|

Getting your Trinity Audio player ready...

|

Equity analyst John Pitts spent a lot of time thinking and writing about Bitcoin SV as a computational commodity. Pitts even hinted that we probably barter with BSV—as when we spend BSV sats, we actually exchange the BSV commodity for a good or service.

Why is that important? We might not be able to predict the price of BSV in an upwards direction. However, if we take BSV as a commodity seriously, then “zero” should be highly unlikely.

BSV price could be anything, even extremely lower than today

Is there any commodity with a price of 0? I do not think so. It would make no sense. Depending on what definition of a commodity we use, a commodity is understood as a standardized good—and a good is a good because market participants demand it, or else it would be simply matter somewhere in the universe.

I already said that I assume the price of BSV is not manipulated. We are probably seeing the “real price” of 1 BSV right now—as a commodity. At this point in time, the users do not need many BSVs to enter the new informational economy.

But they need some BSV sats. Listen, they need BSV sats to enter the BSV blockchain space as an end user. What happens when more people enter who also need BSV sats—even if it is just “some sats” they must get?

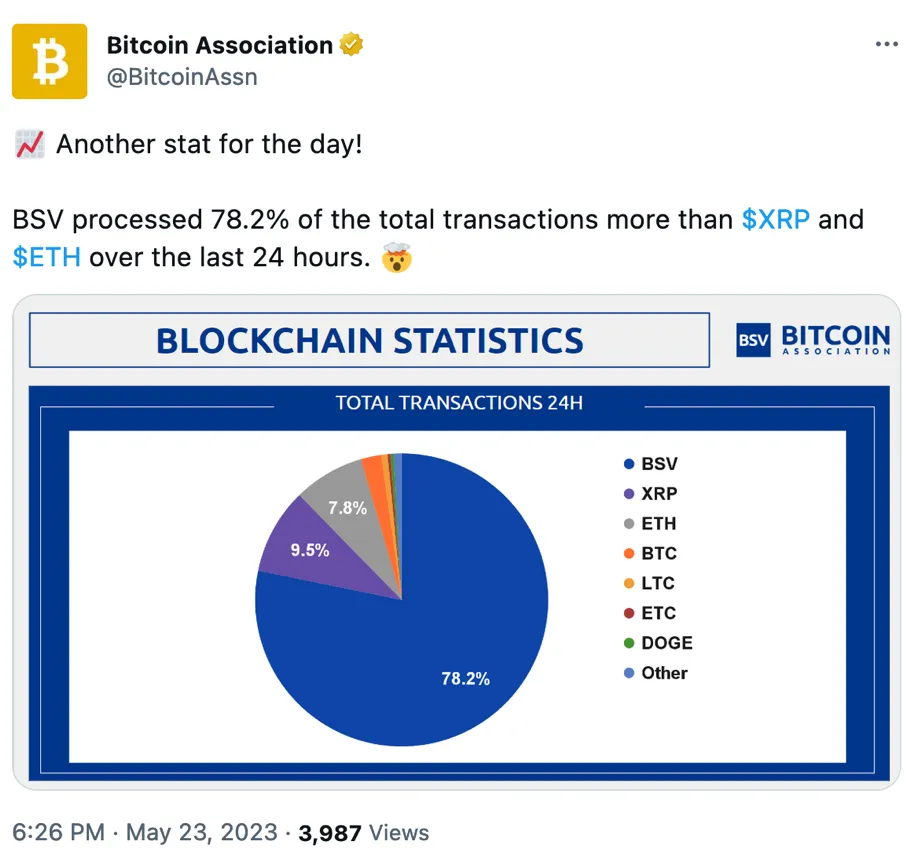

The chart above does not suggest that BSV must appreciate in price. However, it indicates a lower limit, which is likely not zero, owing to its usage. There will probably always be individuals willing to pay a certain amount to engage in transactions on BSV, regardless of whether that amount is high or low.

Is Bitcoin SV the most unlikely digital asset to get to 0?

Do not get me wrong. I am not proposing a low BSV price at all. I am saying that 0 is unlikely and BSV is worth a lot in a digital asset market that basically consists of literal nonsense coins with no use case at all.

In other words: most of the digital assets we know today—the thousands of coins out there—can go to 0, and nobody would even question why that happened. These digital assets are not commodities because:

- They are not standardized, as they are being changed at the software level when it fits the developers or promoters

- They have no proper issuer

- They have no use case other than being traded in databases (not even on their own blockchain!) on non-regulated centralized exchanges, which is a use case for the exchanges, not for the coins

- They are probably unregistered securities instead

If you ‘HODL’ BSV to bet on price appreciation, here is something for you!

BSV is best known for its micropayment capabilities. However, micropayments do not mean that BSV is only here for tiny transactions.

Why do you think the Bitcoin Association enables a digital asset recovery process? Nobody is going to recover 100 BSV sats, but recovering 1000 BSV (1,000,000,000,000.00 sats!) could be relevant if these were lost or stolen.

Bitcoin inventor Dr. Craig Wright stated in his article Digital Signatures:

Bitcoin can function as cash, for small incontestable values, where the cost of seeking to repudiate the transaction exceeds the value of the amount exchanged, compared to the amount needed to go to court and contest the exchange. For amounts under $10,000, there will be little possibility of recovering funds in any meaningful way. (…). Conversely, for large amounts, it is possible to create a strategy for alerting nodes to reject blocks that have been frozen by court order.

Read the last sentence of that quote again—“for large amounts”.

Both the Bitcoin Association and the creator of Bitcoin have essentially acknowledged that BSV is not solely intended as a micropayment system. Otherwise, there would be no need for a digital asset recovery process.

Yes, you are free to “store your wealth” in Bitcoin SV—at your own risk, at your own peril, and at your own ability to predict the commodity market that BSV as an informational commodity is a part of.

CoinGeek Conversations with Ajaypal Pama: BSV can do micropayments, Ethereum cannot

08-18-2025

08-18-2025