|

Getting your Trinity Audio player ready...

|

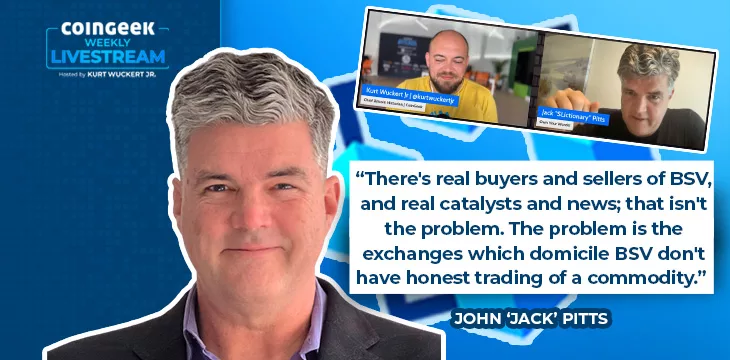

On the latest CoinGeek Weekly Livestream episode, Kurt Wuckert Jr. held an Ask Me Anything, which featured a surprise appearance by SLictionary founder John ‘Jack’ Pitts. Wuckert covered the latest happenings in the Bitcoin space, including the recent BSV blockchain price pump.

What’s going on with BlackRock?

Wuckert begins with the news everyone has been talking about; the BlackRock BTC ETF filing with the Securities and Exchange Commission (SEC). For those who don’t know, BlackRock is the largest investment institution on earth, and it recently applied for permission to launch a spot digital currency ETF.

Spot BTC ETF applications are nothing new, but what grabbed people’s attention this time was that BlackRock acknowledged that other Bitcoin forks might be the real Bitcoin, and it reserves the right to change its mind. This could be linked to the recent BCH and BSV price pumps.

Wuckert expresses concerns about BlackRock’s involvement as they’re known for investing in things on the condition that their ESG agenda is accepted. He points out that, should they launch a BTC ETF, they’ll also want to get in on mining companies, exchanges, etc., pushing their green energy and political agendas. This could have all sorts of unforeseen consequences.

Interestingly, the ETF application directly mentioned Dr. Craig Wright as one of the risks associated with the ETF. This tells us that BlackRock knows of Dr. Wright, his claim to have been Bitcoin’s inventor, and the potential risks if and when he wins the COPA vs. Wright case.

What about the BSV and BCH price pumps? Wuckert thinks speculators are likely positioning themselves to be hedged and “depoliticized” in the wake of BlackRock’s statements. The fact that both coins pumped suggests it’s not a pump and dump, he says.

When digital gold on BSV blockchain?

A viewer asks when anything will come of the ideas about creating a digital gold exchange on the BSV blockchain.

Wuckert says he is aware people are working on it, but he clarifies that it’s not Peter Schiff. He’s not sure what the demand will be, and there are various challenges to overcome, such as custody and attestation, but he’ll keep viewers abreast of any developments.

How do the .sats Ordinals work?

This is another viewer question about something happening in the on-chain Bitcoin economy.

Wuckert says to think of them like DNS records; on the web, these addresses are used to communicate between parties. In Bitcoin, .sats addresses could serve a similar function. He bought Wuckert.sats. Technically, this could allow him to receive payments to that address or sell it at a later date.

If one satoshi becomes equivalent to one cent, can micropayments still exist?

Wuckert answers this one quickly and simply: yes, sub-sat payments can be sent via payment channels, and tokens representing smaller amounts can be issued. It’s possible to send payments of 1/1000th of a satoshi through payment channels, so micropayments can and will always exist.

Can you give us a detailed explanation of ASIC hosting?

Wuckert swears he didn’t plant this question, but it just so happens this is one of the services his company GorillaPool offers. Basically, you buy an ASIC, and they host it, sending you electricity bills to settle and sending the freshly minted BSV to your payout address. It’s a done-for-you service that removes all the hassle of BSV mining.

Jack Pitts joins the conversation

At this point, SLictionary founder Jack Pitts joins the show. Pitts is a veteran investor and expert on short selling, so he’s the ideal man to shed some light on the recent BSV price action.

Wuckert begins by asking if the recently added Huobi BSV futures are good or bad. Pitts answers that since Justin Sun owns a big part of Huobi, it can’t be good. He wants OKX to delist BSV, and he’d push Huobi to do so soon after that happened.

Wuckert asks why, given that it’s generally accepted that more liquidity is a good thing. Pitts answers that liquidity is only good when it’s real, and when it’s fake liquidity at a rigged casino, that’s different. He says there’s a reason these exchanges are domiciled offshore—they’re up to no good.

Why are both BSV and BCH pumping, then? Pitts thinks it’s a brief rush based on a few things like Dr. Wright tweeting “irrefutable evidence” amidst an already pumping price, and it’s possibly also linked to the recent Blackrock ETF information.

I reached out to Jack Pitts and asked him more about this, and he responded with a quote summarizing the situation. He told me:

“There’s real buyers and sellers of BSV, and real catalysts and news; that isn’t the problem. The problem is the exchanges which domicile BSV don’t have honest trading of a commodity as their mission statement, and they probably don’t even have a mission statement.

This leads to hosting a market which is primarily for their own benefit, and they’re unscrupulous with who they have to bury to make their tens of billions. The world hasn’t quite figured out the schemes they are running, and most of that scheme is basically a Sybil attack on cryptocurrency buyers from Grandma to Elon and Saylor.

When you trade at these bucket-shop exchanges, you’re the mark, not the customer. If your exchange uses USDT, stay away. If your exchange prides itself on offering derivatives (Huobi, OKX, BitFinex), stay away. If your exchange ever dealt with Deltec, Prime Trust, or Silvergate, stay away. Better to go earn your BitCoin—go win a SLictionary Word Bounty!”

That’s a wrap for this week’s CoinGeek Weekly Livestream. Subscribe on CoinGeek’s YouTube Channel to get the latest when the next episode drops!

CoinGeek Conversations with John ‘Jack’ Pitts: English speakers are the real keepers of English lexicon

02-27-2026

02-27-2026