|

Getting your Trinity Audio player ready...

|

How a buyer feels after purchasing an NFT is likely correlated with its secondary market price and if they can profit. If a buyer bought at the initial sale price or on the secondary market, and the floor price of the NFT collection dropped below that, they likely have a negative feeling. What if this conundrum could just go away?

“Free” or “fair” mint is a concept executed in the digital currency space where users of various blockchains mint an NFT for only the mining costs of the transaction; the creator earns no profit from this action. The key is that the creator must mint with everyone else or reserve a portion of the collection for themselves. The former is much fairer than the second, and it is no coincidence that it is conceptually akin to how Satoshi Nakamoto launched Bitcoin. Satoshi provably had to mine with everyone else.

It is also no coincidence that free mint projects on Ordinals have the highest floor prices, as this concept strongly resonates with “crypto” users. Bitcoin Frogs was a generative art collection launched on BTC where users minted via the Lightning Network, paying only the transaction fee. This collection now has a floor price of 0.038 BTC ($1,140) on ordswap as of writing. Assuming the transaction fee was $1 or less, this is a 1,000x return in just a few months.

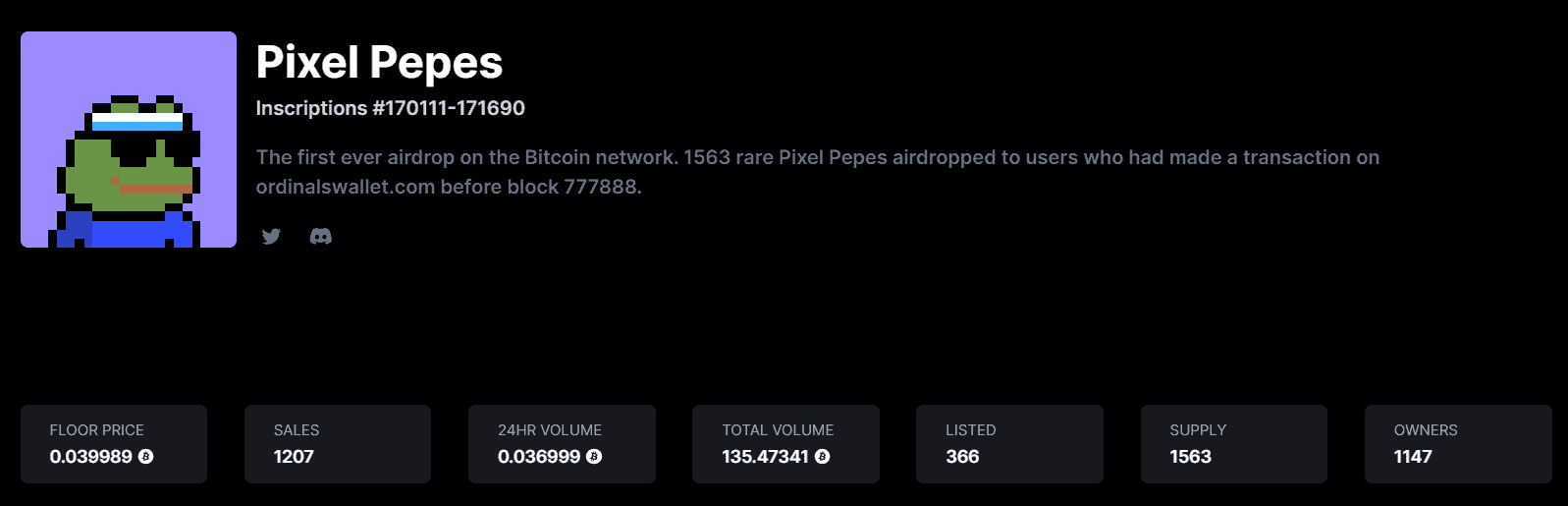

Another method to execute a free mint is an airdrop for certain actions taken. However, this is also a bit less fair than the pure free mint approach since the executors of the airdrop know the conditions beforehand. Pixel Pepes were airdropped to all Ordinals Wallet users who made a transaction before BTC block 777888.

This near-zero cost basis NFT now has a floor price of 0.039 BTC ($1,200) as of writing. For the users, this is a near-risk free opportunity that eliminates the trepidation of purchasing NFTs. The cost is the creator taking the risk of earning no revenue upfront for their product in exchange for organic community adoption that could potentially establish high floor prices.

Furthermore, the community becomes your marketers instead of the creator having to do so themselves. Of course, if no users mint, then the time spent on creation is wasted, but at least the creator receives that feedback quickly before putting more effort into a failed project.

Other assets on BTC (ordi, bitmap) and ETH (Loot), for example, were also free, open mints of fungible tokens, metaverse land, and digital items, respectively. Each asset is worth much higher than its transaction fee cost, to magnitudes ranging from 10x to 1,000x.

The “free” mint may not be so free, depending on the time and day. Since fee markets are programmed into BTC and ETH, if a collection is desirable (or the blockchain is congested that day for whatever reason), fees could spike during the mint, making the mint not so fair at all, turning it more into an auction. What if minting and transaction fees were predictable and so cheap that the creators or platforms make the mints truly free?

If only that was possible.

Watch CoinGeek Roundtable: 1Sat Ordinals on Bitcoin

08-20-2025

08-20-2025