|

Getting your Trinity Audio player ready...

|

The Motley Fool is a paid newsletter founded in 1993 for the purpose of picking stocks for long term value. As of this article’s publication, the Better Business Bureau ranks the clown-themed newsletter at 2.49 out of 5 stars among reviewers. Not exactly glowing!

Recently, Foolish staff writer Anders Bylund published an article called 1 Cryptocurrency to Avoid No Matter What as a hit-piece against BSV. He covered the typical fare of a baseline criticism of BSV while lionizing BTC’s absurd, circuitous governance and calling the losses and coup d’etats “updates” while stating that BSV is a poor implementation of an “outdated design” of bitcoin.

To his credit, Bylund does acknowledge the communist-inspired, Hegelian governance model by the developer intelligentsia when he says, “…the developer community hasn’t always agreed on the best way forward, so what we call ‘Bitcoin’ today is [just] the largest and most widely accepted version of a code tree with several branches.”

Side Note: Imagine thinking a hard money system could be changed by a few devs and selection of a branch as if it’s up to the opinions of anyone to chaotically define and redefine bitcoin.

Some numbers

Bitcoin did indeed go through a brutal civil war, and three chains emerged out of consensus on the SHA256 hashing algorithm with varying claims to the bitcoin name. Bylund uses words like “dangerous” “older technology” and states that BTC transactions are “faster and safer” than BSV.

But is this true?

Due to the “Replace by Fee” or “RBF” change to BTC, transactions are not considered finalized until they are buried under six blocks which takes roughly one hour. In contrast, BSV transactions are considered safe as soon as they are accepted into the mempool of an honest node like GorillaPool or TAAL. That takes about two seconds.

Since 2009, BTC has had a total of about 900 million transactions, and BSV blockchain has nearly 3 billion.

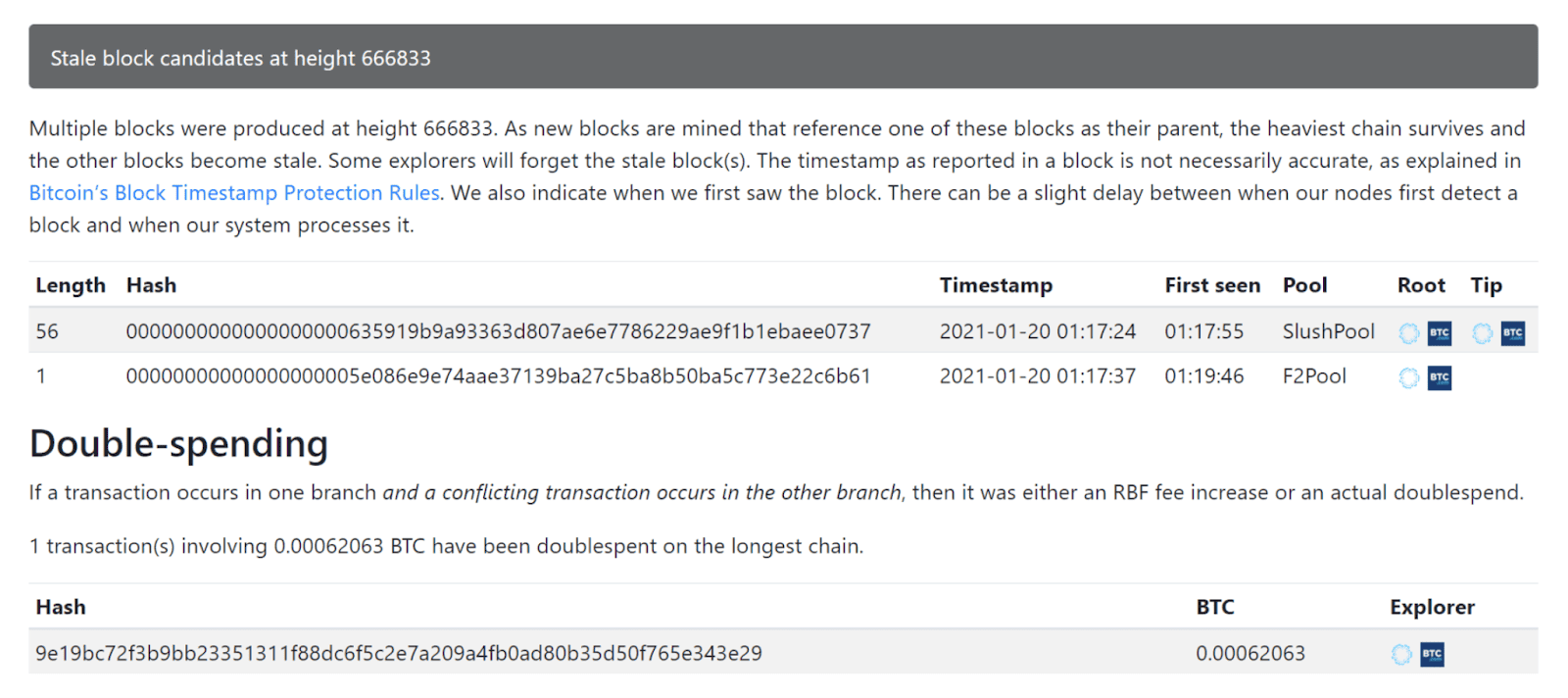

While media reports that BSV can and has been double-spent and is therefore unsafe in the last several years, nobody has provided any cryptographic evidence—calling into question the validity of their accusations. Meanwhile, BTC did have a $21 double spend on January 21, 2021 (that’s a lot of magic numbers, huh?) at block height 666,833 when Slush Pool included coins that had already been spent and then later orphaned F2Pool’s block.

The hashes are public, so anyone can confirm.

So, we have established that BSV has experienced many more secure transactions than BTC, and that the likelihood of security is objectively better than on BTC, but how much faster is it?

Well, BTC is good for (on a typical day) 3-5 transactions per second. Somewhere between 5-7 transactions per second, the average transaction fee starts to rise into the territory of several dollars per transaction. In some cases, $25-$50 per transaction, waiting for days in the mempool, and then an hour of blocks before full confirmation, which makes BTC slower, more expensive and more difficult to use than Western Union.

BSV, on the other hand, has a typical transaction volume of a few hundred transactions per second, with peaks around 30,000 transactions per second and no known limits. Test environments show numbers over a million transactions per second. As volume goes up, so does efficiency, and fees never approach a penny. In fact, they average between 1/10,000th and 1/5,000th of a penny regardless of scale volume.

So where did Bylund get his data that BTC is faster, safer, more reliable or anything else?

Anything else?

Well, Bylund also speaks about BSV as a sort of rejection of modernity. On top of speed, BSV blockchain (the most original Bitcoin protocol) is also capable of general purpose computation, more computations per transaction and a whole bunch more. While BTC languishes with an inability in 2023 to process transactions that it could have processed in 2013, the BSV blockchain has a restoration of Bitcoin’s open and “set in stone” nature.

BSV can do native smart contracts, BTC can’t. BTC uses “Stax” and other 3rd parties

BSV can do native tokens, BTC can’t. BTC uses Taproot and Segwit hacks to use Ordinals.

BSV can do native micropayments, BTC can’t. BTC uses an entirely separate centralized network called “Lightning.”

So, Anders Bylund can say what he wants about BSV’s rejection of modernity, but the type of modernity that BTC embraces is regressive, punitive and suffers from bad user experience from unpredictable fees, payment speeds and features.

Maybe, when something is good, we should just leave it be! Only a fool would break something and call it progress.

CoinGeek Weekly Livestream with Craig Mason: Bitcoin transactions at scale are cheaper

12-27-2025

12-27-2025