|

Getting your Trinity Audio player ready...

|

Just what the world needed—a new blockchain token to finance lawsuits. The “initial litigation offering” (ICO) comes from Ava Labs, operators of the Avalanche DApp platform promises potential buyers a share of the rewards in a successful suit. Interestingly, law firm Roche Cyrulnik Freedman LLP—which represents Ira Kleiman in his ongoing case against Dr. Craig Wright—appears to also be behind the ILO idea, which raises the question: could Kleiman be ready to crowdfund his legal campaign by offering tokenized claims to any outcome?

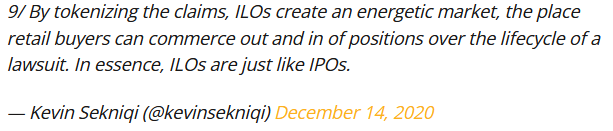

Win or lose, an ILO token could potentially be traded on the open market, with price speculation creating profits far higher than any amount needed to fund litigation. Investors could still make gains if they manage to sell their tokenized claims at a high price before any judgment is made.

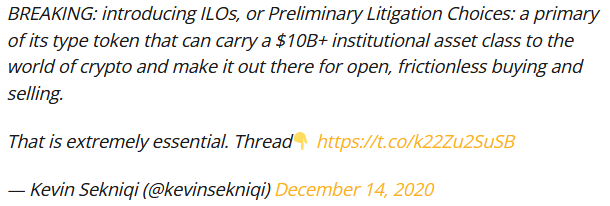

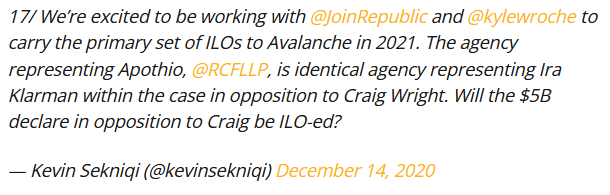

Ava Labs COO Kevin Sekniqi announced details of the ILO concept in a Tweetstreem this week. He also noted that the first ILO is planned for the case Apothio LLC v. Kern County et al. in California—where medicinal hemp producer Apothio is suing Kern County Sherriff’s Office and the California Department of Fish and Wildlife over the destruction of a claimed US$1 billion crop.

Sekniqi noted that Apothio is represented in the case by Roche Cyrulnik Freedman LLP, which is the same firm representing “Ira Klarman (sic) in the case against Craig Wright”. He then wondered aloud if an ILO could also be deployed in that case:

Roche has not indicated whether it actually plans, or needs, to use an ILO in the Kleiman case. Though given the scale of the negative PR campaign waged against Dr. Wright in the media and within the blockchain community thus far, any potential ILO would be guaranteed to generate buzz for both a token sale and the ILO idea itself.

Given that investors (and possibly token sellers) could still potentially profit even from a losing case, and since it is of particular interest to the token-aware blockchain community, the temptation may be hard to resist.

“Criminals will be criminals,” Dr. Wright said at the suggestion an ILO sale could be used in the Kleiman suit.

The Kleiman lawsuit concerns a claim by the estate of Dr. Wright’s late friend and alleged business partner Dave Kleiman, Ira’s brother. It has captured much interest in the Bitcoin community as it concerns a large amount of early-mined Bitcoins, and may reveal previously-unknown information on the identity of Satoshi Nakamoto. Dr. Wright has dismissed Kleiman’s claims as groundless, but should Wright lose, it’s possible he could simultaneously prove his identity as Satoshi in the process—a truly mixed result.

The ILO—is this really a good idea?

An Ava Labs blog post says it is working with Republic Advisory Services on “the regulatory processes to enable primary issuance and secondary trading of the litigation offering tokens minted on the Avalanche blockchain.”

The company describes the ILO concept as such:

“Litigation funding, also known as legal financing and third-party litigation funding, provides individuals who otherwise lack the necessary resources the funds needed to litigate or arbitrate a civil claim. ILOs raise the funding required to pursue litigation in these cases and tokenize an economic right in such claims. Each token indirectly represents a legal claim to a portion of the potential financial recovery which has been converted to a digital asset.”

In other words, if you buy in to an ILO, you are buying a claim to a share of the payout, should your side of the dispute prevail in court. Lose, and the token effectively becomes worthless (if you’re still holding it).

The idea of litigation funding (and receiving a share of any court-ordered payout) is not new. However, the idea of tokenizing the process is. On the surface, it’s a win-win for potential litigants who might have a justifiable complaint but lack the resources to fund a legal team… and smaller-time investors looking to make a profit.

Sekniqi pointed out in his Tweetstream that “litigation funders have been posting record-breaking returns over the past decade,” but due to the high costs involved, they’re usually the domain of high net worth individuals. Needless to say, there’s only a small number of potential funders among this class. Ava Labs is excited at the prospect of opening up a market for retail investors to become involved.

The ILO concept introduces a few perverse economic incentives into the litigation-funding process. When limited to the high net-worth individuals market, funders would attract investors with an interest in the case, or at least a greater understanding of its details.

Opening the market to average retail investors raises the possibility that sellers (and later on, buyers) may over-hype their side’s chances of winning a case. An ILO-inspired “pump and dump” could then ensue beyond the initial issuers’ control, as investors broadcast enthusiasm for their cause, or negative buzz about their opponents, to temporarily raise the price of their bags to less-savvy buyers. The market’s “greater fools” would be the losers there, buying their tokens when speculation and price are high, only to be left with nothing should the judgment go against them.

Naive retail investors buying tokenized shares in a company you know nothing about has proved dangerous in the past. The same dangers would apply to tokenized litigation, if claim shares can be traded freely.

The Kleiman case, should it ever involve an ILO, would see a serious risk of such a pump happening, with Dr. Wright’s detractors raising their now-customary social media armies for the cause of selling tokens to continue the lawsuit—and profit from it.

Again, there has not yet been an announcement of any such token offering in the Kleiman vs Wright case. However investors should remain wary of any such offering should it materialize—it could be a sign that one side sees their own case as hopeless, and is looking to cash out.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift and Ethereum—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

02-23-2026

02-23-2026