|

Getting your Trinity Audio player ready...

|

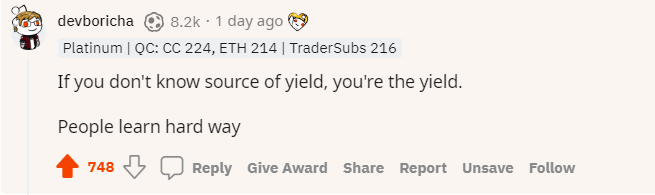

Unable to avert my eyes from the ongoing digital currency crash in June 2022, I came across this gem on the CryptoCurrency subreddit:

This comment sums up the last couple of months in the space, as we saw LUNA (top 15 coin on CMC at the time) literally go to zero as a result from its Ponzinomics. The recent 30% decline while influence by overall fears in the world economy, was accelerated by lending platform Celsius who halted withdrawals on June 12, 2022. While prices have somewhat recovered since, Celsius’ actions have been the receding tide that have revealed who was swimming naked.

"crypto hedge fund"? that's like "world of warcraft gold seller", right?

— moneyman10k (@moneyman10k) June 16, 2022

Several “crypto hedge funds” have been rumored to be insolvent (3AC for example) as they were exposed to digital currency prices via leverage, and somewhat linked to other companies that all have issues simply because the prices fell. This should be no surprise, as generally when the price of BTC falls, all other digital currencies fall, which compared to traditional markets is quite absurd. Imagine if all equities in a certain sector fell just because one of them crashed.

Not only were these companies gambling on digital currency price volatility with leverage, but they were using customers’ funds to do so. Celsius CEO Alex Mashinsky was pressed on how he can pay high yields for simply staking various coins by Peter Schiff on a debate 8 months before the suspension of withdrawals:

Mashinsky never gave a clear answer, and what he does not say speaks volumes. They were able to do so by trading and yield farming on other even more risky so-called DeFi applications and then pay their customers a cut.

This is not too different from how traditional banks operate (more so before the Federal Reserve system was implemented). Banks would take customer funds on deposit and pay them a yield (savings account interest). Banks would have other lending products (business loans, mortgages) that have higher interest rates, and pay their depositors a share, while earning a profit for themselves.

Clearly greed is too alluring. With the fractional reserve banking system and zero percent interest rates, banks, financial institutions and funds have a strong incentive to lend out, speculate or simply gamble up to 33x, 10x or ANY amount higher (as of March 2020).

At least banks typically invest in more stable financial products such as stocks, bonds, or commodities. Regulation has typically prevented established financial institutions from touching speculative “assets” such as BTC or Ethereum. While that is changing the funds are too established, conservative, and regulated to take such wild risks.

The banking system is backed by FDIC insurance so customers’ funds in checking and savings accounts if lost, would be guaranteed to be restored by the government. No such protection exists in the digital currency markets.

Therefore, if one gives funds to another expecting a return, yet it is unclear where the revenue is generated to not only yield but yield enough for both sides to profit, then your funds are the yield!

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple,

Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

02-17-2026

02-17-2026