected. One of the listed potential causes of such deterioration is “the identification of Satoshi Nakamoto, the pseudonymous person or persons who developed Bitcoin, or the transfer of Satoshi’s Bitcoins.” Another is “the ability for Bitcoin and Ethereum blockchain networks to resolve significant scaling challenges and increase the volume and speed of transactions.” The threat of laws and regulations which affect the networks for digital assets is also cited, including the admission that “the complexity and evolving nature of our business and the significant uncertainty surrounding the regulation of the cryptoeconomy requires us to exercise our judgment as to whether certain laws, rules and regulations apply to us and it is possible that governmental bodies and regulators may disagree with our conclusions.”

They also disclose an ongoing investigation by the CFTC which is apparently broad enough to cover a range of behavior by Coinbase. The filing states that these include “a 2017 Ethereum market event, trades made in 2017 by one of our then-current employees, the listing of Bitcoin Cash on our platform, and the design and operation of certain algorithmic functions related to liquidity management on our platform.”

The listing was to take place in the month of March, but mid-way through the month Coinbase had yet to announce a date. The reason seems clear now.

The CFTC investigation cited in the S-1 form eventuated in a $6.5 million fine which was announced on March 18, conveniently just after the publication of the S-1 but inconveniently close to the planned listing date at the end of March. The fine was for Coinbase not disclosing that it was operating trading programs which at times traded against one another. It was also for the actions of a Coinbase employee, who had been pumping the price of LTC by wash trading with BTC on the platform.

The timing is interesting to think about. Coinbase has close ties to regulators: not only is that where Horowitz (the compliance head) was hired from, his successor had worked in the same regulatory role as Horowitz did. Kelly Loeffler, Republican Senator for Georgia, was on the committee which oversees the CFTC. Her husband, Jeffrey Sprecher, owns Intercontinental Exchange (ICE) and its subsidiary, the New York Stock Exchange, with Kelly Loeffler serving as the head of investor relations at ICE before leaving to set up Bakkt, a digital asset exchange owned by both her and her husband. ICE was also an early investor in Coinbase, taking a minority stake which amounted to 1.4% of the company.

Naturally, the public debut had to be postponed, and was reset for April 14. When the day came, Ponzi godfather Bernie Madoff died, and $COIN hit the NASDAQ. Trading opened at $381 a share, significantly higher than the $250 reference price, and climbed as high as $429. It hasn’t been back to those levels ever since.

Post-direct listing

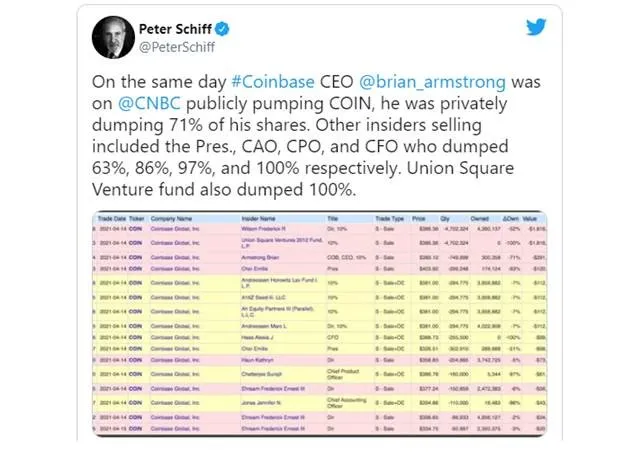

Upon listing, insiders began selling their $COIN shares en masse. Being a direct listing, part of this was inevitable. However, the scale of the sell-off is notable.

- The CEO, Brian Armstrong, sold $291 million worth of shares on opening day, 1.5% of his holdings.

- Co-founder and board member Fred Ehrsam sold $112 million worth of shares.

- Board member Katie Haun sold 150,000 shares ($53 million).

- Union Square Ventures sold $1.8 billion, reducing its holdings to zero.

- Andressen Horowitz sold 294,775 shares at $381 per share ($112 million) reducing its holding to 103,075 shares after previously being a 10% owner.

- CFO Alesia Haas reduced holding to zero, selling some $99 million worth of stock.

- Chief Accounting Officer Jennifer Jones sold 110,000 shares for $43 million, reducing her holding to 18,483.

- President and COO Emilie Choi sold 602,158 shares for $220 million, reducing holding to 74,155 shares.

- Chief Product Officer Surojit Chatterjee sold 160,000 for $62 million, reducing his holding to 5.344.

It’s important to note that these figures don’t tell the full story of Coinbase personnel’s leftover holdings. Staff will have stock options that aren’t reflected in these numbers. However, it’s still a significant sell-off.

