|

Getting your Trinity Audio player ready...

|

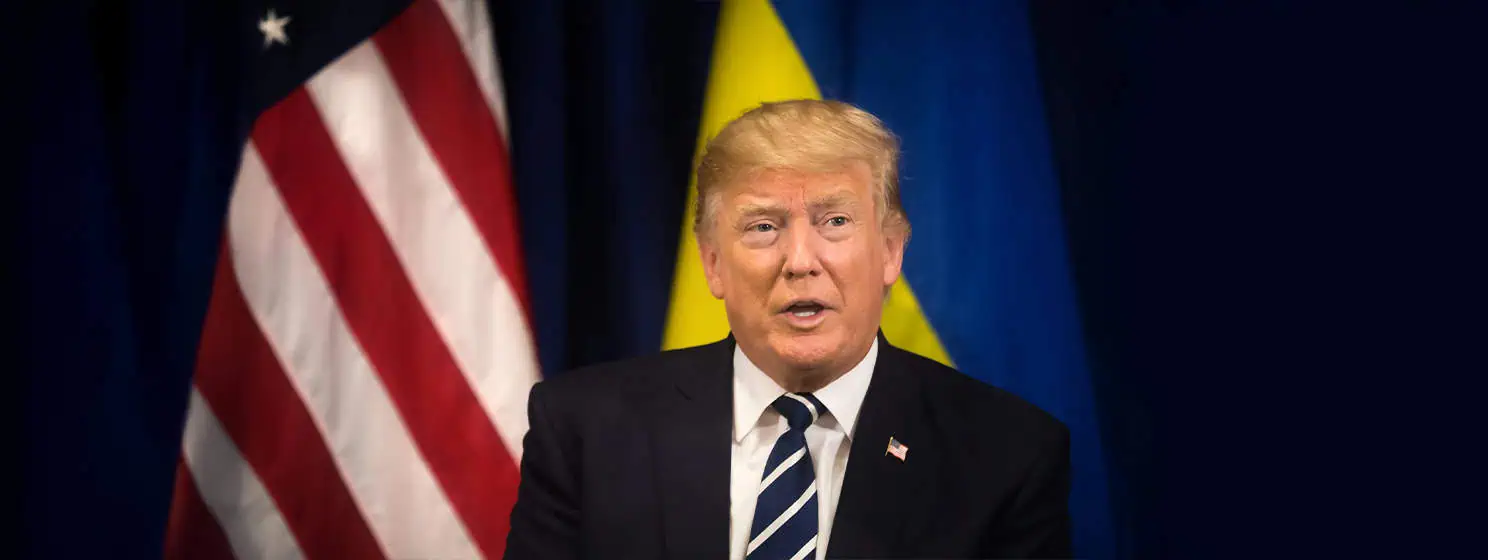

Donald Trump’s new ‘crypto’ project appears to be based on code that was hacked for nearly $2 million this summer, while Trump family members’ X/Twitter accounts were hacked in the hopes of draining Trump fans’ digital wallets.

On September 3, CoinDesk reported on the white paper underpinning the Trump family’s decentralized finance (DeFi) project, World Liberty Financial (WLF). The project appears to share DNA—including founders and code—with Dough Finance, “an Open Source Protocol to create Non-Custodial Liquidity Markets to earn interest on supplying and borrowing assets.”

WLF’s team contains four individuals behind Dough Finance: Zachary Folkman, Chase Herro, Octavian Lojnita, and the pseudonymous developer 0xboga. Folkman once ran a ‘pick-up’ business called Date Hotter Girls that included ‘masterclasses’ on how to become ‘the Ultimate Alpha Male.’

The white paper also lists Trump and his three sons—Donald Jr., Eric, and 18-year-old Barron—on WLF’s roster. Barron is described as WLF’s ‘DeFi visionary,’ his older brothers are ‘Web3 Ambassadors,’ and their dad has the grandiose title of ‘Chief Crypto Advocate.’ (In other words, none of them seem to have any real duties beyond shilling.)

WLF’s white paper reportedly indicates that the project involves decentralized borrowing/lending with a ‘credit account system’ built on the Aave platform and the Ethereum network. The project also features a non-transferrable governance token (WLFI), allowing users to “suggest and vote on adding new DeFi lending markets or integrating new blockchains.”

