|

Getting your Trinity Audio player ready...

|

Runaway success. That is how I would classify a recent project, ‘Ordinals,’ on the BTC blockchain. In a blink of an eye, it has forced itself onto the center stage of BTC headlines, exciting developers from ETH, BSV, and other blockchains, aggravated BTC core developers, captured public intrigue, disrupted the smooth operation of the BTC blockchain with its use, and even threatened a potential fork of the chain itself. All within the short span of two weeks.

What is ‘Ordinals’?

Well, put simply, it is just a rehash of a very old idea, which old-timer bitcoin developers will remember from 2011…the idea of color coins. Coloring coins is generally the act of digitally marking individual satoshis1 such that they can carry extra information and with it some value, whether that be a representation of a concert ticket, an air miles point, or a link to digital NFT art.

This idea, although old, was never properly implemented on the BTC blockchain itself due to the technical limitations that were artificially imposed on BTC after Satoshi left the project—namely, the lack of data storage space on BTC transactions and the lack of the needed OP_CODES in the Bitcoin script language in order to safely process these forms of programmable money2. Ordinals takes a new approach to this old problem, simply by creating a way to count and ID individual satoshis.

Given that NFT art and collectible pictures are the most popular current use of blockchains, this became the focus of the Ordinals project. But what changed? Firstly the BTC core developers, in order to address the years-old complaints that programmable money was no longer possible on BTC proper, conceived of a project called Taproot, deployed in 2022, which would bring back the ability to write programs in Bitcoin, albeit in a roundabout way.

This upgrade allowed the use of the Segwit special “Witness data” space, a particular discounted part of the BTC block, which enjoys a 75% fee discount over the normal rate. What the developers of Taproot did not predict (and indeed, the reason why many of them are calling the Ordinals project an “attack” on BTC) is that people would start using this space to embed pictures and NFT art, clogging up the BTC blockchain and raising average fees. Innovators in a free market tend to use features in ways not intended by the authors—which is the basis of the KISS engineering principle: If you can do something in a simple way or a complex way, the simple way is always best—or Keep It Simple Stupid!

Well, Taproot and Segwit were complex solutions (one of the reasons why the Bitcoin chain split back in 2017). Now, it seems the KISS principle has come back to bite the BTC core developers, as the use of Ordinals has allowed developers for the first time ever on BTC to embed up to 4MB of graphics and NFT data directly onto the main BTC chain. This is a big deal. Because most NFT projects in ETH normally don’t contain the NFT data itself on chain3, instead storing it off-chain in distributed storage systems like IPFS or just cloud storage. NFTs minted in this way have big legal implications, with many legal experts saying that it could mean that the owners of these sorts of NFTs have no rights at all, meaning they purchased nothing, or at least nothing that can be recognized by law. Ordinals allows for the embedding of data on the chain itself, which may allow for proper NFTs that contain the legal rights or copyright to the property itself.

Also, it just makes for a better interface when any block explorer is able to view the contents of the data instead of relying on specialized applications.

