|

Getting your Trinity Audio player ready...

|

In the world of economics, nothing is more talked about, debated over, bounced around, criticized for, yet utterly important, than the risk-free interest rate. It goes by different names, (prime rate, FedFunds, LIBOR, HIBOR…), depending on your country, but it is essentially the minimal rate that you can earn with minimal risk, just by locking up your funds for a term. This interest rate is normally essentially risk free, because it is backed by your central bank, by mandate of your government, and thus as long as you are not planning for the apocalypse, you can be sure that your funds can safely earn interest at this rate.

Now, to be clear, no individual can themselves enjoy the use of this rate, as it is partly just a target (in the case of Fedfunds) or an inter-bank rate (in the case of the -IBORs), but through a trickle down effect, what this rate is will affect the prevailing interest rate that you experience at your local retail or commercial bank (which is itself pretty risk free, though not as risk free as the prime rate).

Needless to say, this single metric is one of the primary controls that central banks have at their disposal in order to manage the economy of a country, and by extension (especially in the case of USD) the global economy, though that is a balancing act of politics and economics beyond the scope of this article and this poor author. The need for a central bank to manage the economy of a country will be an assumed given here. Later articles I may entertain the cursory discussions of an economy that is completely unmanaged (I’m sure sound money activists would love that) but that is too much of a nut to crack here, and will only serve to detract. For now, let’s just take as a given that the need to manage a national economy is at least in principle a worthwhile, and honourable endeavour. Besides, it isn’t that hard to imagine that we would need some sort of stimulus to dissuade too many reclusive Elon Musk-level billionaires from just hoarding their wealth, and burying it in the ground somewhere, or worse, converting it all to gold, and then sinking it into the Marianas Trench.

That stimulus tool against excessive hoarding of wealth is called inflation, and it is done by allowing banks to create debt and money (in equal parts) to the public (presumably the part of the population that is suffering the most during poor economic times). The incentive for banks to do this is controlled for the most part by the prime rate. After all, if banks cannot simply park their reserves and earn lazy interest on it, then they will be forced to seek out those who will want to take loans more aggressively to earn interest from them. Appropriately, those that take loans will demand lower interest rates for doing so, as the prime rate drives all interest rates and thus, the collective risk appetite in the economy. The only problem is that the prime rate and interest rate control is losing its efficacy, due to most people putting their excess capital into the stock market, or worse cryptocurrencies. Such that it is no longer as useful a tool as it used to be. Coupled with that the corruptibility of our bankers, and you soon see that the system could use a bit of patching.

Okay, 512 words in, and you are probably wondering what this has to do with Bitcoin, as you should. Well, it turns out that along with all the technical breakthroughs that Bitcoin (BSV) has enabled, the economic innovation of using a self-incentivized Proof-of-Work system to reward infrastructure providers via transaction fees, is actually a brilliant, self-tuning economic “anchor/gauge/regulator.”

Think about it. You cannot cheat proof-of-work. There is NO useful side product of the work, which means your reward is purely representational of the transactional volume (fees) revenue capacity in the network which is a proxy for economic activity. What does this sound like to you?

Likely nothing, I know. But to an economist, this is the sound of “Eureka!” Because it sounds almost like a self-adjusting limiter, a feedback control circuit in a power grid, a governor in steam engine, a carburator[1] in your car. The exact tool that central banks would love to get their hands on. After all, it isn’t that direct control over interest rates couldn’t be a solution in theory—the problem is just that in practice politics, nepotism, corruption, or the foul mood that bad eggs put over our Governor of the Fed that morning always gets in the way. It is easy to play the hero, and lowering rates to ‘save the economy’ doesn’t take much bravery, but few heads of central banks have the needed chutzpah to be able to ‘do what is needed’ to hike rates up when things seem to be going so good. Thus, an auto-governing system would seem to be exactly the thing we all need like that personal trainer at the gym who is just paid to scream at you while you do all the work. Something we can rely upon to do the hard job when our soft policy makers fail to step up to the task.

The other aspect of proof of work is its fairness. It is arguably the fairest measuring stick for value we humans have ever invented. Think about it, besides possession of gold, what other form of value measurement has had the ability to be so unilaterally global, fair, measurable, and unfalsifiable? A hash is a hash. You may have different costs to produce a hash, inherent to your business or political environment, but the hash is the same, and can be used just the same anywhere in the world. I would say, that besides crude oil, coal, natgas, gold, silver (and maybe rice?), we don’t have any other universally recognized measure of value. If we wanted to go any more general, we would have to measure in watts (which is after all what the energy assets are a proxy of).

Unfortunately, physics dictate that raw power isn’t terribly easy to transport, and even harder to store. That is why historically, we have relied on gold (thank you Sir Isaac Newton for inventing the gold standard of money! Utter Brilliance! …oh, and that calculus thing you invented was pretty cool too.)

