|

Getting your Trinity Audio player ready...

|

A mainstream news article on Dr. Craig S. Wright has been making the rounds, but how many people actually read it? Forbes contributor Michael del Castillo wrote a detailed piece titled “Satoshi or not, here he comes,” exploring the topic of technologies Dr. Wright has invented over the years and how licensing them could become a serious issue in the blockchain industry.

Most of the reactions to Forbes’ tweet about the article were either in opposition to or in support of Dr. Wright. This is despite the fact that the article itself claims this is less relevant than Wright’s possession of a vast IP library related to blockchain functionality.

Whether you believe Dr. Wright was Satoshi Nakamoto or not, even whether he actually is Satoshi Nakamoto or not, is beside the point here. He and his companies own all patents granted to them, and this fact is not in dispute.

Now we’ve got that out of the way…

The reason the argument got derailed so quickly is probably due more to Forbes’ publishing policies than the content of Del Castillo’s article. As some pointed out, the piece sits behind a “paywall,” meaning anyone who wants to read the article must have a paid subscription to Forbes to read it.

Both Forbes and Del Castillo have tweeted a link to the story multiple times, each tweet generating hundreds of likes and retweets. This engagement most likely does not correspond to actual article views, assuming that most regular Twitter account holders are not also Forbes subscribers.

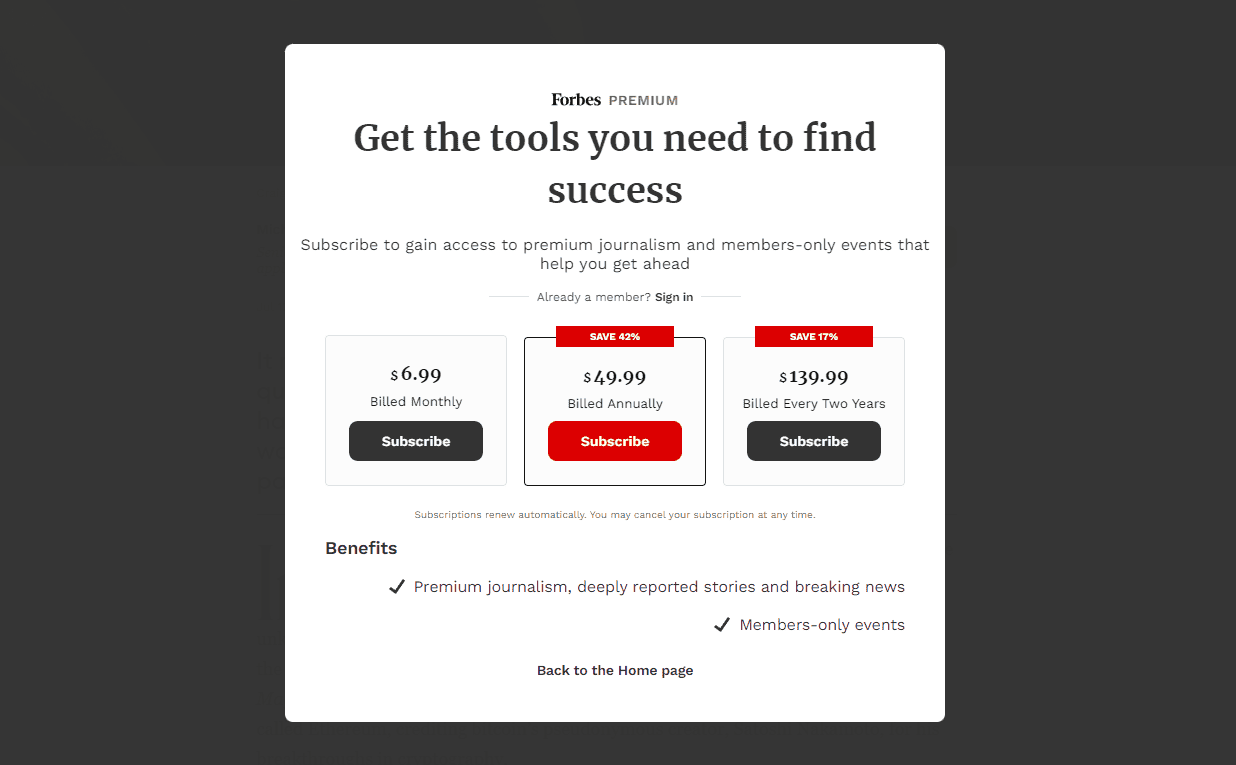

Click on the article link, and you’ll get a brief flash of the story, which is immediately covered by this pop-up screen:

So if you’re interested enough to read the piece, the bare minimum you’d pay is US$6.99 for the “monthly” option, which you could cancel after paying. You’d be able to read all Forbes content for a month if you like it.

Paywalls and subscription-only content have become more widespread on the web in recent years, if not the norm. This has put a huge restriction on casual content consumption because most article views (especially those coming from social media) will be one-time readers who just want to see what the fuss is about on that particular topic. But there’s no option for that. It’s a monthly/annual paid subscription or nothing. There’s no “a la carte” or per-article viewing option.

Can I just pay 5c to read this article? ( just like Satoshi intended ) TY

— Salvation is at Hand! (@ronaldo_hommel) July 12, 2023

(And yes, we do realize that the article is somewhat viewable via archived links or copy-paste locations—but the legality of these is questionable, and if it becomes a significant problem for publishers, they’ll find a way to limit these links as well.)

Marquee financial publishing brands like Forbes and Fortune have long adopted the strictest policies on paid content, subscription-only material, and ad-blocker bans. The reasoning is that (a) people who follow this kind of news tend to be wealthier than most news readers; and (b) many potential investors find the information in these publications useful, and may profit from them, so it’s worth paying for.

