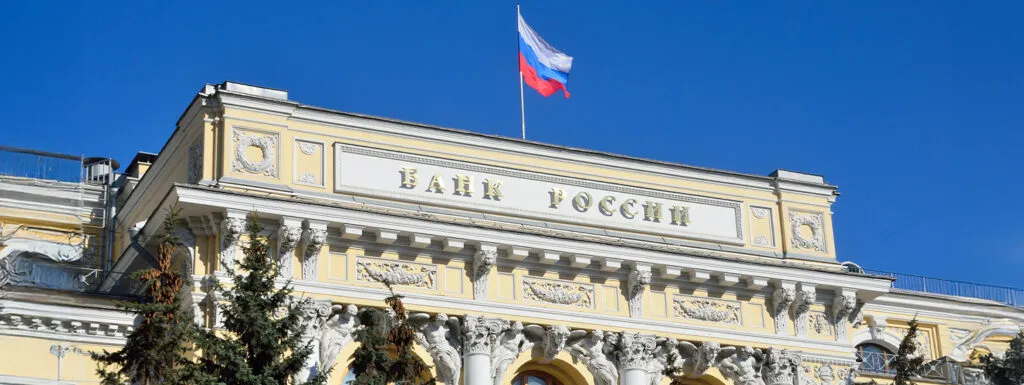

Bank of Russia

Russia tests digital ruble in Tatarstan region

The Russian government has approached the western region of Tatarstan to begin testing the digital ruble, with programmability among the...

Bank of Russia to regulate digital currency trading

The Ministry of Finance and the Bank of Russia are working on a framework allowing “super-qualified” investors to easily buy...

Russia’s largest lender Sberbank joins CBDC pilot

Sber was excluded from the first pilot in August 2023 but joined the latest batch, with the largest digital bank,...

Russia now treats digital assets as property as CBDC faces delay

Russia's new law caps the tax on digital asset profits at 15%; meanwhile, the Trade Ministry argues that retail outlets...

Australia mulls tax reform; Bank of Russia prepares for shakeups

Australia is eyeing to adopt the OECD framework to bolster efforts against digital asset crimes; elsewhere, the Bank of Russia...

Russia pushing ‘crypto’ payments, SWIFT alternative as sanctions bite

Bank of Russia said it had softened its stance on digital asset payment due to sanctions but admitted that the...

Recent

Trending

Most Views

07-05-2025

07-05-2025