|

Getting your Trinity Audio player ready...

|

This post originally appeared on the Unbounded Capital website, and we republished with permission from the Unbounded Capital team.

2021 was an exciting year in the digital currency and blockchain space which brought soaring asset valuations for both publicly traded digital currency assets and private equity. The Bitcoin SV ecosystem had a fantastic year as well, but largely reflected largely in the growth of early stage companies like in our portfolio at Unbounded rather than in market cap of the token accompanying the network, BSV.

We understand that being contrarian in a money grab environment is difficult, however, value is not created overnight. We are confident over the long term this approach will outperform.

At Unbounded Capital we have never been more bullish about the future of the Bitcoin SV ecosystem, and particularly, our existing and potential future portfolio companies. The vast majority of digital currency investors continue to overlook this ecosystem’s progress, distracted by all time high prices in otherwise struggling networks like BTC and Ethereum. We think the strong foundations laid in Bitcoin SV in 2021 will support enormous value creation in 2022 and beyond.

We are gaining confidence that there is unlikely to be a serious competitor to the original version of Bitcoin as a blockchain that can achieve global scale. There are two metrics we think are indicative about the future of blockchain adoption:

- Is the network getting faster and/or cheaper with increased usage?

- Which protocol is attracting the smartest developers and entrepreneurs?

There is not another public blockchain network we are aware of that is getting cheaper over time with meaningfully greater usage like Bitcoin SV.

While networks like Avalanche and Solana are attracting a larger amount of the VC dollars chasing scalable blockchains, we are confident this will be another one of the many short-lived trends in digital currency. These ecosystems are crashing with increasing frequency as they attempt to scale. There is a widening knowledge gap between investors and builders. These networks, while still relatively cheap today compared to non blockchain solutions, have soared in cost, putting aside the immense stability and security concerns. There have been significant profits for investors in these blockchains that are not poised for long term adoption, something we think is reminiscent of many of the dotcom companies in early 2000.

We are seeing most entrepreneurs building on Bitcoin SV not trying to make a quick dollar, but instead focus on long-term value creation. This is reflected in the growing number of companies, projects, developers, and more building on Bitcoin SV over the past several years. Earlier this year we published the first comprehensive list on what is happening in our ecosystem which depending on what metrics you look at, is the 2nd or 3rd largest blockchain entrepreneur and developer ecosystem today behind Ethereum and neck and neck with Solana. And while we can point dozens of companies that tried to build on Ethereum, Hyperledger, and other blockchains move to build on Bitcoin SV, we are not aware of a single example the other way around.

In this year-in-review we will outline our perspective on 2021 for Unbounded Capital and the Bitcoin SV ecosystem and some of the things we are anticipating for the new year.

Infrastructure → Products

When Unbounded Capital began focusing on the Bitcoin SV ecosystem in 2019, we were particularly busy doing due diligence on, and taking meetings with founders of, infrastructure companies. We were excited by Bitcoin SV’s layer-one efficiency and scalability, but the infrastructure required to support the development products was in its still in the early days. For builders and investors, this presented an opportunity. Seizing on this opportunity, up until the beginning of 2021, Unbounded Capital largely invested in these infrastructure companies which improved the Bitcoin SV developer experience. These investments included RUN, HandCash, and TAAL, to name a few. Now, most of those companies in our portfolio have raised capital at higher valuations and have meaningfully increased their users and customers.

In 2021 we began to see the positive consequences of the decreased developer friction provided by these companies. This led to a major uptick in meetings with, and ultimately investments in, companies that leveraged those infrastructure providers’ tools to deliver value to businesses and end-users. These companies include Haste, TDXP, Tokenized, and others. In many ways most of these new companies we still think long term are still fundamentally infrastructure companies, but upon launch also had consumer-facing products.

The maturation of the ecosystem’s infrastructure and tooling not only bodes well for Unbounded Capital by rapidly expanding the pool of companies building on this technology, but it also radically transformed the value of Bitcoin SV ecosystem companies to both builders and investors. The companies we invested in in 2021 + those leveraging earlier portfolio company investments provided tangible experiences of our vision for the future of the internet supercharged by micropayments and novel types of data ownership. What in 2019 and 2020 were largely theoretical pitches about the future of the web, in 2021 became more real. Rather than describing the internet to an investor in 1990, we were showing live demos of email and extrapolating this into a future boon for online connectivity, commerce, entertainment, and more.

This material development has provided a major boon to our ability to interest investors inside and outside of the digital currency space. More on this later. While still early, everything we are tracking supports our thesis on focusing on infrastructure being the best risk adjusted returns for investing in the future of scalable public blockchains, and are excited to see both the amount and types of companies we can seriously consider to invest in grow.