Like them or hate them, you cannot deny them

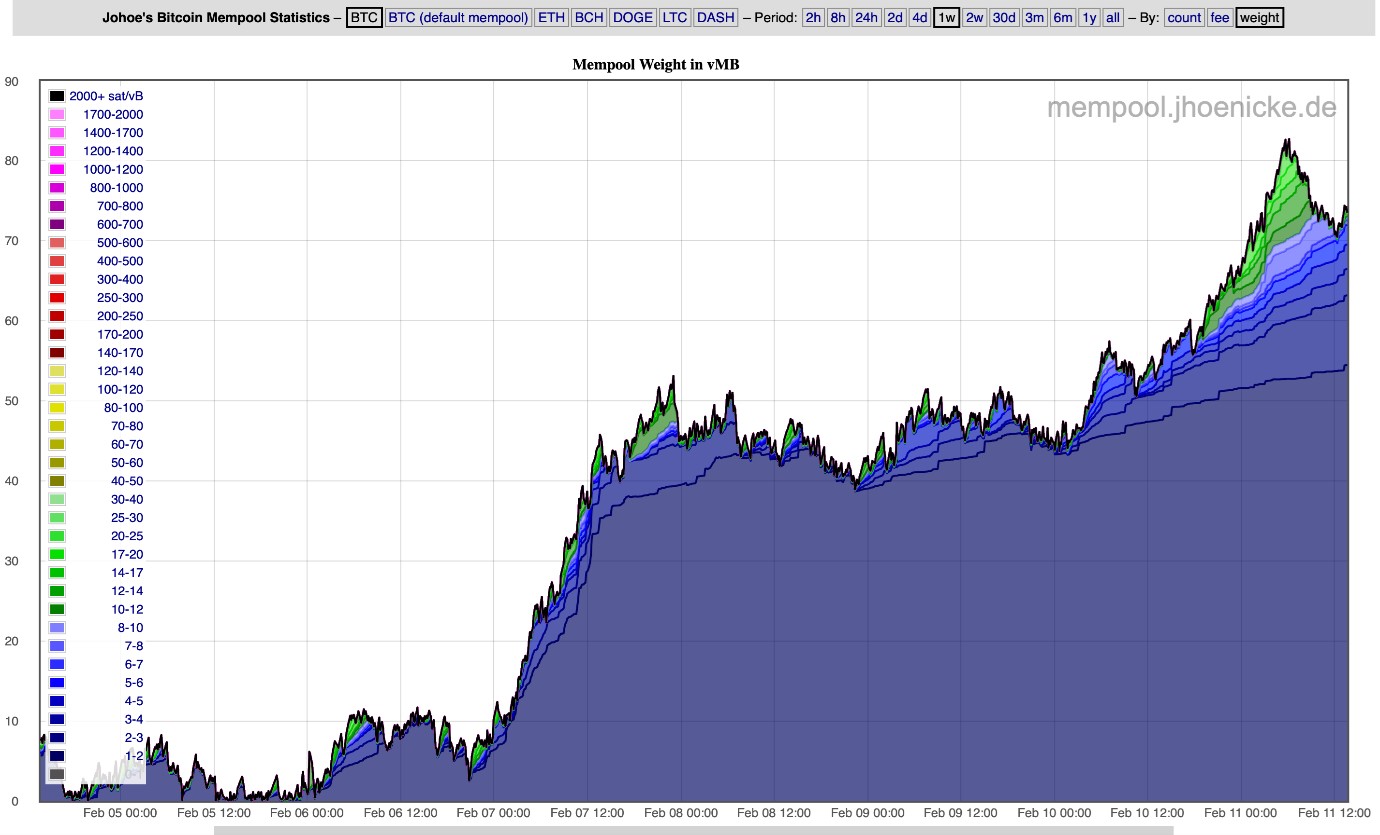

NFT art is popular, but HOW popular was hard to quantify. Due to BTC’s limited block space and scaling capabilities, we can now look at how much the Ordinals project has affected the average fee to publish a BTC transaction to tell. A quick glance at the BTC mempool below tells the story:

The past week alone has seen the average BTC fees spike up to 50sat/byte, with the weighted mempool size rising from less than 5MB to over 80MB.

