|

Getting your Trinity Audio player ready...

|

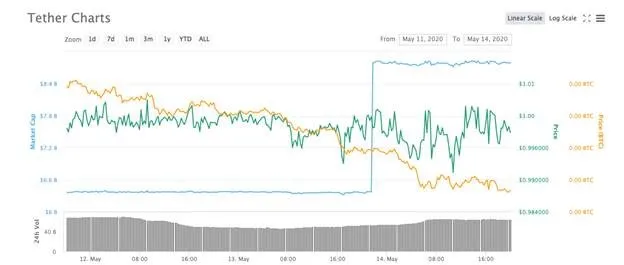

The Tether (USDT) supply increased by over 37% on May 13, with USDT’s market cap jumping from roughly $6.3 billion to $8.7 billion in seconds as new money was printed.

Fire up the money printer

Tether’s $2.4 billion mint is the largest amount of money the company has ever printed in one day. The only comparable Tether mint was Tether’s March 30 print, where roughly 1.5 billion USDT was printed and the USDT market cap shot up by 33%.

It’s no secret that Tether continually mints money into circulation without buyers on the other end. Back in March, we took a look at a $120,000,000 Tether print that followed a pattern you typically see when Tether mints more USDT.

PSA: 200M USDt inventory replenish on Tron Network.

Note this is a authorized but not issued transaction, meaning that this amount will be used as inventory for next period issuance requests.— Paolo Ardoino 🤖🍐 (@paoloardoino) May 14, 2020

It follows a pattern: A bot catches the new Tether mint, then Tether CTO Paolo Ardoino will immediately comment that the minted Tether was printed to “replenish inventory,” or in other words, sitting in inventory and will be distributed as issuance requests for Tether begin to roll in. But is that really true?

Is Tether propping up BTC?

Many people claim that digital assets are a hedge against inflation. As the Federal Reserve prints more money, the fiat currency that is printed suffers from inflation, and as a result, assets and commodities that are priced in that currency become more expensive.

In other words, as the United States government prints more U.S. dollars, items that are priced in U.S. dollars like groceries, gold, and cryptocurrency become more expensive because U.S. dollars become worthless. When you examine the multimillion dollar Tether mints that happen nearly every day, you realize that Tether prints are similar to the U.S. government printing more money.

💵 💵 💵 💵 💵 💵 💵 💵 💵 💵 200,000,000 #USDT (200,382,814 USD) minted at Tether Treasury

— Whale Alert (@whale_alert) May 14, 2020

💵 💵 💵 💵 💵 💵 💵 💵 💵 💵 100,000,000 #USDT (100,312,917 USD) minted at Tether Treasury

— Whale Alert (@whale_alert) May 13, 2020

💵 💵 💵 💵 💵 💵 💵 💵 💵 💵 100,000,000 #USDT (99,187,090 USD) minted at Tether Treasury

— Whale Alert (@whale_alert) May 12, 2020

The Wall Street Journal reported, “[Tether] has become a major source of liquidity in the cryptocurrency market. About 80% of all BTC trading is done in Tether, according to data from research site CryptoCompare.”

Because a majority of BTC trading is done in Tether, and Tether continually mints more USDT into circulation each day, in essence, Tether is inflating the value of BTC which drives the price of BTC upward—the same way minting more U.S. dollars into circulation makes BTC more valuable. Many people think that digital assets are a hedge against inflation, but when you look at Tether, you realize that digital assets like Tether are a source of inflation rather than a protective measure against it.

07-02-2025

07-02-2025