|

Getting your Trinity Audio player ready...

|

A general buzz took over ExCel London at the start of Day 2 of the London Blockchain Conference, noticeable thanks to a winding queue that developed outside the main stage half an hour before anybody was due to appear there.

The reason was evidently entrepreneur Steven Bartlett, who appeared on stage for a fireside chat about business, blockchain, and technology. Bartlett is the founder of a number of startups, and his business acumen saw him appointed as one of the investor ‘Dragons’ on BBC’s Dragon’s Den.

Bartlett, who was drawn from his usual pre-10 a.m. ‘do not disturb’ window by the London Blockchain Conference, talked about the view of blockchain from his vantage point (comparing its current phase to the early days of social media) and giving his predictions for the ‘killer use-case’ of blockchain (gaming).

From the opening keynote, Day 2 saw a continual roster of accomplished and esteemed speakers and panelists take the stage.

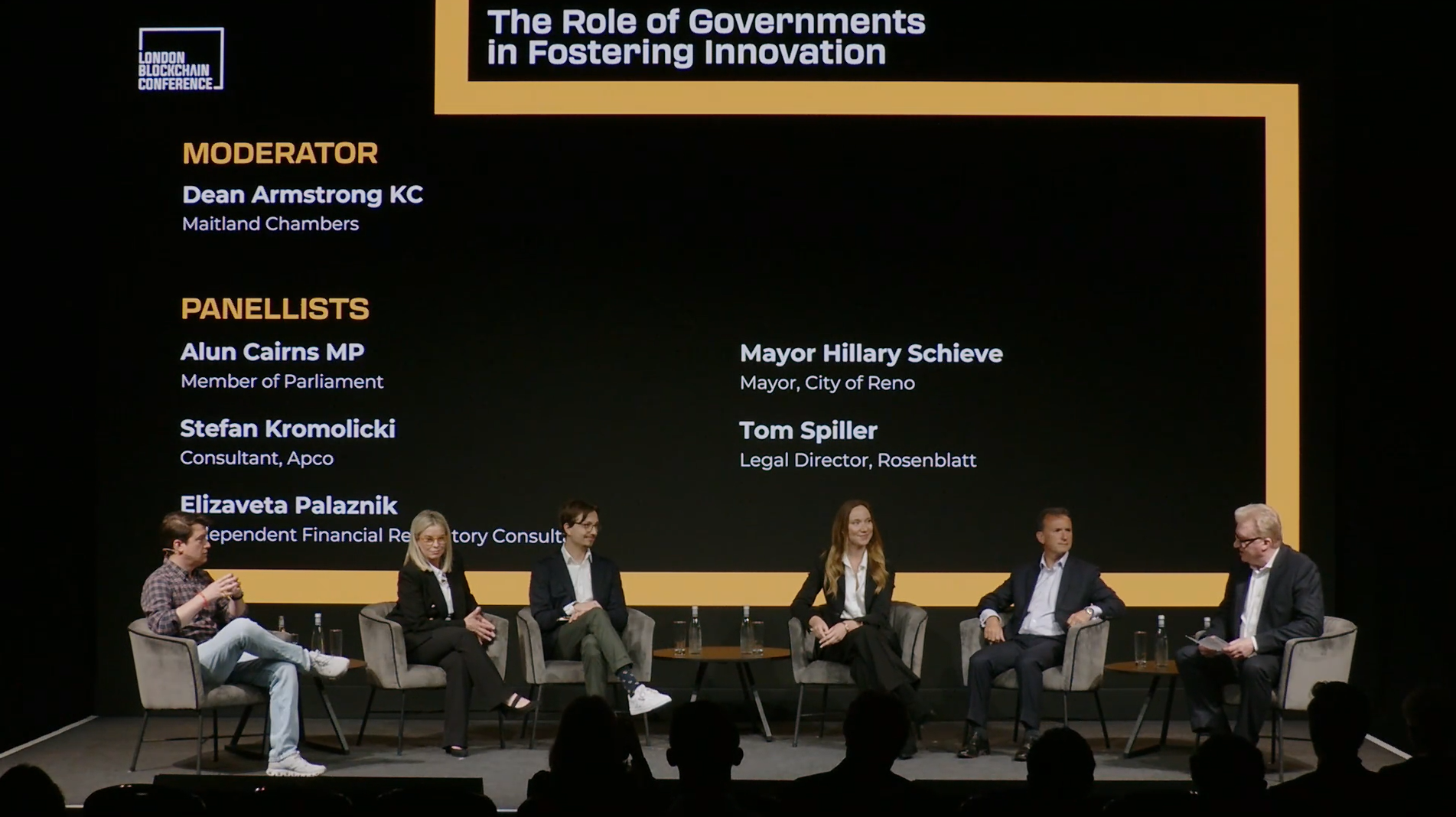

In the morning, the ‘Role of Governments in Fostering Innovation’ panel saw Member of the United Kingdom Parliament Alun Cairns MP joined by legal heavy-hitter Dean Armstrong KC of Maitland Chambers, Rosenblatt’s Legal Director Tom Spiller, APCO consultant Stefan Kromolicki, City of Reno Mayor Hillary Schieve and independent financial regulatory consultant Elizaveta Palaznik. The panel discussed how—or if—effective policymaking from the government can play a role in fostering growth and societal progress.

Elsewhere in the day, a panel of technologists from identity innovator Project Babbage took the stage to discuss the future of identity, contracts, and assets on the MetaNet. Expanding on a common theme during the conference, interoperability is key to realizing the all-encompassing vision of blockchain technology. Offering a digital identity solution is meaningless if that digital identity is roped off from the systems that could make use of it, and a smart contract is little more than a digitized paper document if it can’t interact with, for example, an accounting system that can release payment upon execution of the contract.

Interoperability took center stage again later in the afternoon, as Ijeoma Okoli, director at the Digital Economy Initiative, was interviewed in a fireside chat by Stefania Barbaglio, the founder at Casseiopeia. A former financial lawyer, Okoli had a lot to say about the state of regulation in both AI and blockchain. She told the crowd that as legislators race to shore up the regulatory frameworks applicable to both technologies, it is inevitable that there will be inconsistencies between jurisdictions. This is a challenge because these technologies, by their nature, enable transactions that cannot be neatly boxed into one jurisdiction or the other.