RUN and HandCash

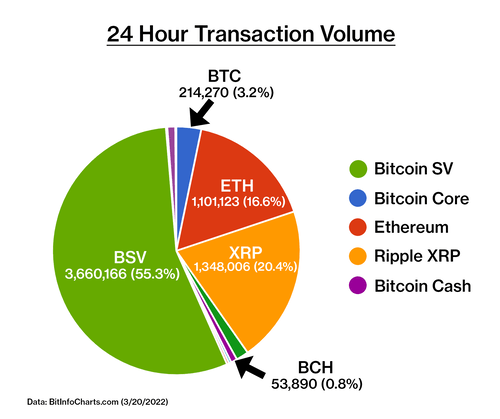

2021 was a breakout year for many UC portfolio companies, but RUN and HandCash had particularly fantastic years. RUN, a company which leverages Bitcoin’s scalability to provide efficient tokens and smart contracts, took off in 2021, going from supporting the generation of a few thousand transactions per month to rivaling and surpassing the entire transaction volume of popular blockchains like Ethereum towards the end of the year. Learn more on Why We Invested in Run.

You may have seen charts like the above on social media. The transaction volume that is leading to such high metrics is largely due to RUN-enabled projects like Cryptofights, Duro Dogs, RelayX and others. Developers seeking solutions to the bottlenecks experienced on Ethereum, Solana, and other networks are starting to take advantage of RUN’s offerings and we expect this trend to continue in the new year. Not only will the individual applications using RUN continue to grow, but RUN will attract more developers building new applications, possibly emboldened by the empirical success of RUN’s initial cohort of customers who have proven its superiority over the competition.

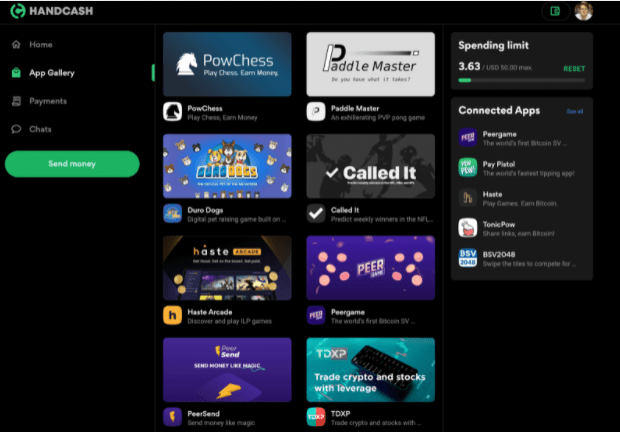

HandCash, the leading wallet and developer toolkit for building applications with nanopayments, is on a similar growth trajectory. Throughout 2021, HandCash’s ‘HandCash Connect” SDK continued to grow, providing more developers with the means of integrating micropayment business models into their apps and seamlessly connecting users to these apps with their industry leading UI/UX.

HandCash users are greeted by new ways to use, spend, and earn their BSV on a near-weekly basis as the network effects of this burgeoning ecosystem attract more users and developers. HandCash also announced major partnerships in 2021 which will rapidly accelerate this growth in the new year. And while this didn’t happen in 2021, the recent news on their addition of Fiat on ramps we think this could make them the most influential company for broader adoption of doing payments BSV for 2022.

New Unbounded portfolio companies

Unbounded Capital made 5 new equity investments in 2021 in Tokenized, Haste, TDXP, and two other companies which will be announced soon. As alluded to earlier, these companies are delivering value to end users in a way that can be experienced today, affecting industries ranging from financial markets to gaming and beyond. What’s so exciting about this new cohort of companies is that several of them build off a variety of the infrastructure companies we invested in the years before. Haste and TDXP, for example, can be accessed via the HandCash app gallery seen above.

NFTY Jigs

We would be remiss not to mention NFTY Jigs, started by Unbounded partners Jack Laskey and Dave Mullen-Muhr. NFTY Jigs is a great example of a company that is leveraging various UC portfolio companies in their offerings and partnering with others as they begin to tackle the gaming space by supercharging NFTs and other digital goods with micropayments. Working alongside RUN, HandCash, Haste, TAAL, and other ecosystem players, they launched their platform NFTY Jigs and its first game Duro Dogs in December 2021 to an incredibly positive reception. In less than two months since launch, NFTY Jigs has minted over 300,000 NFTs, processed over 1 million data transitions and tens of thousands of unique NFT purchases through a business model only viable with Bitcoin SV enabled micropayments. We are extremely proud of the work NFTY Jigs has done to date and are excited for their continued success in 2022.

Pngme + Reserve

Before starting to focus on scalable blockchains and the companies built on top of them, we made four venture investments in late 2018 and early 2019 including Pngme and Reserve.

