|

Getting your Trinity Audio player ready...

|

Bitcoin smart contracting platform sCrypt released a blog and implementation of token limit orders directly using Bitcoin script. An evolution of the on-chain Order Lock technology, which allows purchases of tokens and NFTs directly on-chain without an intermediary, greatly enhances the feature for fungible tokens. On exchanges such as Firesat.io and RelayX with (BSV-20 and RUN tokens, respectively) users can only buy and sell the full amounts of a token order without partial fills. In fact, the Partially Signed Bitcoin Transactions (PSBT) method used on BRC-20 tokens on BTC has the same issue. This limits the potential liquidity, as sellers must find a buyer not only willing to buy at their exact price, but the exact number of tokens as well.

On-chain Limit Orders, no exchange needed https://t.co/QRce9uBVZu

— sCrypt Official | OP_CAT 🐱 (@scryptplatform) November 18, 2023

For example, if I want to sell 1,000 1sat BSV20 tokens at a price of 500,000 satoshis each, then I must find a buyer willing to pay 5 BSV for exactly 1,000 tokens. With the existing Order Lock script, buyers cannot only buy 100 of the 1,000 token orders for the listing price. With the new sCrypt innovation, limit orders are now possible. Combine this functionality with BSV’s scale and one satoshi fee, and the potential is limitless.

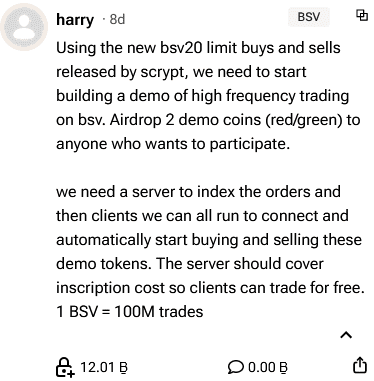

Prolific Twetch and Ordinals Wallet developer Harry theorized leveraging this feature to build high-frequency trading on the BSV blockchain. As he mentions, the exchange should take the burden of the fees so the users can trade for free. In fact, the low fees can be leveraged further to allow new users to deploy, mint, and list new tokens for free, as well as solve the onboarding issue.

BSV blockchain users were quite interested in participating, as they took a community initiative to deploy RED and BLUE BSV-20 tokens, which took less than 12 hours to mint.

Such a paradigm is a stark contrast to the ongoing clogging of the BTC chain with BRC-20 trading, down to 50 satoshis per byte of data as of writing from 200 satoshis per byte earlier in November 2023.

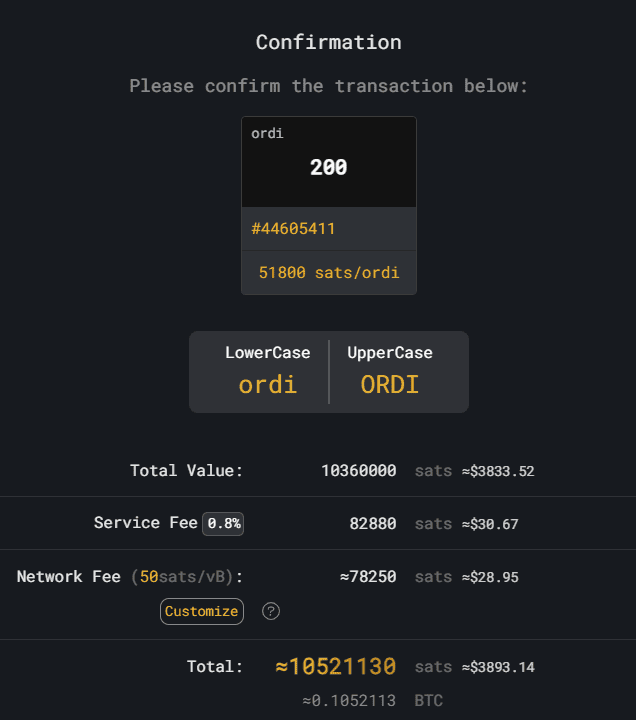

For example, on the popular BRC-20 Ordinals exchange Unisat, I have the option to purchase 200 ordi for 51,800 BTC satoshis each. The network fee is an additional 78,250 satoshis each ($29) just to execute a single trade. The high fees and inability to execute partial fills of the order severely limit the potential liquidity, which is why some users prefer centralized exchanges for BRC-20 tokens, such as Binance or Gate.io. However, as we have witnessed on many occasions, the risk of using these custodial exchanges is 100%, as they require deposits and withdrawals to take possession of your on-chain assets.

Now, Bitcoin itself can be the exchange. With zero risk of losing funds due to the exchange, instant settlement, and virtually zero fees, this system can onboard the entire planet. As centralized exchanges face more regulatory risk, users still need a platform trade. Clearly, the demand exists as these users tolerate BTC’s clunky, high-fee user experience due to its liquid on-chain market. Just because exchanges such as Binance or Kraken may be impaired or even shut down does not mean the demand will disappear. Ironically, Bitcoin, as originally designed, which started this entire industry in the first place, is the solution.

Watch: Consumer protection tops BlockQuake exchange list of priorities

09-08-2025

09-08-2025