If a deleted codebase on Github is any indication, WLF leans heavily on Dough Finance’s technology. It’s unclear whether the code now underpinning WLF contains the same vulnerabilities that led to an exploit that resulted in the loss of $1.8 million.

On July 12, Dough Finance was exploited following a series of flash loan transactions. The hackers used vulnerabilities in the protocol’s smart contracts to steal a quantify of ‘wrapped’ ETH tokens that they proceeded to launder through the Ethereum-based Tornado Cash coin mixing service.

On September 4, WLF’s official X/Twitter account posted a thread attempting to reclaim the narrative. The thread said WLF was “not taking any chances,” and the project’s code “has been thoroughly reviewed” by “security experts,” including BlockSec, Fuzzland, PeckShield, Zokyo “and more.”

The thread also stated WLF’s mission thusly: “Make crypto and America great by driving the mass adoption of stablecoins and decentralized finance.” WLF claimed that by “spreading U.S.-pegged stablecoins around the world, we ensure that the U.S. dollar’s dominance continues, securing America’s financial leadership and influence on the global stage.”

WLF warned skeptics that “our plan will speak for itself. The brightest minds in crypto are backing us, and what’s coming will make all doubters think twice.” Well, sure, given that all the backers are Ultimate Alpha Males, right?

Who governs the governors?

Predictably, the Trump family appears to be banking on making major bank from WLF, at least, in terms of the project’s allocations of its ‘governance’ tokens. The white paper reportedly indicates that 70% of the WLFI tokens will be “held by the founders, team, and service providers.”

These insiders will also receive a portion of the proceeds from the public sale of the remaining 30%, while an additional chunk of these sale proceeds will be reserved “to support [WLF’s] operations.” WLF spokesperson Jim Redner told CoinDesk that the project had “not finalized their tokenomics yet.”

Regardless, if WLF was even contemplating the distributions above, it would leave control of all WLF decisions in the hands of very few individuals, most of whom share a surname. It would also bolster the widespread suspicion that WLF is just another crypto cash grab, following Trump’s four collections of non-fungible tokens (NFTs), his ‘Crypto President’ sneaker line and other kitschy crypto crap.

Don’t fall for their scam, wait for our scam!

Some Trump-supporting’ crypto bros’ have expressed annoyance at the prospect of competing against the family’s DeFi project, including Castle Island Ventures partner Nic Carter, who also suggested that WLF “genuinely damages Trump’s electoral prospects, especially if it gets hacked.”

The Trump family didn’t offer much in the way of security assurances when news broke on September 3 that the X/Twitter accounts of Eric’s wife/Republican National Committee co-chair Lara Trump and Donald’s daughter (with Marla Maples) Tiffany had been breached by hackers. The accounts appeared to promote WLF, but the links they directed users to were fraudulent.

The alarm was first sounded by Eric, who tweeted, “This is a scam!!!” The official WLF account quickly chimed in with its own warning “Do NOT click on any links or purchase any tokens” related to the fraudulent websites. The compromised accounts were swiftly locked, leading Eric to praise X/Twitter (and its Trump-loving owner, Elon Musk) for its “amazing” response time.

This wasn’t the only time that WLF’s promoters have been compromised. Earlier this week, The Independent reported that WLF’s official Telegram channel featured ads by an unaffiliated channel promoting a ‘World Liberty Financial Airdrop.’ The ads promised up to $15,000 in tokens for anyone who connected their wallet, although anyone who did would have seen their wallet drained.

WLF’s official channel warned its 230,000 subscribers not to fall for this trick, but at least one of these ads remained on the channel for four days before being removed. WLF also enlightened its followers that it was “not doing any airdrops or selling any tokens at this time.” (Emphasis added.)

Single-issue donors

While Trump’s presidential rival Kamala Harris appears to have a slight edge over him in nationwide polls, a recent poll by Fairleigh Dickinson University shows that Trump’s crypto pandering has won him the majority of crypto voters.

The survey, conducted between August 17-20, found Trump leading Harris 50-38 among ‘likely voters who own crypto,’ while Harris leads Trump 53-41 among those who don’t own crypto. Of the 801 voters surveyed, 15% said they either owned or previously owned some form of digital asset, meaning Harris’ 12-point lead is among a group 5x larger than Trump’s camp.

