|

Getting your Trinity Audio player ready...

|

Professor Peter K. Yu from Texas A&M University recently published a research paper titled Deploying Blockchain Technology in the Copyright Office. Prof. Yu concludes that copyright offices could benefit tremendously by implementing blockchain solutions—however, he also identified challenges.

The benefits of a blockchain-based copyright administration are evident and explained in detail by Prof. Yu:

- Immutability or strong tamper resistance

- Traceability of copyright data

- Blockchain transparency

- Disintermediation

Specifically, Prof. Yu mentioned registering copyright, storing ownership data, and licensing records. The World Intellectual Property Organization (WIPO) launched its WIPO Proof in 2020, but without a blockchain.

Digital fingerprints and secured copyright data

Prof. Yu states:

“By providing a time-stamped digital fingerprint, WIPO Proof was designed to show the existence of each submitted file at a specific point in time. Although the service did not utilize blockchain technology and has since been discontinued, it demonstrated how new technology could be actively deployed to document and recognize contributions in the creative process – something that blockchain technology can also do very well.”

Here at CoinGeek, we have commented on points 1 to 4 above regarding the benefits of blockchain implementation from our perspective over the years:

- Improving trust with blockchain

- Traceability of Bitcoin

- Transparency and blockchain

- Settlements with Bitcoin

While we probably agree with Prof. Yu’s research concerning the benefits, we might have another opinion on the challenges copyright offices could face using blockchain technologies.

Prof. Yu rightly points out that there are reasons to worry about the security of the applied blockchain solution. For example, vulnerabilities have already led to a loss of digital assets—be it through hacking attacks or by incautious blockchain users.

However, keep in mind that anything happening on the blockchain is never “only digital”—our legal system and all laws apply to blockchain problems precisely the way they do to all other problems we face in life. We write this to emphasize that asset recovery on blockchains is possible.

More challenges for copyright offices to implement blockchain solutions?

The security of blockchains is just one of Prof. Yu’s worries. In his research paper, he explains that the operating costs of blockchain solutions in a copyright office could be too high—on the one hand, due to mining costs and, on the other hand, by the high transactional fees that are associated with the BTC blockchain or Ethereum.

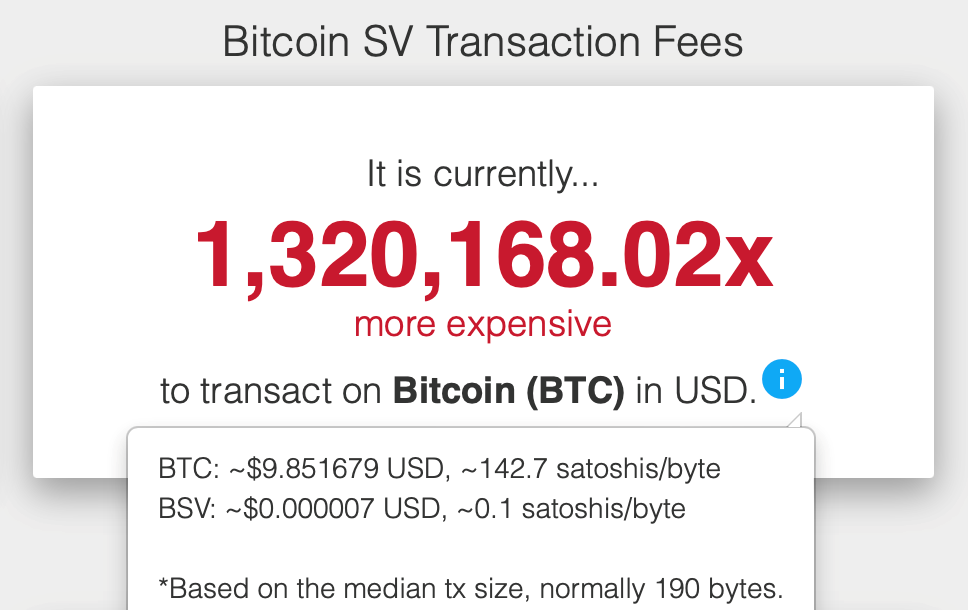

We recommend having a look at the BSV blockchain (also called Bitcoin SV or Bitcoin Satoshi Vision) instead, as it offers ultra-low-cost microtransactions. Recently, IBM’s Dr. Agata Slater introduced Trace, a BSV blockchain-powered platform that enables tracking of supply chains and distribution chains.