However, the subscription trend has extended to all kinds of news—click on a link to a local news story from a city on the other side of the world, and these days you’ll often be confronted with the same kind of pay/subscription wall. This repels nearly all potential readers instantly, as most people will not have enough interest in that location to bother subscribing.

Why would they do this, given that more article views would increase a site’s ranking, making it more valuable to advertisers? After all, isn’t that what pays for “free” content?

Maybe not so much. The 2022 IAB Internet Advertising Revenue Report noted a 10.8% growth in internet advertising revenues that year, but also added that it had slowed somewhat from previous years.

In February 2023, ModernRetail published a far less optimistic view of the market, with a piece titled “The digital ad market is in a slump.” Online advertising giants like Google (NASDAQ: GOOGL), Meta (NASDAQ: META), and Amazon (NASDAQ: AMZN) have all witnessed multi-billion-dollar declines in advertising income. Justifications for this drop included usual suspects like “the uncertain and volatile macroeconomic landscape” and “the pandemic.”

However, there’s also been a general feeling among large publishers and those paying for advertisements themselves that internet advertising doesn’t hit like it used to. A larger percentage of revenues flows to the “giants” mentioned above and less to the publications themselves. Companies are still paying for ads, but they often complain the results are less effective. The web is now saturated with banner ads, and readers, who’ve tired of their presence and are irritated by their intrusiveness, don’t click on them to the same extent they once did. The pie may still be growing, but everyone is getting a smaller piece.

The industry is by no means dead, but it may be saturated.

Then there are the privacy concerns: in order to squeeze more money out of advertising, site hosts will hoover up as much information about their readers as possible to mine data they can provide to ad companies. This comes in the form of questionnaires, purchase orders that seek to know everything about you, your career status, and your life, and “invisible” data collectors like cookies that track your online viewing—even after you’ve left the site you first landed on.

Many viewers have installed ad-blocker and cookie-blocker extensions on their browsers, but even these aren’t as effective as they used to be. Sites nowadays will often block access to content altogether if they detect these extensions are present.

All this has led to more “creative” and deceptive advertising practices, like publishing unmarked “advertorial” content that appears to be news (but isn’t) or secretly paying popular “influencers” to pretend to endorse certain products. This is illegal in several countries, but is near-impossible to stop given the volumes and frequency.

What if there was a better way to pay for content online?

There is a better way. There was always meant to be a better way, too. The HTTP 402 status code, aka “Payment Required,” has been included in the HTTP protocol since version 1.0 in the mid-1990s, but is rarely, if ever, seen. This suggests those who designed the web always intended for it to have a mechanism for easy payments.

However, “easy payments” and the WWW have never been a good match. The main solution so far has been credit/debit cards, which come with fees and inefficiencies. It’s not economical to charge readers a few cents, or even a single dollar, to read one article this way. Those who do charge small amounts tend to bundle payments over a month. This means cards aren’t charged immediately, and those receiving the payments don’t see any money for a while. Accepting credit cards is also expensive and inconvenient for smaller sites and content creators.

With all of that out of the way, we can move on to the reasons why the BSV Blockchain should be the solution to all these problems related to online content consumption, paying authors/creators, advertising, and internet payments in general. It feels almost cliched to bring it up since Bitcoin has promised to fix online payments for almost as long as it has existed.

I can't read the article. I think it is the best time that @Forbes use micropayment of #BSV to read some article.

— stephen dela meer (@StephenDelaMeer) July 13, 2023

The problem is BTC became bogged down in the same issues as credit cards. Transactions on BTC have high fees and are slow due to the network’s self-imposed 1-4MB transaction block limits and its unrealistic, network-wide, five transactions per second. BTC promised a lot it didn’t deliver, and only when the BSV blockchain restored Bitcoin’s original protocol did the promise return.

BSV blockchain can process millions, potentially billions and even trillions, of transactions per second. Its fees remain at a small fraction of a U.S. cent. What does this mean? It means any site, large or small, can charge for a single view. That single view could cost a reader $1 or a few cents…possibly even less. The market will find the most appropriate price for such micropayments over time, but it would have to be something that encourages casual and one-off readership of articles, as well as subscriptions.

Publishers (like gyms and cable TV companies) tend to prefer recurring subscription models over a-la-carte, even if consumers don’t. But BSV blockchain allows for this as well. Paywalls, if publishers prefer them, could still exist, but they could have options other than per month or year. Readers could pay for a single article, more than 5-10 articles, or another price for a longer subscription.

Really, it’s all about providing options to your consumers. Paywalls and subscriptions, as they currently exist, impose severe restrictions on readers accessing content. This is disadvantageous to users who close the window and comment on headlines instead, creators who’d prefer to have their work shared as widely as possible, and publishers who don’t make any money at all from non-subscribers.

Also, with BSV blockchain, there’s no need to bundle payments. Those receiving income from content can get their payments in real-time. For smaller creators, this means money in their pocket right away, not at the end of each month.

Paywalls and advertising weren’t supposed to be how the internet economy worked, and with BSV blockchain technology available right now, there should be other, more efficient options. Micropayments are the answer and in time, everyone will likely find them to be the best answer.

Oh, and by the way, there’s one more reason to use BSV blockchain micropayments over any other option: Dr. Wright’s company nChain holds patents covering micropayment technology. That nugget of information was also in the Forbes article, which most readers and Twitter commentators probably never saw.

Watch: Peer-to-peer electronic cash system—that’s micropayments

07-19-2025

07-19-2025