Does any of this matter? Not according to Nick Beauchamp, associate professor of political science at Northeastern University. In a Northeastern Global News article posted September 3, Beauchamp said crypto “appears on almost no one’s list of important issues, and most people are either unaware of it or have rudimentary opinions.”

Beauchamp added that the “crypto ‘voting block’ is not voters but donors … there are several crypto-associated donors who care very much, and these people are the only reason that the campaigns are making crypto statements, and probably the only reason many Republicans and some Democrats like [Senate Majority Leader] Chuck Schumer are resisting regulation.”

Making it rain

Much of the crypto industry—nearly all of its more opinionated members—placed its Trump bet before Harris assumed the Democratic nomination from President Joe Biden. Ever since the industry has been trying to cover their butts in case Trump loses and they’re left holding a bunch of worthless IOUs.

Trump claimed to have raised around $25 million from crypto titans during his appearance at the BTC Nashville conference at the end of July, primarily from an $844,600-per-seat roundtable event on the fringes of the conference.

Expectations from a September 13 fundraiser to benefit Harris are far more modest, looking to raise at least $100,000. The organizers, including Tiffany Smith (co-chair of the Blockchain & Cryptocurrency Working Group at law firm WilmerHale) and Cleve Mesidor (founder of the National Policy Network of Women of Color in Blockchain), told Reuters the goal of the meet-up was to “make a statement about what crypto is for Democrats as a potentially new administration contemplates how do they look at this.”

Additional fundraisers are planned by the Crypto4Harris group, which recently held an online town hall featuring Dem bigwigs, including Schumer and multiple members of the House of Representatives.

On September 4, Fortune quoted Alesia Haas, CFO at the Coinbase (NASDAQ: COIN) digital asset exchange, saying Harris was “using Coinbase Commerce now to accept crypto for her own campaign.” However, a Coinbase spokesperson later clarified that it was Harris-supporting Future Forward USA PAC that is accepting crypto donations via the payment platform. Trump’s campaign has been using Coinbase Commerce since May.

‘Crypto’ congress?

Coinbase’s chief legal eagle, Paul Grewal, told Bloomberg this week that November’s election would see “a pro-crypto Congress emerge” regardless of which party/candidate triumphs. Coinbase is among the biggest campaign contributors in the current election cycle, giving over $50 million to certain political action committees, including the crypto-focused Fairshake.

When Congress reconvenes after its summer break, both parties will have an opportunity to angle for the ‘crypto’ voter. The House Financial Services Committee will likely hold a number of hearings on the digital asset bills that emerged in the current session. Committee chair Rep. Patrick McHenry (R-NC) is retiring in January and has expressed hope that a bill offering some federal crypto oversight can get a floor vote.

September 10 will see the Committee’s Subcommittee on Digital Assets, Financial Technology and Inclusion put DeFi under the microscope in a hearing titled Decoding DeFi: Breaking Down the Future of Decentralized Finance. We seriously hope Trump’s new project gets broken down before it breaks down in public and MAGA’ investors’ somehow find a way to blame it on the Democrats.

Warren v Deaton

One interesting ballot battle in which ‘crypto’ will surely play a role is the Senate seat currently held by digital asset skeptic Elizabeth Warren (D-MA). On September 3, the Republican primary for the right to challenge Warren was won by John Deaton, an attorney who has represented Ripple Labs in its fights with the Securities and Exchange Commission (SEC).

Deaton enjoyed sizable cash infusions from crypto notables, including $1 million from Ripple and additional funds from the Winklevii of Gemini fame. Fairshake has yet to open its wallet for Deaton, but the cash may start flowing now that his November bout with crypto’s archnemesis Warren is official.

While Deaton said he would “be an advocate for smart, tailored crypto policy,” he told Fox Business that his campaign would focus on “serious issues, more pressing than crypto.” Deaton also claimed that Warren was “the crypto candidate, not me,” adding that Warren “built her re-election campaign on building an anti-crypto army.”

Warren effectively threw down the gauntlet following Deaton’s win, telling WBUR, “now the question is, can crypto buy this seat?” A larger question might be, can crypto buy the presidency?

Watch: Aaron Day and Kurt discuss CBDCs, Blockchain, and US Economy

07-14-2025

07-14-2025