We were the first money in Pngme at a $2.5 valuation and over the summer of 2021 they raised $15m as part of their Series A at a $70M valuation. And since then there has been significant growth to the business and team. And soon their DeFi protocol Masa will launch to continue their mission of empowering the developed world into the global economy through developing credit and providing uncollateralized loans.

Our investment in Reserve was in their second round in early 2019 through investing in the RSR token. The reserve stablecoin has now seen meaningful adoption in Venezuela, they have launched in Argentina, and the team has grown tremendously since our initial investment to support growth. At the time of this writing, we were able to lock in a 12x return on about ⅓ of our position through selling OTC and are steadily selling most of our remaining position.

While today we are focused on the BSV ecosystem, great companies and returns in our space can of course be built using other blockchains as we have seen with Masa and Reserve. Our fund started in 2019 as a venture/hedge fund investing in digital currency and blockchain broadly and if we see a compelling reason to focus on other ecosystems outside the BSV ecosystem to make money for our investors we will.

BSV price action

As we outlined in our piece How We Are Trading The Seventy Billion Dollar Lawsuit Over Satoshi’s Bitcoins, we felt there was asymmetric upside in being long both spot BSV and BSV convexity around the Kleiman Wright trial. While things did not pan out in a way that resulted in major price action, we still think the assets and contracts in how we expressed this position were wildly mispriced, and with likely two major court cases (McCormack vs Wright + COPA vs Wright) involving Craig Wright that more directly broach the question of ‘Is he Satoshi?’ than Kleiman Wright trial for 2022, we expect similar opportunities from mispricings to exist around those trials.

The Wright v McCormack case, which has a trial date set for May 24, 2022, is one of two pending cases in the British courts. One this one, CSW is the plaintiff who is alleging that popular podcaster Peter McCormack defamed him and, in doing so, cost him damages. Initially McCormack’s defense was one of truth; he claim that he did not defame CSW because instances where he called him a fraud were truthful. During the course of the pretrial proceedings this truth defense was abandoned and McCormack is now claiming that while he did defame CSW, his false claims did not cause damages. The trial will be over whether or not CSW suffered damages from McCormack’s claims that he is a fraud. We anticipate a positive outcome for CSW and upside potential from that PR. The digital currency space largely views the claim the CSW is a fraud pretending to be Saotshi Nakamoto as a given, so a loss for McCormack has the potential to raise some eyebrows from more passive onlookers to this question in the space.

The COPA case, CSW’s second pending trial in the UK, has CSW on the defense. COPA is claiming that CSW does not own the copyright to the Bitcoin whitepaper and, thus, directly challenging his claim to be Satoshi Nakamoto, who everyone acknowledges retains the copyright. This will be CSW’s most direct opportunity to defend this claim in court, much more so than Wright v MCCormack or Kleiman v Wright. Because of the directness of the challenge and the large players on the plaintiff’s side as part of COPA (Square/Block, Meta, Coinbase, Kraken, Microstrategy, etc) we expect the largest asymmetric opportunity on BSV expressed in spot exposure or options to come from this trial. There is no public trial date set for COPA at this time.

Some of the potential catalysts independent of Craig Wright for the coming year for having the price of BSV reflect the value of the ecosystem include:

- Unbounded and other BSV content tailored to investors going viral

- CryptoFights going from often surpassing the entire transaction volume of Ethereum to 100xing the volume

- Getting closer to the near term goal of 1M TPS (currently at 70,000, making BSV the leading TPS of any transaction processing system in the world)

- TDXP becoming the defacto global exchange for trading equity derivatives for emerging markets

With BTC up 50% to close the year and the broader digital currency space in a huge market, it was certainly disappointing to see the price of BSV end the year 25% down. But our mandate isn’t to consistently time the digital currency market: it is to get exceptional long term returns for our investors. For the trust and shared time horizon, I thank all of our LPs reading this as it has allowed us to add to our nominal BSV position at or near market lows over the years. Given our conviction on the future of the space has never been higher, we think most likely in five years we will look back on 2021’s BSV net price decline as a positive as it allowed us to lower our cost basis.

And a silver lining for Opportunity Fund investors is that we have always seen an inverse correlation between the price we’re paying for portfolio company investments and the price of BSV. If BSV ended the year at 500+, we likely would have paid 2x+ the price for our recent venture investments.

Unbounded Capital media and content

Major publications covering Bitcoin SV

Another development in 2021 was the radical increase in coverage of Bitcoin SV by major news outlets. This coverage was largely spurred by the culmination of Craig Wright’s (CSW) years-long legal battle with the estate of his former friend and partner Dave Kleiman. The Kleiman v Wright “Satoshi Trial” in November 2021 brought attention from publications like Reuters, The Wall Street Journal, CNBC, Bloomberg, The Washington Post, The Times, Fortune, ABC, NBC, FOX, CNN, NY Post, The Independent, The Telegraph, The Daily Mail, The Guardian, and many others. While there was a range of angles to this coverage, it was largely positive for Bitcoin SV by extension. CSW’s infamy in the digital currency niche has often created a roadblock that prevents many otherwise-curious investors and developers from exploring the ecosystem. The coverage of the Satoshi Trial provided a counternarritive to CSW largely from widely-read and reputable news organizations outside of this niche. The new eyes that this courtroom drama brought to Bitcoin SV will likely approach the ecosystem with less pre-existing biases and lead to interest in the products being built, all of which stand on their own merits.

