|

Getting your Trinity Audio player ready...

|

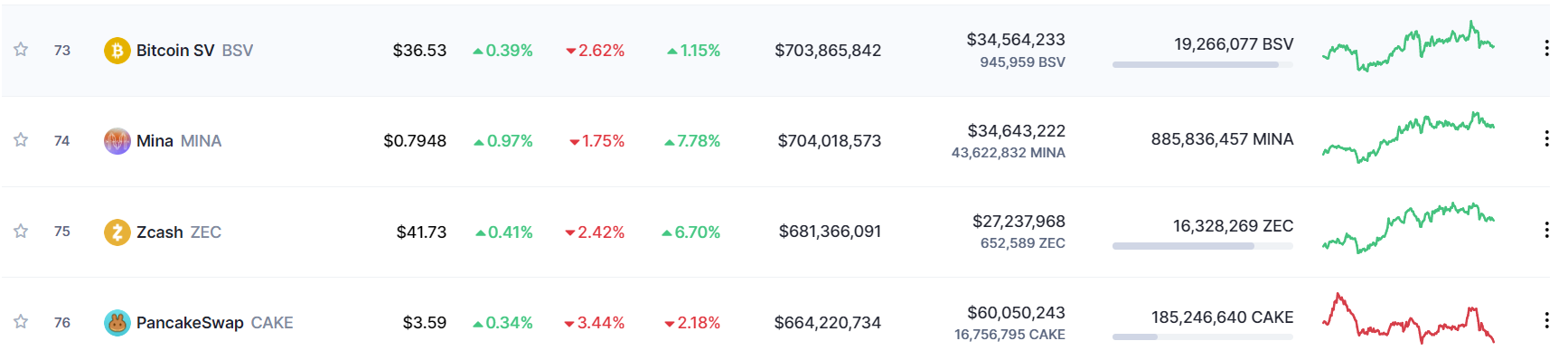

Bitcoin SV (BSV) continues to lose market price share against other digital currencies in 2023. Nearly five years after exchanges created the ticker symbol, BSV continues to make new lows against BTC, nearly worth 1/1000th of what most call “Bitcoin.” BSV has also dropped in rank, down to the 70s on CoinMarketCap, next to reputable and serious coins like MINA and CAKE.

The maligned chain still processes millions of transactions per day, but clearly, this is not leading to any appreciation in the coin price, which indicates that the nature of these is not actual exchanges for goods and services, but applications simply flexing by putting data on-chain, just because. If anything, the more of these types of transactions that get put on-chain seems to correlate to lower demand and, consequently, lower coin prices.

Of course, contrarians to these facts will point out that “BSV is not crypto” and that “enterprise adoption is coming soon.” These tired lines have been repeated seemingly even louder and more frequently as more developers jump ship to other chains or quit altogether while bold claims, promises, and partnerships are perpetually imminent.

Colloquially, this view would be labeled as cope, as BSV businesses continue to fail, and the much-maligned blockchain only has two consistent miners on a given day. The reality is that this is the greatest problem in the BSV space, yet seemingly nothing is being done about it.

Only two miners exist because there is not enough incentive to commit sustained hash power compared to rivals BCH and BTC. Additionally, there is not enough transaction volume despite the millions being broadcast to the network daily to amount to enough fee income. Therefore, something’s got to give, as the definition of trying the same things repeatedly with a different result is insanity.

Community members and leaders need to realize that the current strategy (whatever it is) is not effective. The community has witnessed two long-term companies leveraging BSV, RelayX, and Twetch’s teams move over to build on BTC to earn more profit by taking advantage of the Ordinals craze ongoing since January 2023.

In response, BSV, following other UTXO blockchains such as Doge and Litecoin, adopted their own version, known as 1 Sat Ordinals. While this has been a spark, nearly 30 days after the fair launch, BSV still does not have a public collection minter nor marketplace to take full advantage of these new on-chain assets. This fact demonstrates that the manpower simply is not present to incentivize the development of these features at such a pace to be able to compete with other blockchains.

The cratering BSV/BTC ratio reflects this harsh reality.

However, despite this bleak perspective, the fact that is still ever-present is the inability of any blockchain other than BSV to reasonably handle the burden of demand to onboard the global economy. For example, in my previous article, I wrote a quote that BTC isn’t for those living on $2 a day, and neither are Ordinals. Meanwhile, those same Ordinals, with more robust functionality, can be created very cheaply on BSV. Enabling creators worldwide to get involved, not just the wealthy or those who got in early, is how we prove that we are not wrong.

How is this achieved?

Get BSV in as many hands of those in second and third world countries as possible. Using already developed tools like Pay Pistol, we can easily distribute coins for little cost. Second, allow them to mint and create assets for free or nearly free. Third, provide a marketplace for these near zero-cost assets so that virtually only making a profit is possible. This is only possible on BSV, and we need to start showing, not telling.

Watch: Crypto regulation will make life easier for BSV

03-11-2026

03-11-2026