|

Getting your Trinity Audio player ready...

|

Last week, I gave a pretty harsh warning to a Palm Beach crowd about a massive shift in bitcoin mining economics. In between lots of bullish pitches about “crypto” and some specific sales pitches from local businesses at “Crypto Connect Palm Beach,” I said something like, “I can’t in good conscience ask you to spend your money on blockchain assets or mining equipment because of what is transpiring in the background right now…”

Explaining mining economics to a Palm Beach County crypto audience tonight. pic.twitter.com/k6EN4YHwRt

— Kurt Wuckert Jr | GorillaPool.com (@kurtwuckertjr) June 27, 2024

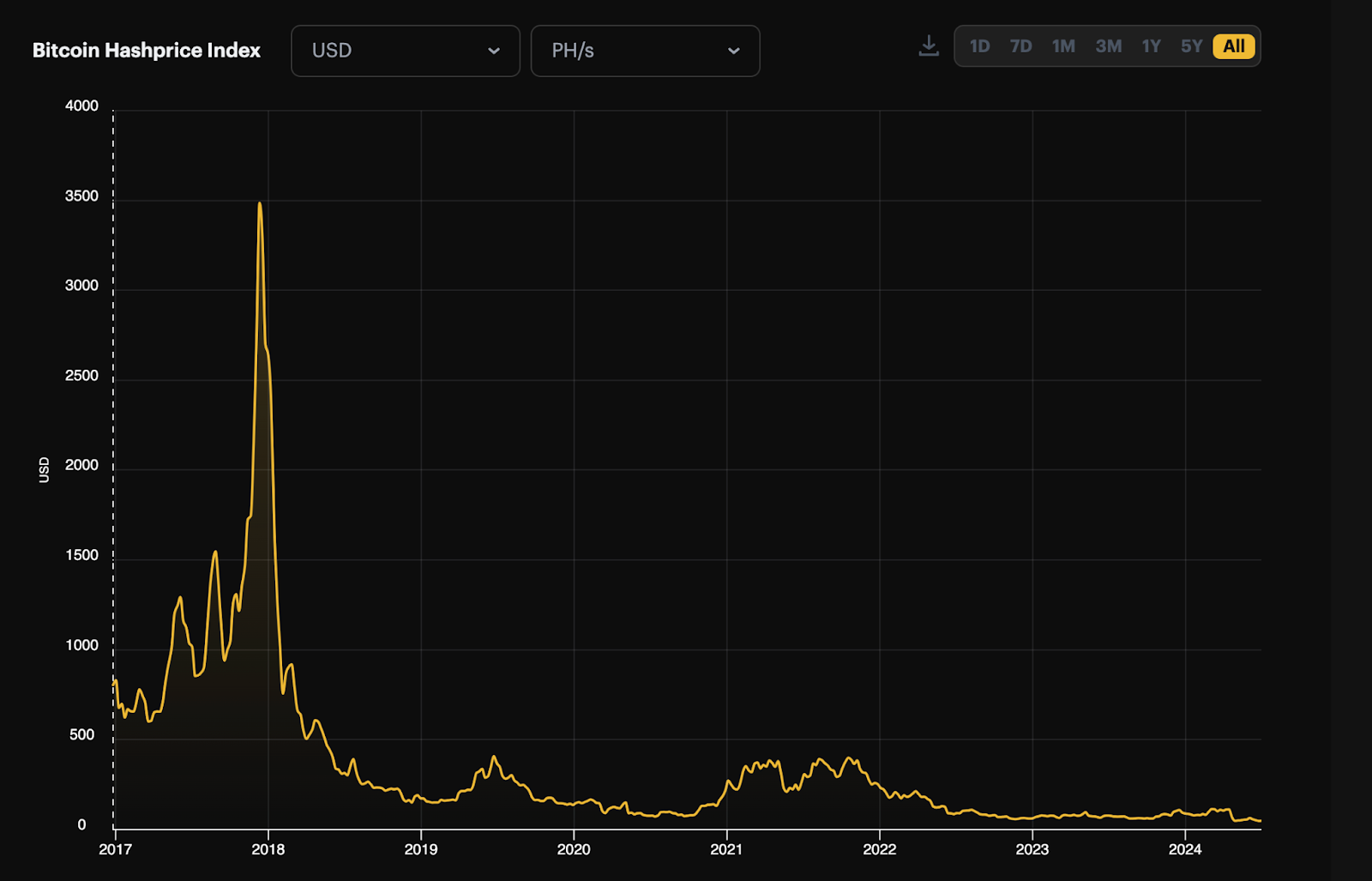

And the background is that mining SHA256 blockchains is near a six-year low in profitability despite the fact that the price of BTC is still hovering around all-time highs.

For years, a pervasive myth has lingered in Bitcoin: the belief that the price of bitcoin follows its hash rate as some kind of leading indicator. This notion has been particularly prevalent among proponents of BTC, who have long maintained that as more computational power is devoted to mining, the price of BTC will naturally increase. However, recent developments, especially those observed across BCH and BSV, have debunked this myth, revealing a more complex and (in some cases) manipulated relationship between price and hash rate.

The BSV perspective: Unmasking the truth

While Bitcoin was never designed to have to deal with arbitrage among multiple SHA256 chains that refuse to orphan one-another, the BSV blockchain has provided clear evidence that not all hashing behavior is directly speculative. This revelation is not entirely new to those closely following BSV, but it is now becoming increasingly apparent even to those entrenched in the BTC economic paradigm. The fallacy that price follows hash is being exposed, particularly under the scrutiny of regulators who are becoming more adept at identifying market manipulation in the space.