One of the more amusing sessions of the day came under the careful stewardship of moderator and journalist Charles Miller. Miller drilled down on the various consensus mechanisms underpinning the various blockchains out there on the market: proof-of-work, proof-of-stake, and proof-of-authority. Miller opted to launch the discussion by assigning each of his three panelists to explain a different mechanism.

Gregory Ward, co-founder and chief development officer at SmartLedger solutions, was asked to explain proof-of-work. Kevin Alkema, CEO of Bitcoin Minor Sales, had the unenviable task of being assigned the defense of proof-of-stake despite being, as Miller puts it, a proof-of-worker at heart.

Jake Campton, communications lead and project management at Vechain, got the assignment of explaining proof-of-authority, which is used by Vechain. He explained that in proof-of-authority, there’s no competitive aspect to the consensus mechanism: there are instead KYC nodes. It’s a less-known mechanism, but Campton points out that it is almost a permutation of proof-of-stake.

With that conceit as a jumping-off point, what followed was an in-depth and experience-based discussion of the various models and their advantages or disadvantages. It even culminated in an impromptu poll taken of the audience: if you were starting a business wanting to make use of blockchain, would you prefer to make use of proof-of-work or proof-of-authority? In what may be a reflection of the robustness of the discussion, and despite taking place in front of an audience that is likely far more familiar with proof-of-work, the ‘proof-of-authority’ option draw the support of about a quarter of the hands in the room.

Day 2 was brought to a close by a keynote presentation from Tibor Merey, managing director and partner at Boston Consulting Group. The topic was a deceptively straightforward one: taking place on the Best Practices for Enterprise Adoption track, Merey examined industry case studies and practical blockchain applications to try and get to the bottom of the eternal question: what’s the difference between failed startups and the unicorns of the world? Merey draws from an impressive body of experience in blockchain, based on the 150+ blockchain and Web3 projects that Boston Consulting Group has advised on in the enterprise space, and it was clear from the lively (and competitive) Q and A at the end that his insights were well appreciated.

Watch: Day One Summary at #LDNBlockchain24

03-09-2026

03-09-2026