Imagine an economic system and stable coin that based its value on proof of work? Which is, according to the economic model of BSV, a proxy to the amount of economic activity in the system. (Quite contrary to how copycat PoW coins like BTC do it, in BSV you only need as much PoW commensurate to the amount of transaction fees being paid by economic activity in the network. Nothing more.

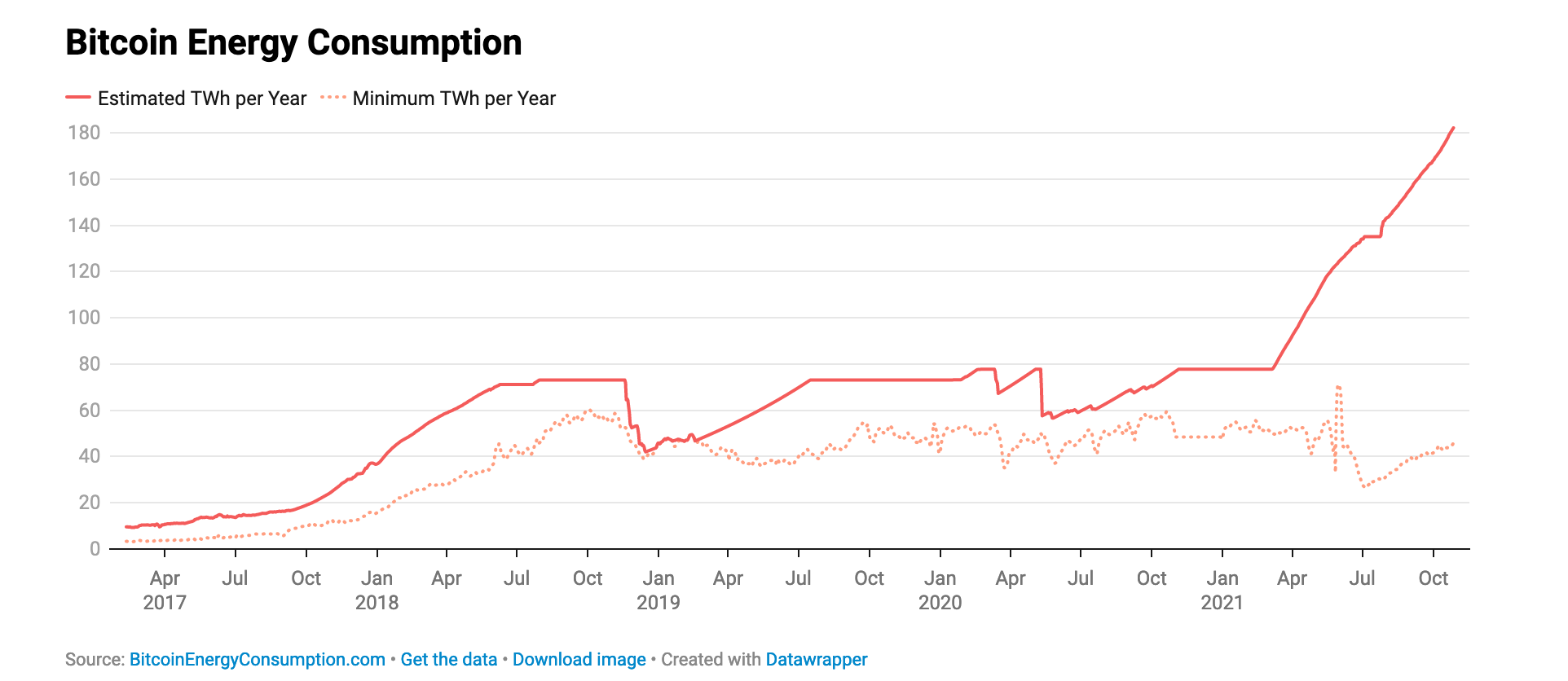

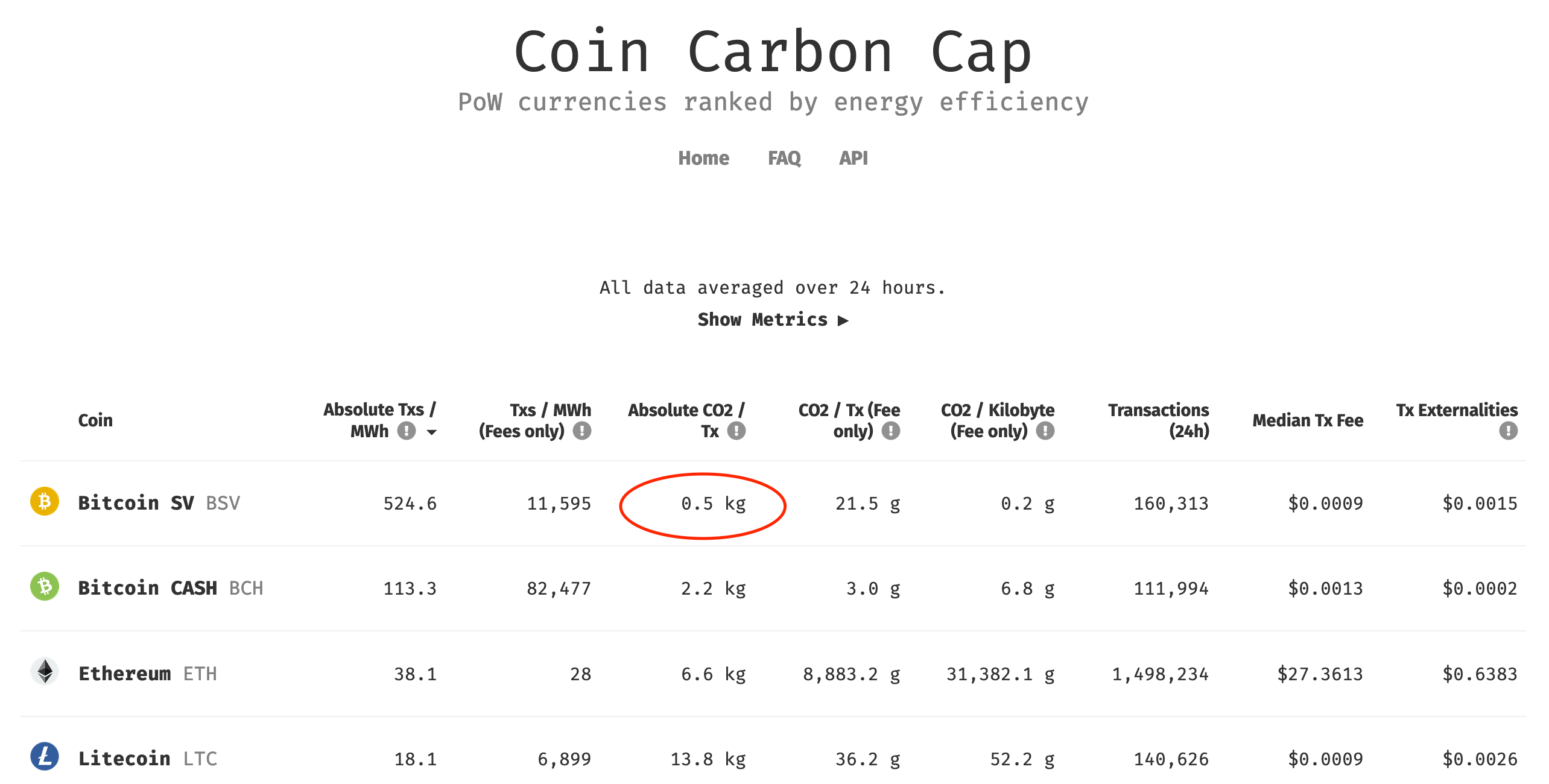

While BTC energy efficiency is getting worse and worse, (current stats show it consuming as much energy as Thailand) BSV uses only a tiny fraction of that. More importantly BSV energy use seems quite correlated with the amount of real economic activity on the blockchain, and does not seem to be affected by price speculation. Why? Because there is no need to compete to generate the most blocks, when 1 block can be of unlimited size. That is the key economic difference in BSV. Miners make money from fees and not just block rewards. In the long run, BTC miners will eventually move to mining BSV, or just shutdown, because after block rewards disappear in BTC, there will be no further desire to keep all those GWh burning farms hashing away creating 1MB blocks. The fees from transactions simply won’t be sufficient to support this extravagance.

BTC in comparison, is about 1,000x worse… about 860kg of CO2 per txn according to this study. And that is only going to get worse as BTC price appreciates.

The more you think about this, the more it makes sense. If we had a totally green[3], low carbon footprint system that could regulate the economy, by adjusting the risk-free interest rate to control lending and spending appetite (which is the counter-balance to economic exuberance), de-coupled from politics and corruptible central bankers, wouldn’t that be worth looking into?

I think it is, and I think some people[4] are already looking into it. Needless to say, once you have an honest, neutral, fair, and global system like BSV out there, smart honest people will think of brilliant ways in which to make society better. Just like good ol’ Sir Isaac.

Jerry Chan – October 2021

***

Notes:

[1] I do realize that I’m dating myself as most of you young’ins likely had to check Wikipedia for that term. Back in the good old days engine control systems were ANALOG. No fancy schmancy fuel injection gizmos or ECU chips that can fail. (Or take over your car)

[2] Coin Carbon Cap — https://coincarboncap.com/

[3] BSV as a Green Technology — https://unboundedcapital.com/green-bitcoin

[4] Cambridge Cryptographic — https://www.cambridgecryptographic.com/

02-25-2026

02-25-2026