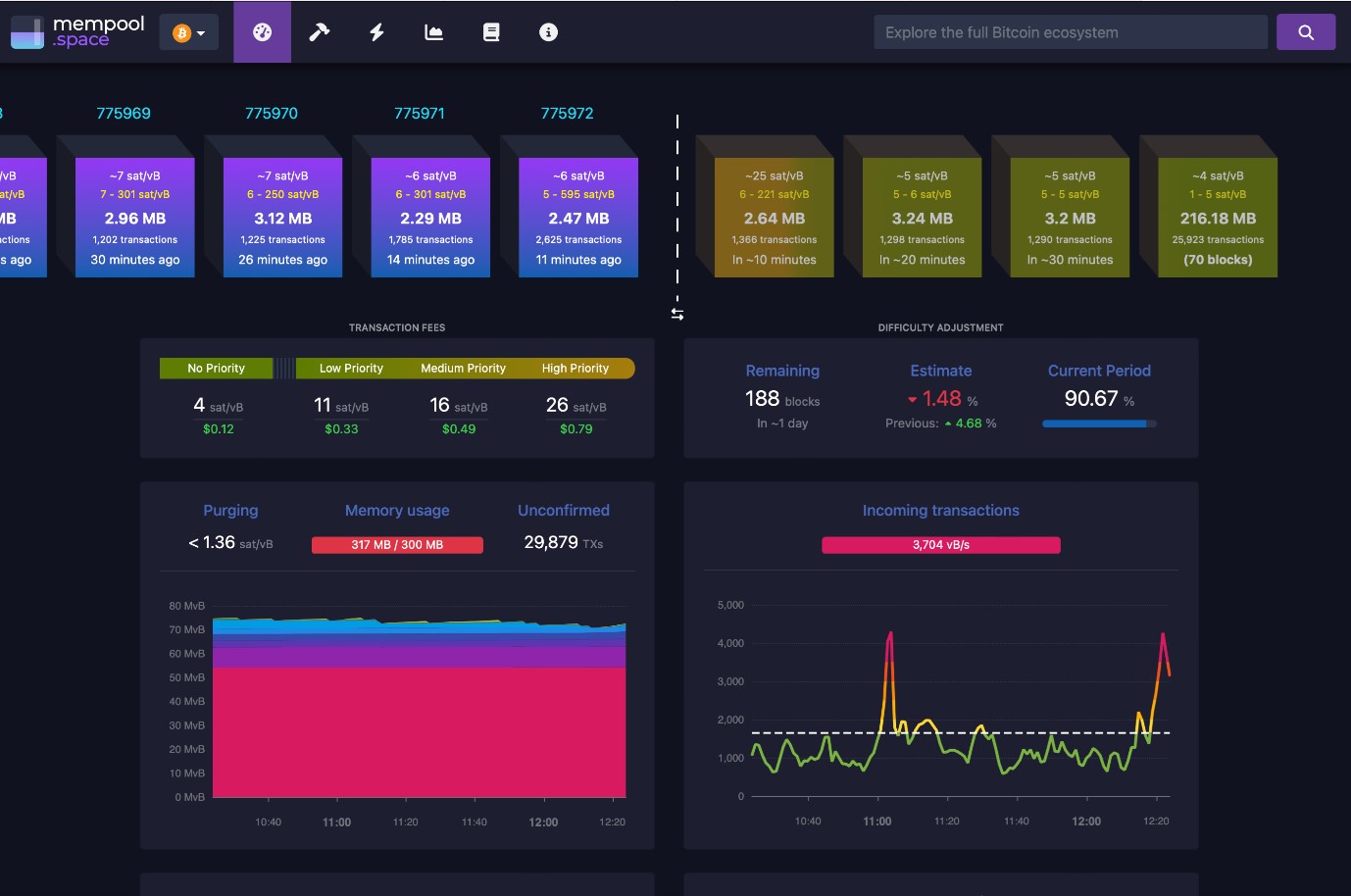

The raw size of the mempool is currently hovering over 317MB. This is a big problem for the BTC community, which claim that for BTC to work, the lowest-spec nodes must be supported. They claim that people should be able to run a BTC node with a RaspberryPi and 2GB of memory. These nodes will have an increasingly hard time keeping up with the bigger blocks and an enlarging mempool size.

