|

Getting your Trinity Audio player ready...

|

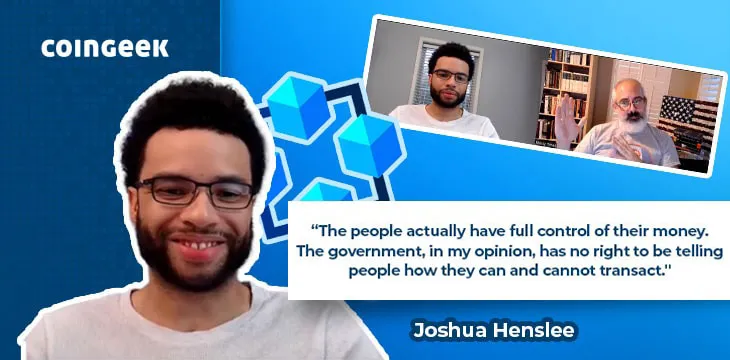

Bitcoin influencer Joshua Henslee joined the Messy Times podcast to talk about Bitcoin SV (BSV), the state of the economy, what will happen to the prices of digital currencies, and much more.

Henslee explains how BSV is different from the mainstream ‘Bitcoin’

Henslee begins by explaining how BSV differs from what everyone else thinks of as Bitcoin. He says that it’s an implementation of the original Bitcoin protocol that was released back in 2009. He reminds us that the original had no arbitrary block size limit, had smart contracting functionality, and while there are minor (trivial) differences, it’s as close as it’s possible to get.

As a result of this, BSV scales almost unboundedly, and the fees have been pushed down to fractions of a cent. This allows people to build apps and transact on the blockchain.

What apps are being built on BSV right now?

Henslee talks a little about the consumer applications like social media, games, and gambling apps currently dominant on BSV. He explains the instant payouts and microtransactions these apps generate, introducing him to the concept of Instant Leaderboard Payouts as seen in the Haste Arcade.

Christopher Messina finds the concept interesting and wonders if a larger user base would affect people’s behavior. He rightly notes that it’s easy enough to rank on leaderboards when there are a few hundred players but wonders what would happen when 80,000 people are competing for the top 10 spots.

Financial inclusiveness and a decentralized revolution

Messina gives his opinion that the errors in central banking are compounding to such an extent that there’s almost a call for a “decentralized revolution.” He asks for Henslee’s opinion on this, given that he’s closer to the digital currency side of things.

Henslee explains that BTC was originally like this but has moved in the opposite direction. Some developers actively call for financial exclusion, saying that Bitcoin is not for people who earn less than $2 per day. This flies in the face of what Satoshi Nakamoto said about how Bitcoin was designed to facilitate small, casual transactions. This revolutionary spirit is gone from BTC, Henslee says, and they actively cheerlead for Wall Street and central banks to pump their bags and make them richer.

On central banks and the lack of utility in the digital currency space

Messina gives a brief history of the Federal Reserve and how major banks set it up to intervene when things went sideways in the economy. He notes that inflation is built into this system and feels it is theft.

Henslee sees a future with “parallel systems” in which vast numbers of people reject central bank digital currencies. He credits the rise of Bitcoin with waking people up to the fact these CBDCs aren’t all good and could be actively harmful in many ways. Henslee also notes that a scalable blockchain will be required to run such a system but thinks it will be years before it is implemented.

Messina points out that there are already a lot of controls in the existing system. For example, he says that the Internal Revenue Service (IRS) can take money out of your account if you don’t pay taxes and companies like PayPal prohibit you from buying certain items, such as ammunition, that are perfectly legal.

Henslee talks about the current economic situation and how Bitcoin has never existed in an environment of sustained higher interest rates. He’s curious as to what will happen to most altcoins and BTC that have no utility other than speculation. He believes this could be the time for utility coins like BSV to shine since they’re still useful even when the price goes down.

“Nobody actually cares about these assets. They care about the fiat amount they’re worth,” Henslee says.

A broad look at the current financial slowdown and systemic risk

Henslee believes that the current situation, with bond yields spiking and a selloff in risk assets, will hit digital currencies harder than anything else because of the lack of utility for most coins.

Messina notes that, in general, markets are completely dislocated from reality thanks to government intervention without rhyme or reason. In Henslee’s view, true capitulation hasn’t happened yet because U.S. markets still expect the Fed to pivot as the Bank of England did recently.

Looking back at March 2020, Henslee notes that a flood of money in the form of stimulus checks and central bank intervention drove prices past all-time highs. Otherwise, useless coins like BTC benefited from this as their valuations jumped past all-time highs. However, Henslee sees the potential for deflation as people bail into cash and deleverage as rates rise.

In Messinas’ view, all of the problems come down to government interference and market intervention. He sees something like BSV as a solution here because it is chosen (or not) by the market, and its monetary policy can’t be randomly altered by whoever happens to be in power. Henslee agrees, adding that Bitcoin will destroy companies like PayPal, which have overstepped their mark.

To learn more about central bank digital currencies and some of the design decisions that need to be considered when creating and launching it, read nChain’s CBDC playbook.

Watch: The BSV Global Blockchain Convention presentation, BSV Blockchain: A World of Good

07-08-2025

07-08-2025