When we mention “ultra-low-cost,” we really mean it. As demonstrated here, BSV Blockchain is cost-efficient in comparison to the wider known BTC blockchain:

How many blockchain transactions are needed for a copyright office?

Concerning scalability, Prof. Yu’s assertion is correct—the current “popular” blockchains, such as BTC or Ethereum, seem to lack the capability to operate at scale. Regarding BTC and ETH, Prof. Yu explained that:

“The fourth challenge posed by blockchain technology relates to scalability. At its current state, the technology is too slow to handle day-to-day copyright transactions. Bitcoin [BTC] issues a block every ten minutes, while Ethereum [ETH] issues a block every twelve seconds. Despite its faster speed, the latter is still not fast enough to handle a large number of copyright transactions.”

We agree with that. For a copyright office to use blockchain solutions comfortably for uncountable numbers of daily transactions, one would need peace of mind concerning scalability.

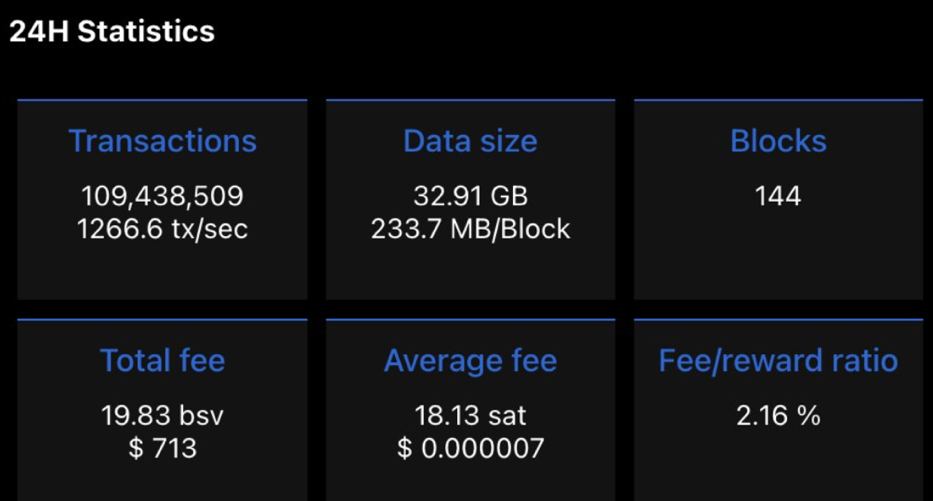

For example, a widely used blockchain necessarily needs reliable zero-confirmation transactions, simplified payment verification, and no scale ceiling. The BSV blockchain has proven its capabilities with world records in scalability, such as having processed 128 million transactions within 24 hours (see the press release).

How is that possible?

Simple, the BSV blockchain makes sure to cater to all data management needs imaginable, and that is not an exaggeration. 2022 surprised us with the processing of an enormous BSV block of 3.65 GB, highlighting the evolution and expansion of this technology. Remember, famous economist George Gilder publicly stated:

“Satoshi’s vision is now manifest in a level of transactions that dwarves the level of transactions of BTC. (…). Bitcoin SV is now taking off in the transactional field.”

The BSV blockchain could handle the challenges of a copyright office. With this tool, we can track and trace copyright data efficiently. Furthermore, the tracing and tracking comes with the built-in valuation method of Bitcoin itself—as Bitcoin is an informational commodity, the exchange of data on the original Bitcoin blockchain automatically ties all processed data to a value (see our comparison of Yuval Harari and Craig Wright regarding data).

We must understand that the BTC blockchain and even Ethereum fail at being a data management tool. These digital assets seem to serve only one purpose, and that is being traded on ‘cryptocurrency’ exchanges for profit-seeking. However, the original Bitcoin was never meant to be primarily a trading vehicle, but much more: a precise data management tool, a digital ledger, and an informational commodity.

In other words, if the WIPO or a copyright office knew about the capabilities of the BSV Blockchain, they would already be working to implement it.

Watch: Bitcoin is not a cryptocurrency

03-01-2026

03-01-2026