|

Getting your Trinity Audio player ready...

|

Fintech and blockchain are well established sectors. They have their own conference circuits where insiders have been meeting for years, appearing on panels, lining up for free lunches and hoping that one day their vision of the future will arrive.

Well, at the Fintech Week conference in London, it almost felt as though that day had arrived. The worlds of Bitcoin/blockchain and fintech were coming together under the banner of “global money.” And the catalyst for their potentially explosive fusion was Facebook’s complicated, vague, ambitious, not-quite-a-cryptocurrency project, Libra.

In a session called The Future of Money, the starting point for moderator Barry James was that global money is now inevitable. The only question is who’s going to own the system. Will there be one big player, or will we find ourselves using multiple currencies, like a wallet full of store cards?

There wasn’t much dissent from Barry’s confidence from his panel. Jonny Fry, CEO of Team Blockchain, said world-dominating currencies seem to have a life of about a hundred years and by that measure, the U.S. dollar is coming to the end of its run. The only problem with Libra is that it will be a kind of stablecoin, backed by a mix of established national currencies, rather than a true, freestanding cryptocurrency. That means, somewhat confusingly, that it’s “backed by the currencies it’s designed to replace.”

Helen Disney, CEO of Unblocked, admitted that the idea that “we [the fintech sector] really are going mainstream” could be scary. But for it to happen, the new money must fulfill three conditions: onboarding new users must be easy; the technology must work flawlessly and there must be a network effect—people being drawn to use it because other people are. Obviously Facebook should have that last one sewn up.

Simon Gleeson of the law firm Clifford Chance took the most radical view of the future by stating confidently that “there’s no need for money: all we need is a central register that keeps track of obligations.” He believes that there’s “no natural connection” between governments and money—it’s just that historically, governments have been the biggest financial entities. With giant payment services such as Alipay, payments are moving out of the banking system. And for all the discussion of what backs a currency—whether it’s gold, a state, or any other mechanism—the value, said Gleesion, is in the end nothing more than what people are prepared to accept that it is.

Gleeson’s point about the loosening connection between money, big banks and government was underlined in a later presentation by Freddy Kelly (above), co-founder of Credit Kudos, and a former programmer. Kelly’s subject was The Future of Big Tech. And he was pretty sure that its future would involve many of the functions of banks.

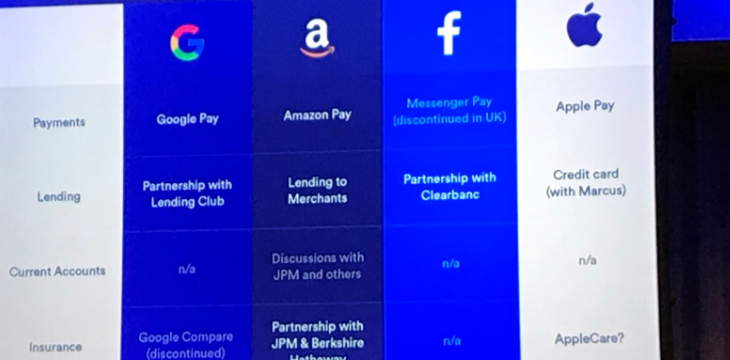

He had a chart (below) on which he cross-plotted the four tech giants, Apple, Amazon, Google and Facebook against four traditional banking or finance functions: payments, lending, current accounts and insurance. While not all 16 boxes could yet be ticked, there’s a good deal of activity already to be seen—especially in payments, but also in some smaller projects that the four already have underway in other areas:

On Libra, Kelly pointed out that the ‘decentralizing’ effects associated with cryptocurrency will be counterbalanced by the size and power of Facebook or any other of the tech giants that get into the game. Their monopolistic, centralizing tendencies can’t be avoided—although Facebook is trying to distance itself from running Libra by setting up a system of business partners for its governance and promising that it will grow more decentralized as it develops.

So what did I learn about Libra from Fintech Week? Well, I found that it’s galvanised fintech and blockchain businesses to believing in their sector with a new confidence, even if they are also worried they could be flattened by tech giant initiatives.

But as to exactly what Libra will be like, I’m not sure that I’m much clearer than I was when I consulted Astrology.zodiac.signs.com, where I found out that Libra’s strengths are “cooperative, diplomatic, gracious, fair-minded, social” and its weaknesses are “indecisive, avoids confrontations, will carry a grudge, self-pity.” Mark Zuckerberg is a Taurus.

03-01-2026

03-01-2026