|

Getting your Trinity Audio player ready...

|

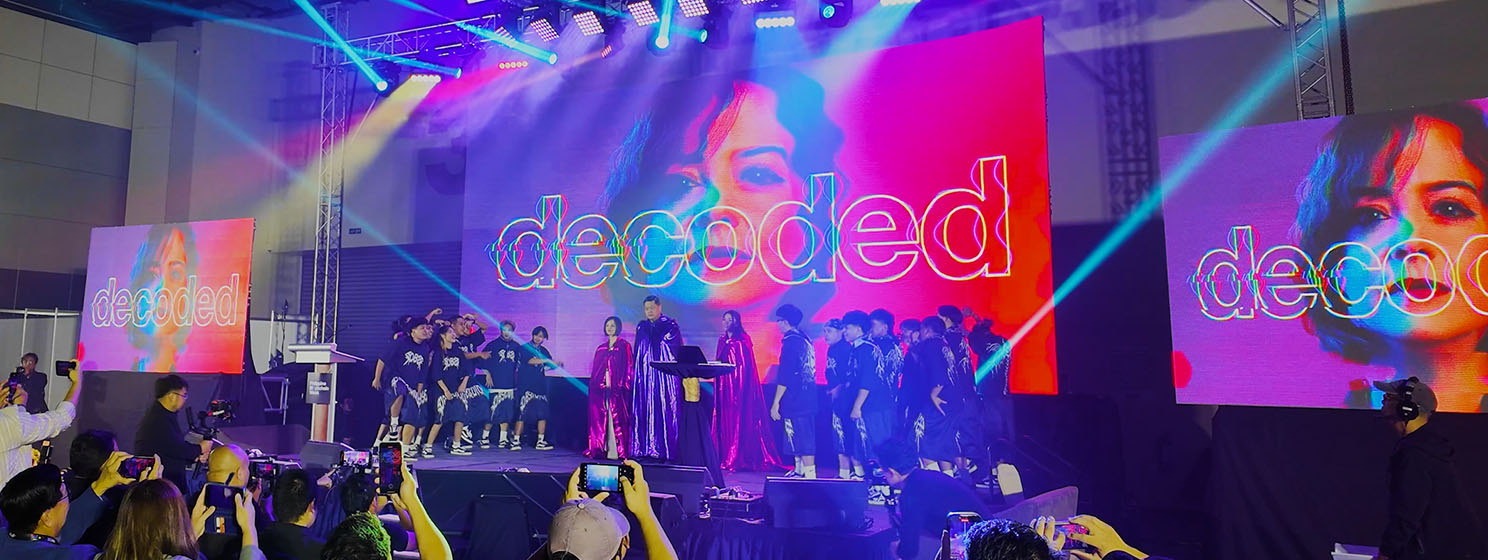

Philippine Blockchain Week 2025 brought together global leaders, regulators, founders, and digital currency enthusiasts under this year’s theme—“Decoded.” The message was clear: blockchain is no longer just for the technically inclined. It’s being translated into everyday use, real business value, and practical regulation. And the Philippines is at the heart of that transformation.

“We decode it for everyone,” said Donald Lim, Lead Convenor of Philippine Blockchain Week and Founding President of the Blockchain Council of the Philippines. “We make sure that everyone understands where everyone plays and how this technology can help. We act like an interpreter—how it goes to business, how we bring it to users to make sure it’s a safe and legit environment.”

Lim stressed the importance of regulation in building a responsible ecosystem. “If you want to be part of the ecosystem, you have to follow certain rules in a particular country. The rules are designed to keep people safe and informed,” he said. However, he also pointed out a challenge: “There is a gap between regulators, government, the private sector, and also the user base.”

The country’s Securities and Exchange Commission (SEC) recently addressed this gap through a new regulatory framework for Crypto Asset Service Providers (CASPs). According to Atty. Mark Gorriceta, Managing Partner at Gorriceta Africa Cauton & Saavedra, “If you are into crypto asset service… you can now register your company or your activity in the Philippines under this new regulation. Basically, it really invites more investors to legitimize in the country within the jurisdiction of the SEC.”

To register as a CASP in the Philippines, foreign companies must incorporate as a domestic corporation, have at least PHP 100 million in paid-up capital, and meet strict operational and reporting standards—ensuring that market participants are credible and accountable.

This regulatory shift not only opens the door for foreign players but also empowers local institutions. “With these new regulations, licensed players like Philippine banks and digital wallets can now offer new products—not just peso-to-crypto exchange, but even token trading like a digital stock exchange,” he adds.

Mainstream platforms are already integrating these changes. Luis Buenaventura, Head of Crypto at GCash, said over three million Filipinos now use GCrypto within the GCash app. “We’re growing at a pretty steady pace because the GCash brand has built enough trust,” he said. “Now the challenge is getting those users to think of crypto not just as speculative, but as something like long-term savings.”

Investor and Web3 evangelist Evan Luthra, founder of KOL Capital, brought a global perspective. “I’ve spoken at over 200 events in 50 countries. The Philippines is ground zero for GameFi and Web3 adoption,” he shared. Though this was his first visit to the country, he was impressed by the energy and talent. “What’s great about Filipinos is that they’re early adopters. Even just playing a game, they end up with a crypto wallet. That’s a huge opportunity.”

Luthra also highlighted how blockchain is reshaping work and creativity. “Web3 is about ownership. Nobody works for someone—everyone’s a partner. That’s what tokenization enables,” he said. “As a creator with 3 million followers, I bring value, and in crypto, that’s what matters. Degrees are everywhere. But value—real value—is what makes someone investable.”

He was especially struck by the presence of students at the event. “I’ve never seen school children at a blockchain conference before,” he said. “Technology doesn’t care about degrees. I started building apps at 12. Events like this expose kids early—and that’s powerful.”That message echoed across the event, from metaverse job pipelines supported by the government to AI-driven blockchain tools like Chatoshi. Billed as “the ChatGPT for Web3, crypto, and anything blockchain,” Chatoshi is fine-tuned to answer real-time queries about token sentiment, on-chain analytics, and transaction statuses.

“We’re connected directly to blockchain tools,” said Chatoshi’s Joe Pepito. “If you want to know if a token is a scam, or check your transaction status, you can just ask Chatoshi.” The platform pulls data directly from the blockchain, including educational resources, token legitimacy checks, and even market trends. “At the end of the day, we want to help people feel less skeptical about the space. Information empowers users to make smarter, safer decisions,” Pepito added.

Also aiming to make blockchain more relatable to everyday Filipinos was actor and entrepreneur Marvin Agustin, who introduced a playful campaign called Fishblock. “They wanted to use fishballs as a representation that blockchain could penetrate even down to the vendors,” Agustin explained. “It’s hard to understand when we just talk about the technology. But if we tie it to something familiar, maybe more people will get it.” The campaign featured digital currency-enabled payments and NFTs.

Agustin, a restaurateur, also sees real value in blockchain for the food industry, stating, “The Department of Trade and Industry (DTI) is trying to link all suppliers and stakeholders. It’s a supply chain solution that can really benefit small business operators.”

As the event wrapped up, Lim emphasized the broader vision: “I want to position the Philippines as the blockchain captain of Asia—because the government is open, and the private sector is investing.”

For builders, creators, and investors alike, the future is no longer abstract. It’s decoded, and it’s already being built.

Watch | The Philippines startup boom: Highlights from Sinigang Valley Build Startup Festival

03-04-2026

03-04-2026