Some evidence of this includes the fact that the largest hashers in the United States are now publicly traded with stock price being added to the calculation on total company profitability. Furthermore, simply being a large consumer of electricity by hashing also creates profit opportunities in power arbitrage, curtailment agreements and things like carbon credits, severely muddying the waters of Bitcoin’s basic hashing economics.

The same is also true in the big block space with the added perspective of people hashing on BSV for reasons of belief, which is itself a sort of long-term speculation that the market continues to make incorrect decisions about the value of SHA256-secured assets.

Consider the data point that while BSV can often be more profitable to mine than BTC in absolute terms and measured in US Dollars. We have observed BTC hash power swing to BSV when profitability arbitrage swings quickly, but we do not see similar swings occur when BTC profitability outpaces BSV.

This shows that BTC hash power is less dedicated and has more of a mercenary mentality, while BSV hash power is committed to BSV for more fundamental or deeply held values of the individual hashers.

The regulatory eye and market manipulation

As BTC’s market cap grows, the impact of large transactions, large traffic, or manipulative tactics becomes more pronounced and more important. Regulators are paying closer attention to these dynamics, and recent developments suggest they are beginning to understand the extent of market manipulation within the crypto space.

While the U.S. Securities and Exchange Commission (SEC) has recently seemed to have backed off for now in deeming that Ethereum‘s premined and insider-distributed “ether” cryptocurrency is somehow NOT a security, there is some current United Kingdom class action litigation about market manipulation around favored vs. unfavored assets which could turn the tide to a stronger-armed posture about the application of the law in the blockchain economy. This potential ruling could have significant implications, undermining the very identity of BTC and blowing open the truth of how winners and losers are chosen behind closed doors at major exchanges. This would obviously impact mining economics but also broadly dampen the bullishness that pervades the space.

But that’s not all!

Several myths underpin the BTC narrative, and the debunking of the price-follows-hash fiction could trigger a broader reassessment of these beliefs. One of the most persistent myths is the idea that BTC has a limited supply, which purportedly gives it inherent value. However, if BTC is perceived as just another crypto token with no unique functionality, its scarcity becomes irrelevant. In essence, BTC could be seen as having an unlimited supply in terms of its utility—or lack thereof. Or they could just add “tail emission,” like Peter has been begging for since forever…

More evidence that we can't rely on fees in the future to pay for PoW security.

Bitcoin needs to implement either tail emission (hard fork) or demurrage (soft fork). Either way it's a tax on savings to fund the security of those savings. https://t.co/tauJ2xtvu3

— Peter Todd (@peterktodd) February 19, 2023

Another myth under threat is the notion that BTC is decentralized in its mining operations. The reality is that BTC mining is becoming increasingly centralized, with two large pools and only a small handful of large hashing players dominating the entire network. Unlike BSV, which has the capability to specialize in mining and distribute power more evenly at scale, BTC is moving towards a winner-takes-all scenario due to reliance on perpetually small blocks and bullish price movements in terms of fiat dollars. This centralization not only undermines the security of the network but also contradicts the very principles of decentralization that Bitcoin was founded upon.

The impact on mining economics

The implications of these revelations are profound, particularly for mining hardware purchases. Many investments in mining equipment have been predicated on the flawed economic theory that the price of a token is intrinsically linked to the amount of hash power directed at the network. This misguided belief has led to irrational expenditures on mining hardware, with little regard for the actual utility or functionality of the token being mined.

Bitcoin mining profitability is near an all-time low, highlighting the disconnect between hash rate and price. As mining becomes less profitable, it becomes evident that the economic models many have relied upon are fundamentally flawed. The price of BTC is not determined by the hash rate alone but is influenced by a myriad of factors, including market sentiment, regulatory developments, and speculative trading.

But hash rate has gone up almost nonstop since 2018, which has driven profitability down almost nonstop except for at the peak of the last bullrun bridging 2021-2022.

So, the last time mining hit an all-time high, the price of BTC was less than $20,000 per coin, and it has never gotten close ever since.

A paradigm shift in economics

We need a serious reassessment of the underlying principles that have guided the industry thus far. The realization that hash rate follows price—and not vice versa—demands a more nuanced understanding of how bitcoin (and everything else) derives value. Price going up isn’t making the infrastructure of BTC any more profitable. In fact, it has dropped significantly and is only trending down, which means something needs to shift. Either there needs to be more on-chain transaction fees, or there needs to be a massive capitulation in hash power for the sake of those hashers who remain.

For BTC, this shift could herald a period of introspection and reevaluation. As the myth of decentralization is dispelled and the true nature of BTC’s utility (or lack thereof) is exposed, the market may begin to reallocate resources toward more functional and scalable blockchains. BSV, with its focus on real-world utility and scalable solutions, stands poised to benefit from this transition with the laser-focus on long term utility, usability and scalability. This narrative, to be fair, has also been long coming soon, but it’s also the only possible way forward.

Either BTC hard forks to look a whole lot like BSV, or it has a major upheaval and reorganization of the underlying economic theories that have carried it so far. Or, of course, the culture of BTC remains completely toxic to what the data is telling it, and BSV benefits from a major passing of the torch event.

Conclusion: A new dawn for blockchain realism

The world is evolving. The economy is slowing globally, and world powers are looking for clever ways to gain more power. In this Darwinian landscape, only those blockchains that can demonstrate real-world utility, scalability, and decentralized security will thrive. BSV’s emphasis on these attributes positions it as a formidable contender in the next phase of blockchain development. The future of Bitcoin will be shaped not by myths and misconceptions but by practical, scalable solutions that meet the demands of an increasingly digital world, and this will only get clearer as funny money dries up around the world reducing malinvestment and people are forced to move toward tools that make their lives objectively better.

Watch: Determining blockchain’s economic value

02-24-2026

02-24-2026