|

Getting your Trinity Audio player ready...

|

Have you raised your Bitcoin SV Node software hard cap 2GB? If you did, then your nodes most likely broadcasted the blocks over 1GB in size that are continually being created and mined on the BSV enterprise blockchain.

Over roughly the past hour, BSV has added over 3GB to the chain from paying transactions.

Miners have earned over 16 BSV from transaction fees, at a rate of roughly 4.25 BSV in subsidy to fees, or 19% of the total reward being comprised of fees at a rate of ~500 sats/KB.

— Matthew Zietzke (@MZietzke) August 5, 2021

Bitcoin Association has advised mining node operators to raise the block size hard cap setting to 2GB, while non-mining nodes—exchanges, applications, and others—have been advised to raise their limit to 10GB. It took BSV miners less than a week to come to consensus and raise the block size hard cap to 2GB, a feat that other blockchain networks are constantly trying to figure out how to coordinate. No blockchain besides the BSV blockchain has found a way to successfully scale.

Why should I run the most up-to-date version of node software?

When some nodes are not running the most up-to-date software available, nodes accidentally create two different versions of the same blockchain ledger. The nodes that did not update will sometimes orphan the blocks created by nodes running the most up-to-date node software because the two different node operators are essentially following different sets of limit rules that determine how blocks are created and broadcasted.

It’s important for node operators to run the most up-to-date version of node software because when all nodes are on the same page it allows network participants to flawlessly recognize, create, and broadcast the most accurate version of the blockchain ledger.

Big blocks, big rewards, bigger transaction fees

Due to the increased hard cap, bigger blocks can be created on the BSV network.

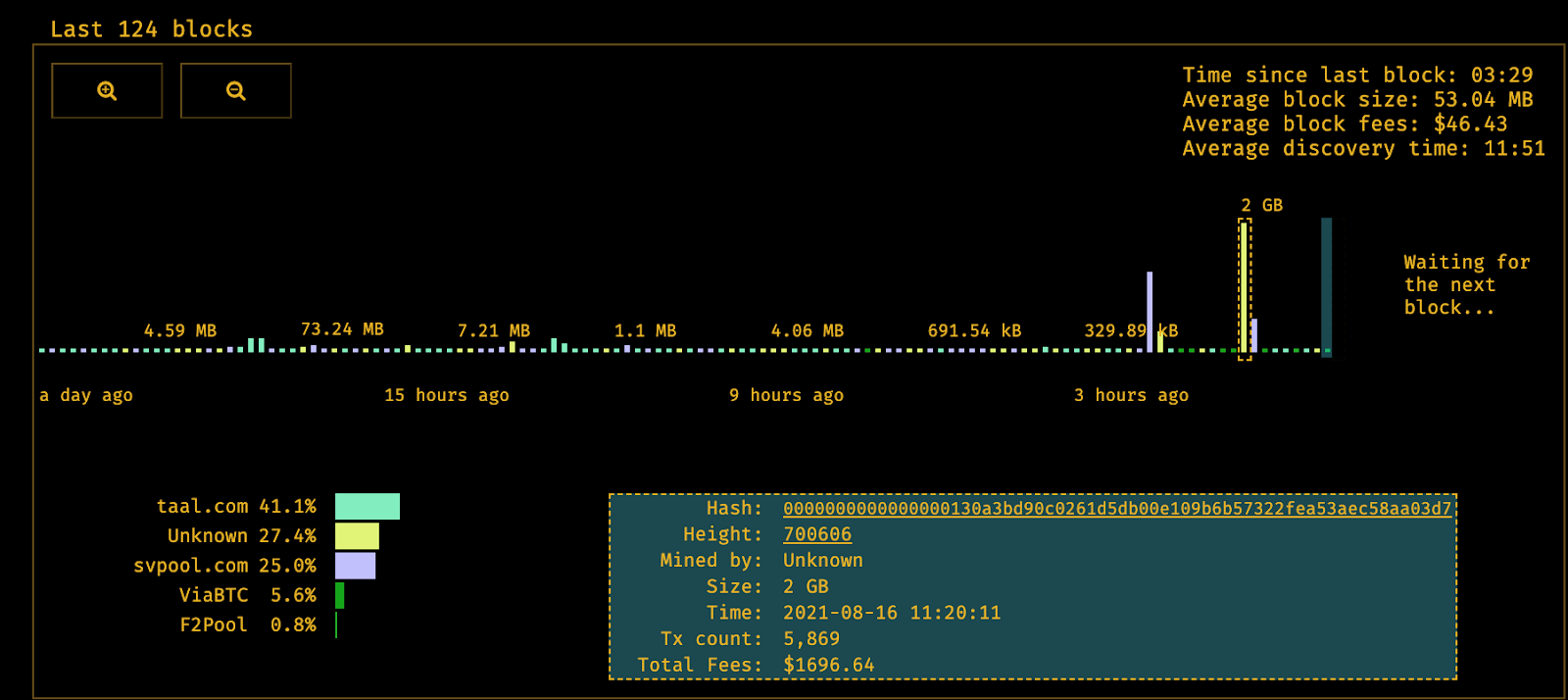

On August 16, a world record-sized 2GB block was mined on the BSV enterprise blockchain––the 2GB hard cap made it possible for this block to be created and broadcasted.

The 2GB block contained $1,696.64 in transaction fees—roughly 10 BSV worth of transaction fees at the time the block was mined; this was the second instance in which the transaction fee attached to a block on the BSV network exceeded the block reward.

As time goes on, the transaction fees attached to blocks will become increasingly important. As the block reward continues to halve after every 210,000 blocks, miners and transaction processors will rely on the transaction fees attached to blocks rather than the block reward to keep them profitable. This is one of the many reasons why a blockchain needs to be able to operate at scale. If a blockchain can operate at scale, enterprises and governments can use that blockchain for their daily operations creating real commerce and utility on-chain; as a result, there should always be a sufficient amount of fees in each block.

On blockchains that lack utility and are primarily used for speculation, miners and transaction processors are likely to be significantly affected with each block reward decrease. These miners will be earning less from block rewards, and since the chain’s underlying coin or token does not have utility, the revenue generated via transaction fees attached to blocks will place the miner’s profits in jeopardy.

The road to success

The hard cap increase is a significant achievement that paves the way for more enterprise solutions and government use to take place on the BSV blockchain. The more data that can fit into a block and be settled nearly instantaneously at costs that are a fraction of a penny, the better. Now, it is up to the businesses, governments, and consumers that are using the BSV blockchain to harness this newfound scalability that no other blockchain currently has.

Watch: Teranode Live Demo Showing 50k TPS on BSV Blockchain

03-06-2026

03-06-2026