|

Getting your Trinity Audio player ready...

|

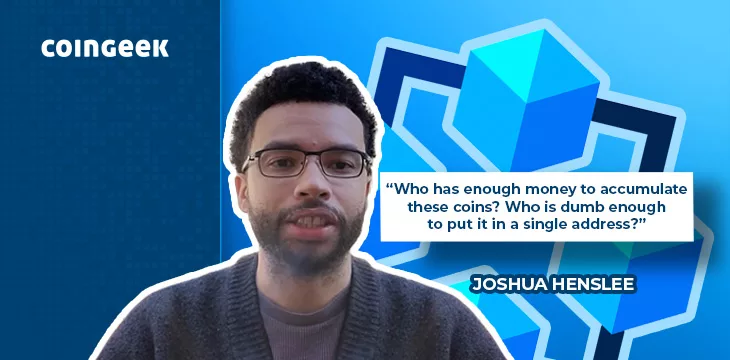

Bitcoin thought leader and developer Joshua Henslee released another intriguing video this week asking whether the BlackRock ETF could be a Bitcoin basket holding BSV, BCH, BTC, and eCash. He highlighted some activity that might indicate this is so.

Is BlackRock buying all Bitcoin forks?

Henslee kicks things off by asking the central question in the video: could the BlackRock Bitcoin spot ETF be a basket or index including all forks? While he is skeptical, he says the theory is based on a few indicators, and he’s going to outline them in this video.

First, there’s the BlackRock ETF documentation itself. The financial giant said it reserved the right to decide what Bitcoin is. More on this later.

Next, there’s the massive accumulation of BSV, BCH, and eCash that Henslee has observed in recent weeks. He points out that someone recently purchased more than 1.5 million BSV coins. They began accumulating in early January and storing the coins in one address. Another address has accumulated more than 1.3 million BCH, and another has accumulated lots of eCash.

Who would do such a thing? Perhaps an entity with deep pockets that wants to easily verify that its ETF is backed by real coins by pointing to a single address. Of course, this is mere speculation, but it does make logical sense. The same answer goes for who or what would have the money to buy this many coins in such a short period of time.

Why would anyone buy all the main Bitcoin forks? It’s possibly a risk management strategy. In paperwork related to its Bitcoin spot ETF application, BlackRock said it reserves the right to decide what Bitcoin is. Holding all forks eliminates the risk and means it will get any future splits, too.

Henslee says many more people need to be informed about the different forks and that Bitcoin didn’t originally have a block size limit. They need to understand its true capabilities. A huge fund buying all forks could ignite interest in them again, although the BTC maximalists would no doubt be mad.

While we don’t know who is buying and can only speculate, the market has clearly understood something, and someone is hedging their bets. It’s either BlackRock or another large entity. Henslee believes it’s highly likely to be the same entity since huge quantities of all forks are being bought up and stored in single wallets.

What does this mean for BSV blockchain and in general?

Henslee highlights how BSV is 700:1 to BTC and 6:1 to BCH at the time of his video. These ratios are deeply screwed up, and they would get normalized very quickly if a big name like BlackRock bought BSV in such large quantities. He could see the ratio against BTC being corrected to 70:1 or even 20:1 in an optimistic scenario.

He also points out that BSVers are not likely to go back and buy BTC and BCH, but holders of those tokens might take a second look at BSV. They’re already rich, so why not buy BSV if BlackRock is?

Henslee will be watching to see if these addresses keep accumulating. He says they have purchased tens of thousands more coins on the day he made the video alone. Other big addresses are accumulating, too.

Again, while we can only speculate about who this is, it makes sense for a company like BlackRock to derisk its position by hoovering up BSV, BCH, and eCash on the cheap. To have 1:1 matches against BTC would be a chump change for a massive financial entity like this.

Rundown of this Joshua Henslee video

- Someone is buying huge quantities of BSV, BCH, and eCash. These coins are stacked in one wallet on each chain.

- Henslee speculates that it could be BlackRock. He can’t prove this, of course, but he believes it would make sense for them to derisk their BTC portfolio.

- He correctly says the buyer must be someone with deep pockets hedging their bets. Why else would anyone bother to buy these tokens unless they think there’s some risk that BTC isn’t the real deal?

- He’ll keep an eye on the wallets and the buying activity and keep his viewers informed on anything significant.

CoinGeek Conversations with Yves Mersch: Digital currency regulation and the role of BSV blockchain

07-16-2025

07-16-2025