Mempool—The capacitor of the blockchain

Like a digital capacitor, the mempool is where transactions that have yet to be confirmed sit, awaiting a miner to publish a block, at which time nodes can clear out their mempools of the transactions which were included in that block. Like a capacitor, or for those in which physical models are easier to visualize, a giant water tank, there is a flow of txns going into the tank, and there is a sink or a hole that takes water out. If the flow of water in outpaces the flow of water out, the tank will eventually fill up and build up pressure until it springs a leak. In the case of a capacitor, over-voltage will cause it to explode. In BTC, with a limited block size of 1MB, the sink for the mempool is only 1MB every 10 minutes. If the flow of txns in, is more than 1MB/10min, then the mempool will continue to grow…until the node runs out of memory and crashes. The scalable version of bitcoin, like BSV, doesn’t have this problem because there is no limit to the outflow; blocks can be as large as needed.

BTC solves this in another way. They allow published transactions to be replaced by subsequent replacement versions with a higher fee. This means if a txn seems to be taking too long to confirm, the sender can send a new one that pays more in miner fees, which presumably will allow that txn to jump the queue to the front of the line. This means that an overflowing mempool will result in dynamically escalating fees, in a rush to determine who can pay the most to get their transactions into the blockchain. This, while interesting to L2 networks like Lightning Network, which depends on reliable BTC transactions to process their channel opening and ‘punishment’ transactions, doesn’t address the problem of nodes’ mempools just popping all over the network. Having the highest fee-paying txns getting high-priority treatment doesn’t help sink the ever-increasing backlog of low fee-paying NFTs awaiting confirmation. BTC has no means to purge valid fee-paying transactions from the mempool. In fact, to do so would be antithetical to the BTC ethos; it would be seen as “censorship” by most of the community.

Yet this is exactly what many of the BTC core devs are saying on social media—that these transactions constitute an attack on BTC and should be filtered out.

Adam Back, CEO of Blockstream and spiritual leader of the BTC community, called for censoring these transactions, though he quickly deleted the tweet. Ironically, the tweet was saved and written to the blockchain4 and then turned into an NFT itself.5 One such developer Luke Dashjr went as far as writing a patch that could be installed into BTC nodes that will do the censoring, but stopped short of installing it into the official BTC code repository. He is also the same developer who recommends REDUCING the maximum block size to 300KB from 1MB, further exacerbating the problem of the already too small sink rate for the mempools on BTC. This has raised rumors that BTC developers may fork the BTC chain in order to remove the ability for Ordinals to work and to restore BTC to doing only what the developers deem as valid transactions.

This drama is just getting started. But one thing is for sure: it is clear that there is a big market demand for on-chain NFT art, and many developers, if blocked out of using BTC, may start to investigate BSV, the only other Bitcoin project which allows for the minting of NFTs on-chain. Indeed, many BSV proponents have publicly announced support and praise for the Ordinals project, even going as far as helping other BTC developers set up tools to use Ordinals. This makes the final twist in this plot even more bizarre, as recently, the alleged founder of the Ordinals project went out on Twitter with a slander attack against Dr. Craig Wright, a rant that drew many eyebrows. While the motivations behind it are unknown, one could only guess what would cause such an outburst. Could it be that he sees BSV as a potential competitor to his project? Or just general personal displeasure against the ongoing court cases involving Dr. Wright. Only time will tell, but the drama has just begun.

/WallStreetTechnologist

NOTES:

[1] The smallest denomination of bitcoin, 1sat = 10e-8 BTC/BSV

[2] These ended up driving a faction of developers to develop their OWN separate blockchain, called Ethereum in order to address these features.

[3] Worth noting that storing unlimited data NFTs on chain has been possible on BSV bitcoin since 2020 “Genesis” upgrade.

[4] Thanks to Twetch.com

[5] Thanks on Relayx.com by user @DoubleAxeApes

Watch: Why are edges important in Bitcoin programming?

Recommended for you

The views expressed in this article are those of the author and do not necessarily reflect the position of CoinGeek.

03-05-2026

03-05-2026