|

Getting your Trinity Audio player ready...

|

I recently sat down with a freshly brewed cup of coffee and dug into Circle’s latest USDC stablecoin report.

As I read, I found myself agreeing with much of what was said. Circle is on a mission: to empower the world to use U.S. dollars and make it as easy to transact with them as sending an email. Circle calls USDC “money with a mission” and admirably wants to make sending, spending, and saving accessible to all.

However, while I agreed with much of this, I couldn’t help but wonder if the people at Circle are missing something important. Allow me to explain.

The adoption of Web 3.0 and enterprise-grade blockchains

The Circle report paints a vivid picture: we’re on the brink of a Web 3.0 revolution. The primary use case of digital currencies being speculation is largely over, and applications that empower users and make anything we can imagine possible are popping up on enterprise-grade blockchains.

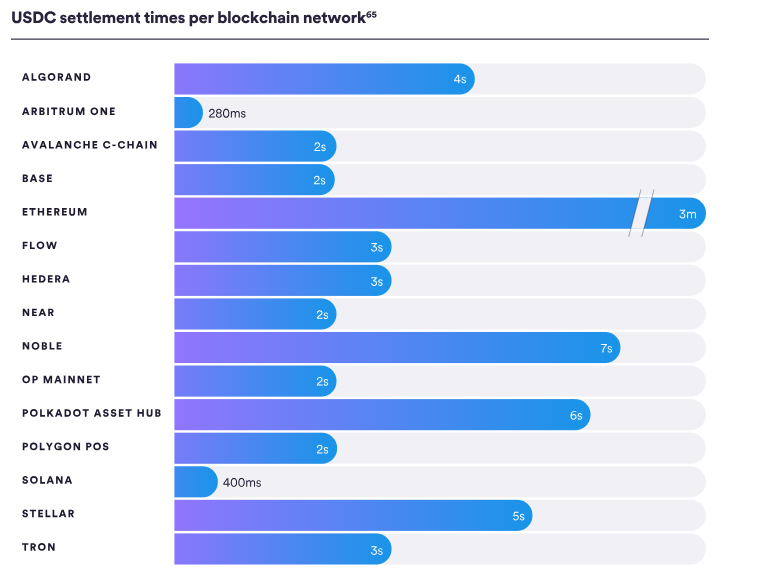

There’s only one problem with this: only one enterprise-grade blockchain exists, and Circle has largely ignored it. While it boasts that USDC is available on 15 blockchains, it fails to mention that it isn’t on the most scalable one that could help it complete its mission faster.

Indeed, issuing USDC on a true enterprise-grade blockchain with fees of 0.000003 on average would go a long way to helping the people Circle wants to empower. Yet, when

HandCash tried to facilitate USDC on the BSV blockchain, they pulled the plug at the last minute, costing a company with the potential to empower millions in the Philippines, Nigeria, and elsewhere of their valuable time and resources.

Circle either doesn’t realize or is omitting the fact that Web 3.0 will only work on a scalable public blockchain, and there’s only one option. Even Hedera’s hashgraph, often touted as a cutting-edge alternative that makes blockchain obsolete, can only do 10% of the transactions per second BSV can (100k TPS). Solana is closer at 65,000 TPS, but even the two combined don’t match BSV.

A multi-chain world is pointless and is a security risk

Throughout the Circle report, I encountered many claims about how it is available on so many blockchains, how its Cross-Chain Transfer Protocol (CCTP) has facilitated 66,500 transactions since its launch in April 2023, and how it aims to make USDC available on all blockchains with strong development cultures.

However, I heard no mention that having multiple blockchains is a pointless waste of time and a demonstrable security risk. Bridge hacks that cost tens of hundreds of millions are in the news every week, and all of the transparency the blockchain offers is lost when we introduce multiple ledgers.

I understand that Circle has to go where the users are today, but once again, it is either missing or obfuscating the bigger picture. Eventually, everything will end up on one blockchain, and it will be the most scalable one.

Throughout the report, Circle talks a lot about the internet and how it wants to make monetary transactions as easy as sending an email, but it fails to mention that the competing internet protocols all migrated onto one (TCP/IP) that underpins everything and the competing networks like NCP, DECnet, and X.25 all faded into irrelevance. It will be the same with blockchains.

Circle acknowledges that “fintech, traditional banking, stablecoins, and CBDCs all exist in some form or fashion, but remain disconnected.” It doesn’t make the leap that we’ll need one stable, scalable protocol that allows that level of interoperability for everything to be connected.

Making financial services as easy as a click

This sort of stuff gets me fired up, and I found myself nodding in agreement with what Circle said. I believe in the power of micropayments, digital wallets, and a peer-to-peer electronic cash system to empower the world’s poorest people.

Circle talks about several regions in its report —Latin America, Africa, and Asia Pacific among them. Once again, there seems to be a disconnect between what Circle wants to achieve and the technology it operates on.

For example, here’s a screenshot from a Statista report on monthly incomes in Asia-Pacific countries:

What’s the problem here? USDC’s primary home is the Ethereum blockchain, with fees per transaction currently sitting at $22.76 and over 160,000 pending transactions at the time of writing. This isn’t going to cut the mustard for this part of the world.

While USDC does work on Solana and Hedera, which offer much smaller fees, none of these ledgers scale to meet the required transaction throughput to make Circle’s vision a reality. In fact, all of them combined can’t process even a fraction of the required throughput to underpin a new digital financial system.

Regulations are starting to play a big role

Finally, the Circle report acknowledges that regulations in the EU and elsewhere are beginning to come through.

The report specifically mentions MiCA in the EU. What it doesn’t say is that MiCA requires compliance with AML/CTF rules and gives national and EU-level authorities supremacy when it comes to supervisory and enforcement powers.

Again, one scalable ledger with total transparency, true auditability, and the ability to freeze and recover assets will obviously win in a regulated world. And again, there’s only one blockchain even talking about these things, let alone making them a reality—Bitcoin SV.

The EU MiCA rules are a good insight into how things will likely go in the U.S. and elsewhere, albeit with some national variations and local flavors. Governments worldwide want to do business with the European Union, U.S., China, and other massive economic powers, so their rules must align.

Read the Circle report—it’s well worth it

Overall, I thoroughly enjoyed reading the Circle USDC report. I agreed with much of what was written about what the mission is and the direction things are headed. Still, I couldn’t help but notice that Circle is omitting the important truth about one scalable blockchain being needed to bring all of this to fruition. A multi-chain world is one of the many blockchain myths that must be dispelled.

Go ahead and read the Circle USDC report. I’d love to hear your thoughts over on X, and don’t forget to subscribe to CoinGeek for more content like this!

Watch: Bitcoin15–Bitcoin’s Birthday and the future of scaling on Bitcoin

Recommended for you

The views expressed in this article are those of the author and do not necessarily reflect the position of CoinGeek.

03-05-2026

03-05-2026