|

Getting your Trinity Audio player ready...

|

BSV cannot be friends forever with other blockchains that use SHA-256 hashing algorithms. The reason is that there exists only so many ASIC mining machines that require a high amount of capital investment and upkeep chasing a fixed subsidy of coins across three blockchains. To justify the sustained usage of these ASIC mining machines, as the subsidies dwindle, the fiat currency price of the subsidized coins must meet a certain profitability level. In an environment where the fees of block rewards are a paltry percentage compared to the fixed subsidy of 6.25 units, this model can persist.

What if one of the blockchains suddenly has fee income that throws this mining profitability calculation out of the status quo? The current innovation of ASIC miners to make hashing as powerful as possible while efficient as possible is not accounting for this scenario of fee income rising.

Found Fresh Bananas 🍌🍌

Block: 733,689

Size: 3.65 GB

Tx count: 2,512,670

Average fee: $0.00038

Total fees: 9.76 BSV

Total revenue: 16.01 BSV

Revenue from fees: 60.96%https://t.co/tbY59NdZvf— BananaBlocks™ by GorillaPool🍌🍌 (@banana_blocks) April 4, 2022

Block 733,689 was mined on the Bitcoin SV network with 2,512,670 transactions, netting 9.75 BSV coins in transaction fees alone in addition to the 6.25 subsidy. While this is a good sign in demonstrating Bitcoin’s ability to scale, it is still not enough. One or even a few of these blocks is not enough to disrupt the status quo of chasing the subsidy alone. For example, let us compare scenarios to Bitcoin Cash.

As of April 2022, BCH is worth $370. 6.25 * 370 = $2312.50. The block mined by GorillaPool only earned 6.25 * 100 + 9.75 * 100 = $1600. Even with a world-record block, this does not impact miner behavior enough to incentivize switching chains.

However!

The hash rate on BSV is quite low, in fact so low that it is constantly being ridiculed by critics over and over again. Given that fact, in this example if BTC or BCH miners had deployed some machines to mine BSV they could have potentially earned 150% more revenue for nearly the same amount of work and cost. Some pools mine all three chains, deploying hash rate proportionally based on the price. Nodes do not expect to earn 2.5 times revenue for the same effort, but if there exists unique profit opportunity for the same effort, then you have arbitrage—but you cannot have arbitrage.

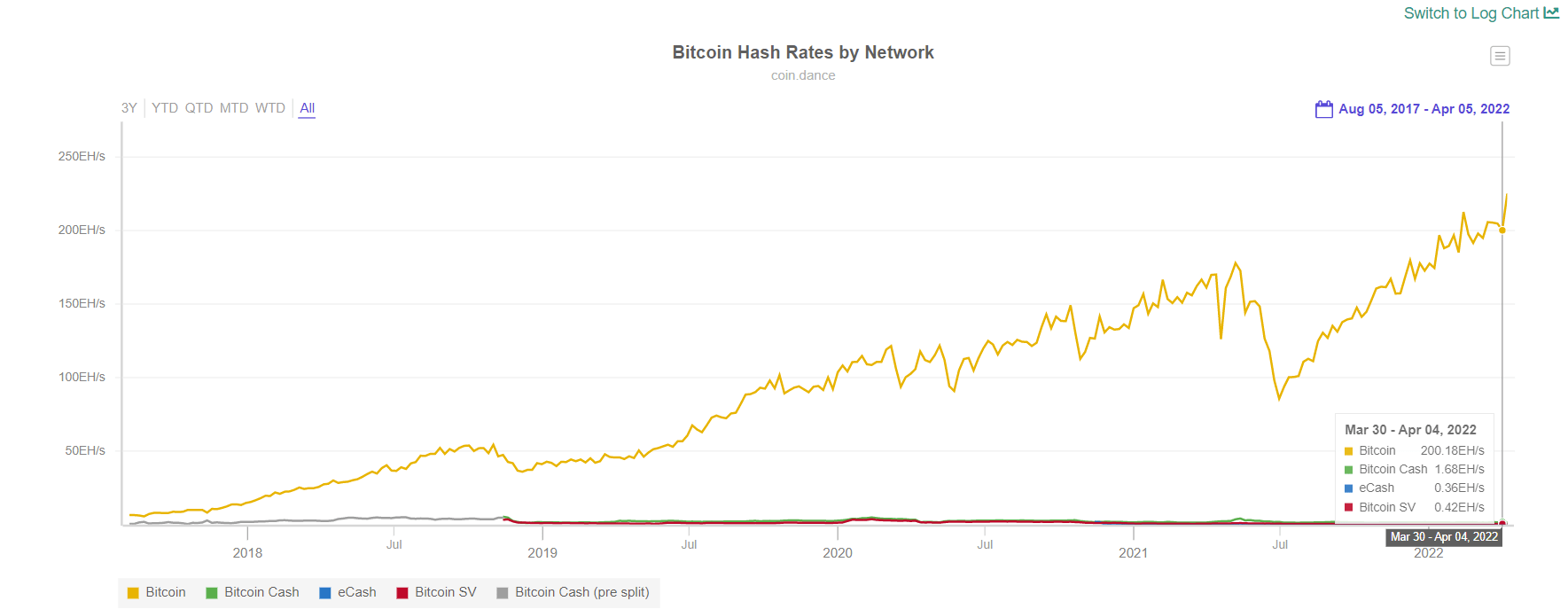

Such market anomalies do not manifest often, but when they do, they do not last because they are quickly taken advantage of. This one-off example and opportunity have little impact but if it happens more consistently then the entire mining market can change. The hash rate distribution is nearly in perfect proportion with the typical prices of BTC, BCH and BSV:

Source: CoinDance

This proportion completely ignores the transaction fee revenue (as it should) because it is currently a non-factor. When that does become a factor, the innovation and investment into high-powered ASICs starts making less sense moving forward, especially as the subsidies halve. Additionally, consistently increasing the fee income is functionally the same as a coin price increase in terms of miner revenue.

As the fee income starts to offset and replace the subsidy, miners will need less hash rate and more hard drives, servers, and transaction processing capability. Hash rate will no longer be the commodity it is today simply because its return on investment will not be as high. Also, this assumes the coin prices remain as high as they are today. Can the BTC and BCH prices sustain these levels with their current hash rates as the block subsidy cuts to 3.125 in 2024, then 1.5625 in 2028?

Watch: CoinGeek New York panel, BSV vs other blockchains—the differences that matter

02-26-2026

02-26-2026