And remember Jeffrey Sprecher, husband of CFTC senator Kelly Loeffler? He announced in May that ICE had sold its entire 1.4% stake in Coinbase the day it was listed.

Coinbase lists Tether days after listing

As brazen as that might sound, what Coinbase did next is even more dramatic—but makes perfect sense in light of the mass insider selling. On April 22, just days after the direct listing, Coinbase announced that it would be launching support for the stablecoin Tether (USDT) on Coinbase Pro. It was made available on the regular service at the start of May.

Tether is radioactive material despite their repeated pleading for everyone to ignore the man behind the curtain. They were recently banned from New York by the NY Attorney General’s Office and exposed for lying about the reserves backing each tether and concealing an $800 million-plus loss in client funds from customers. Without any confirmed backing whatsoever, Tether prints USDT under the guise that each one is backed by a U.S. dollar equivalent and then sends the USDT to exchanges where they are swapped for BTC and providing a mechanism for the price of BTC and other coins to be pumped entirely for free. The entire scheme is complex—CoinGeek has covered it extensively, as have independent journalists Amy Castor and David Gerard.

As an exchange, this is undoubtedly great for Coinbase—while it works. Coinbase is presumably about to join the list of tightly-connected exchanges which are the recipients of newly minted USDT and who sell those in exchange for BTC. This outflow of USDT to exchanges is always correlated with positive BTC price movement shortly thereafter, according to a study published in The Journal of Finance. Pumping prices attracts more excitement and new bagholders to the BTC ecosystem, meaning more fees for Coinbase in a general sense, but also in terms of fees collected on BTC/USDT transactions which would never make sense if USDT’s reserves were exposed.

Tether has been perhaps the most-talked about subject in the digital asset industry over the last 12 months. Their failure to speak honestly about the backing of Tether (let alone offer proof) has been highly publicized, and the potential effects on digital asset markets when the scheme collapses have been discussed at length, most recently by CNBC’s Jim Cramer.

Why then does Tether not get a single mention in any of Coinbase’s direct listing documentation? Listing USDT is significant news which was undoubtedly known well in advance of the listing for it to be ready to announce just days after. Even on the morning of the listing itself, commentators pointed to Coinbase’s to-that-point refusal to list USDT as one of the reasons Coinbase has managed to stay on-side of regulators, encouraging news for the performance of the stock. Not only does the Tether scheme pose an existential risk to companies like Coinbase, but Coinbase offers its own stablecoin, USDC in conjunction with Circle.

Surely Tether qualifies for a mention in Coinbase’s investor disclosures? It could be speculated that the reason for Tether’s conspicuous absence is that USDC is running the same scheme USDT is, and it would be impossible to tell on Tether without telling on themselves. This is also why a cash-grab using Tether wasn’t practical before the direct listing, when insider holdings were at their maximum.

In any case, Amy Castor summed up these peculiar circumstances neatly:

“Ecstatic bitcoiners claim the move legitimizes Tether. Actually, the move delegitimizes Coinbase.”

The party’s over: all that’s left is to see who foots the bill

If Coinbase’s main goal to capture as much wealth as possible, why now? Why go through the rigmarole of a direct-listing pump and dump if Coinbase is making money hand over fist for its shareholders?

Tether is part of it. Every glimpse we get at Tether’s so-called reserves backing USDT, we find more evidence that they aren’t backed at all and hear new, bumbling obfuscations from Tether general counsel Stuart Hoegner tying to justify why they won’t just subject themselves to an audit. Now that regulators are starting to catch on to the scheme, the party is about to come to a spectacular end. When it does, it’ll take most of the market—companies like Coinbase, who have been enjoying the phenomenal boom in crypto this scheme has helped create—down with it. Shares will be useless—cash won’t be.

There’s also the wider regulatory crackdown on the digital asset industry. The oft-talked about legal gray areas that blockchain and Bitcoin have created are being eroded faster and faster: legislators are closing loopholes and adapting existing legal frameworks to address digital assets specifically, or introducing new regimes entirely. Regulators and law enforcement are taking action against bad actors with increasing speed and forcing compliant, private businesses to do the same. And in the wake of these enforcement investigations come wave after wave of private lawsuits from the retail investors who ultimately pay the bulk of the price.

It’s a freight train that the likes of Coinbase have seen coming—in part because they helped set it in motion. Otherwise, there’s no reason for companies like Kraken to suddenly be interested in going public. It isn’t a coincidence that this rush to go public is happening at the same time: they know the music is coming to an end, and best believe the likes of Coinbase and Kraken won’t be the ones holding the bags.

Everything that digital asset service providers do from here on should be viewed through that lens.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple and

Ethereum—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

07-15-2025

07-15-2025