Increased media interest in UC

Unbounded Capital has always put a major emphasis on creating content to explain our thesis and help shift the mindspace towards our vision for the future of the internet. 2021 brought increasing attention to this content, much more so than any year prior. From our second Ebook, this one focused on how Bitcoin is a Green technology, to podcast and video appearances on major digital currency and investment outlets such as Real Vision and Infinite Loops, the number of people we have been able to educate and excited on Unbounded and Bitcoin SV has never been higher and we will continue to focus resources on expanding these efforts in the new year.

Increased investor interest in UC

Mirroring, or perhaps due to, our success in media in 2021, came an incredible surge in interest in Unbounded Capital from investors. Encouragingly, this interest came from investors that are LPs in many digital currency and blockchain funds as well as investors outside of, and even previously disinterested in, the Bitcoin sector. The greatly improved investor pipeline is of course partially attributable to the bull market in the digital currency space, but we have found that the developments in the ecosystem throughout 2021 are making the Unbounded pitch much more successful on its own merits. Investors are becoming excited about our vision of the future of the internet and their ability to experience it, with the products launched in 2021 playing a major role in this shift.

In order to support this demand and continue investing in our core thesis, we have closed our Opportunity Fund to new investors (note as an LP you can still invest additional capital into the fund) and are launching a $50M ($70M cap) Fund II. Fund II, with a target first close of Q2 2022, will have a traditional VC fund structure focused on early stage companies building on scalable blockchains. We will be increasing our average investment size and investing in more companies with the strategy that has given us early success in the Opportunity Fund.

2022

The successes of 2021 and the massively positive trajectory of ecosystem development in conjunction with increased investor interest are setting the stage for a breakout 2022. What are some of the things we expect?

More acquisitions; like Moodys buying Kompany

BSV RegTech KYC/KYB platform Kompany recently agreed to acquisition by Moodys to be closed in the coming months. We expect this variety of exit for BSV companies to become more of a trend in the coming years as the utility of micropayment and novel data applications built on scalable blockchain infrastructure continue to demonstrate their disruptive potential. While many enterprises have been sidetracked by the decentralization red-herring since a boom in blockchain interest in 2017, we think the value provided by companies, those with an infrastructure focus in particular, leveraging Bitcoin SV’s unique properties will be impossible to ignore.

App growth; like Duro Dogs, CryptoFights, and TDXP

In addition to early BSV-infrastructure exits in 2022, we anticipate consumer facing startups to see a major uptrend in addition as the friction on onboard users to this growing sector of the economy continues to plummet. HandCash’s recent addition of seamless fiat on-ramps has already significantly lowered the barrier to entry to BSV gaming companies, like Duro Dogs and FYX Gaming, which are targeting typical, non-Bitcoin gamers. Because of the ecosystem’s emphasis on interoperability and the ability for onboarded users from one application to earn and use BSV in other, connected applications, we think these improvements will be a tide that lifts all boats in the ecosystem. A rising tide will have an especially positive impact on BSV infrastructure companies which are providing tools and services for applications across the sector.

Improved investor sentiment from high penetration of content

The transformative potential of Bitcoin SV has begun to show rather than tell. Every month new applications are launched which attract new cohorts of users and demonstrate additional functionality now possible thanks to Bitcoin SV’s scalable blockchain foundation. The benefit of these applications are compounded by continued investment into content creation and education by Unbounded and others in the space. In 2021 we saw a major increase in both the quantity and quality of the publications that this content was reaching. We expect this trend to continue in 2022 as Bitcoin SV, and the applications that leverage it, continue to pick up steam.

We realize the turbulence in these markets can be jarring and we anticipate a great deal more volatility in the years to come given increased regulation and the uncertainty in the world right now. There will be massive shakeouts in digital assets that will affect prices across the board. We won’t get every decision right, but we do believe in the asymmetric upside for BSV infrastructure companies. We are committed to be the very best custodians of your capital and we are grateful to you for placing your trust in Unbounded Capital.

Onwards and upwards,

Zach Resnick & Dave Mullen-Muhr

This article was lightly edited for clarity.

Watch: CoinGeek New York panel, Investing in Blockchain Ventures

https://www.youtube.com/watch?v=SdWurEo58ok

03-01-2026

03-01-2026