|

Getting your Trinity Audio player ready...

|

During the CoinGeek Weekly Livestream on February 23, I joined Kurt Wuckert Jr. to discuss $SHUA and the current events in the digital currency space. I announced the opportunity to convert $SHUA from Money Button’s SFP to the Run on Bitcoin protocol on RelayX at a rate of 1 to 700,000. While on a livestream I broadcasted a single 45KB transaction with over 200 outputs that airdropped 50 $SHUA tokens to each person who replied to a teasing tweet from RelayX founder Jack Liu days prior.

Leave your RelayX 1handle and you might get some of each. #SOON #HODL #BTC https://t.co/gq73kLyH0X

— Jack 🇪🇸 🇭🇰 🇸🇬 🇨🇦 (@liujackc) February 17, 2021

The fee was only 22,000 satoshis or around 4 cents at current BSV prices.

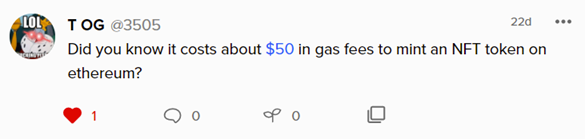

One of the justifications for the creation of Ethereum was Bitcoin’s inability to do complex scripts, which is necessary to support tokens atop the protocol. With gas fees on ETH reaching absurd prices as the #2 ranked blockchain climbed to all-time highs near $2,000 per coin, token commerce on alternative chains becomes more cost-prohibitive by the day. Gas fees were recently in the thousands of dollar range to execute a simple A to B transfer.

https://twitter.com/JumperWave/status/1357011826517630977

I am not sure what the fee would be to send an ERC-20 token to 200 people at once, but I imagine it would probably be higher than $0.04.

You know what's worse than paying $80 for an Eth transaction?

It failing.

— TrVon 🟢 (@TrVon) February 28, 2021

To even get started in the ‘DeFi’ economy, one must have a decent amount of money to get started. This prices out not only those who lack the funds but even participants who do have the capital but would balk at high entry or transfer prices. For example, one could have $2,000 worth of a stablecoin they would like to stake for a yield but would not transfer if the gas fee is in the hundreds of dollars.

The fact that potential value that could be exchanged at any given point is limited by other blockchain’s inability to scale is akin to economic sanctions imposed on all its users.

I find it appalling that the BTC, BCH and ETH camps talk of ‘economic freedom’ and ‘decentralized finance’ while essentially enforcing capital controls via block size limits, script size limits (even taxation) or centrally planned gas fees. Despite these disadvantages, these chains are recently manufacturing more economic activity leaving BSV in the dust over the past few months.

The price rises and usage does show that these schemes are viable and have some legitimacy even in suboptimal conditions. This is proof that this will blossom to unimaginable levels on a platform that scales. With the recent token explosion BSV users are finally getting creative, no longer asking anyone for permission and beginning to build these same schemes out.

BSV scalability enables mass distribution of not only tokens and financial products but ideas as well. Those who cannot afford or choose to forego high fees are now a part of the conversation. Their innovative ideas, particular economic interests and talents are now on the table and can thrive like never before.

Another shout-out to Jack Liu who pointed out in the first episode of the CoinGeek RoundTable that it is not just the economically disadvantaged who were previously blocked from this type of ecosystem, but even billionaires.

https://www.youtube.com/watch?v=UXvssVNM_rw&t=1560

02-20-2026

02-20-2026